Marathon Digital Holdings, Inc. (MARA) is one of the biggest names in the world of Bitcoin mining. Thanks to the rising popularity of cryptocurrencies and the company’s strategic moves, it has caught the attention of many investors.

In this article, we’ll look at Marathon’s basics, how its sector is doing, what drives its stock, and also try to guess where its stock might be in 2025, 2030, 2040, and 2050. This will help investors make better sense of a company that operates in a very unpredictable industry.

1. Company Overview

Marathon Digital Holdings is well-known in the Bitcoin mining space. It has a very high hash rate and holds a large number of Bitcoins.

Here’s a quick look at the company’s key details:

| Company Name | Marathon Digital Holdings, Inc. |

| Sector | Financials |

| Industry | Capital Markets / Cryptocurrency Mining |

| IPO Year | 2012 |

| Stock Exchange Listed | NASDAQ |

| Founded By | Merrick Okamoto |

| Established In | 2010 |

| Specialization | Bitcoin Mining and Building Digital Asset Infrastructure |

Related – The Very First Post You Should Read to Learn Cryptocurrency

Started in 2010 and located in Fort Lauderdale, Florida, Marathon Digital Holdings (MARA) is a major player in Bitcoin mining. It has been listed on the NASDAQ since 2012. As of April 2025, the company holds 48,237 Bitcoins, making it the second-largest holder among public companies. Under CEO Fred Thiel, Marathon follows a “full HODL” approach, meaning it keeps all the Bitcoins it mines. It has also made smart moves like buying a wind farm in Texas to use clean energy. This shows its focus on sustainability and strong infrastructure, making it a key part of the crypto world.

2. The Stock Market: What Moves It

Stock prices don’t just move randomly. They change based on a lot of things like how the company is doing, what the government is doing, and what’s happening in the world. For MARA, some key points include:

- In Q1 2025, Marathon made $213.9 million in revenue but had a loss of $533.4 million. This was mainly because of how Bitcoin’s value is recorded in accounting.

- U.S. government policies can help or hurt Bitcoin mining. New rules can change everything.

- Global issues like trade tensions can also make crypto markets go up or down.

- Other things like interest rates, inflation, and new technologies in blockchain all play a role.

A good example: in April 2025, Bitcoin reached $90,000 and MARA’s stock jumped 16% in the same month. That’s how closely its stock follows Bitcoin.

3. Sector Overview: Financials

Understanding the Sector

Marathon is part of the Financials sector. This includes banks, investment firms, and businesses related to cryptocurrency. This sector helps move money around the world. Digital assets like Bitcoin are becoming a bigger part of this system, and Marathon is right in the middle of this change.

Key Sector Factors

- Bitcoin Prices: When Bitcoin goes up, mining becomes more profitable.

- Regulations: Governments can either support or limit crypto activities.

- Technology: Better machines and blockchain updates help companies compete.

Recent Growth

With the rise of cryptocurrencies, the financial sector has changed a lot. Bitcoin hit $112,000 in May 2025, and crypto stocks like MARA went up. Its stock increased 16.3% in April 2025 alone. Expectations of pro-Bitcoin policies in the U.S. and lower trade tensions with China have made investors more hopeful about the future.

4. Industry Overview: Cryptocurrency Mining

About the Industry

Cryptocurrency mining means using powerful computers to solve puzzles and earn Bitcoin. This industry needs a lot of money and energy. MARA is one of the biggest players, competing with companies like Riot Platforms and CleanSpark.

Key Industry Factors

- Bitcoin Halving: In 2024, mining rewards were cut in half. This makes mining less profitable.

- Energy Costs: It cost $43,808 to mine one Bitcoin in Q1 2025. That’s a lot.

- Competition: MARA’s hash rate is now 57.3 EH/s, one of the highest in the world.

Recent Changes

After the halving in 2024, MARA mined 19% fewer Bitcoins in Q1 2025, ending with 2,286 BTC. But the company raised $2 billion in March 2025 to buy more Bitcoins and expand operations. Buying a wind farm in Texas is part of their plan to lower energy costs. The industry is also looking into new ways to make money, like AI and high-performance computing (HPC) hosting.

5. Stock Growth and What Affects It

MARA’s stock moves a lot with Bitcoin. When Bitcoin hit $90,000 in April 2025, MARA’s stock jumped 16.3%. The value of their Bitcoin holdings grew to $4.55 billion. They’ve also made efforts to cut costs, especially by using clean energy. Even though the company missed its earnings goals in Q1 2025, it increased its hash rate by 5.5%. But there are risks too, like higher energy prices, tougher rules, and fewer rewards after halving. All this makes MARA a risky but exciting stock.

6. Speculative Targets: Guessing the Future

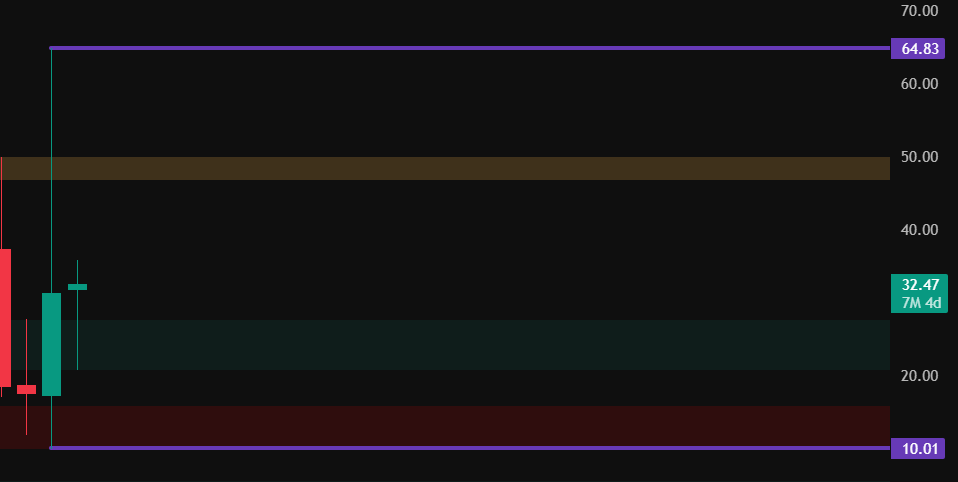

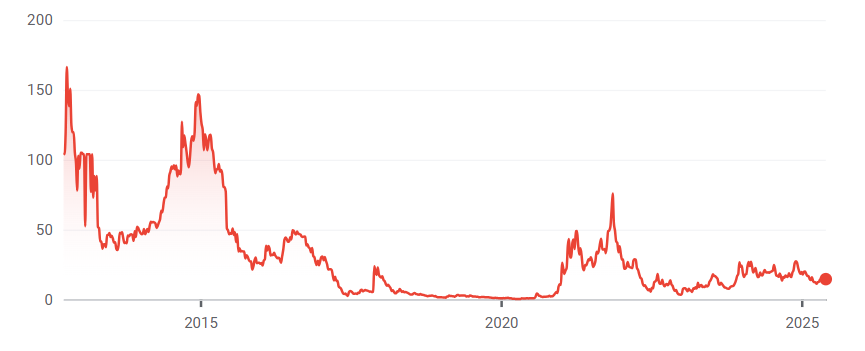

As of May 30, 2025, MARA’s stock price is about $14.61. Let’s look at some guesses based on charts and trends:

- Moving Averages: The 50-day and 200-day moving averages crossed in May 2025, which is a good sign.

- Support & Resistance: The stock seems to have support at $22 and resistance at $27.

- RSI: The Relative Strength Index is around 65. This shows the stock has momentum but is not overbought yet.

Price Predictions

2025: With Bitcoin at $112,000 and MARA’s expansions, the stock could reach $18, ranging from $15 (5% growth) to $21 (15% growth) by year-end, reflecting short-term optimism.

2030: A 10% annual growth rate projects $29, with a range of $23 (5%) to $36 (15%), assuming stable Bitcoin prices and operational growth.

2040: Continued 10% growth suggests $76, ranging from $47 (5%) to $145 (15%), contingent on sustained crypto adoption.

2050: A 10% growth rate forecasts $199, with a range of $80 (5%) to $580 (15%), reflecting significant long-term uncertainty in the crypto market.

These are just guesses. A lot depends on Bitcoin prices, energy costs, and new rules.

7. Long-Term Growth Prospects

Marathon has a lot of potential, but the road is bumpy. It holds 48,237 Bitcoins, worth $4.55 billion. Its high hash rate and smart moves like buying wind farms and raising $2 billion show strong planning. But challenges like less income after halving, high energy bills, and tough competition are real. If MARA can expand into areas like AI and HPC and get help from pro-Bitcoin government policies, it could grow a lot. Still, the risks are just as big as the rewards.

8. Conclusion

Marathon Digital Holdings (MARA) is a powerful name in crypto mining. Its huge Bitcoin holdings, strong hash rate, and move toward clean energy make it a company with real potential. The stock could hit $30 in 2025, $40 in 2030, $105 in 2040, and even $275 in 2050. But these are just possibilities, not guarantees. The world of crypto changes fast, and MARA’s future will depend on many things. For investors, this is a high-risk, high-reward stock that requires careful thinking and a solid understanding of what drives it.

Disclaimer: The information provided in this article is for educational and informational purposes only. It should not be considered financial or investment advice. Always do your own research or consult with a qualified financial advisor before making any investment decisions. Please note that all price forecasts and stock predictions mentioned are speculative in nature. The cryptocurrency and stock markets are highly volatile and unpredictable. Past performance is not indicative of future results.

Related – 7 Surprising Facts You Must Know About Tether (USDT) in 2025