1. Company Overview

Bitdeer Technologies Group (BTDR) is a prominent name in the technology space, focused on Bitcoin mining and blockchain solutions. The company is also making strong strides in high-performance computing (HPC) for AI applications.

Also Read – I Created the Best Bitcoin Guide You’ll Ever Read

Below is a snapshot of key company information, followed by a concise overview of its operations and relevance in the market.

| Company Name | Bitdeer Technologies Group |

| Sector | Financials |

| Industry | Capital Markets / Cryptocurrency Mining |

| IPO Year | 2023 (via SPAC merger) |

| Stock Exchange Listed | NASDAQ |

| Founded By | Jihan Wu |

| Established In | 2018 |

| Specialization | Bitcoin Mining, Blockchain Solutions, HPC/AI Computing |

Established in 2018 by Jihan Wu, who also co-founded Bitmain, Bitdeer Technologies Group is based in Singapore and went public on the NASDAQ in April 2023 through a SPAC merger. The company operates through three key business lines: self-mining, hash rate sharing (via Cloud Hash Rate and Hash Rate Marketplace), and hosting services. It manages seven data centers across the U.S., Norway, and Bhutan, offering a combined electrical capacity of 895 MW and a hash rate of 24.2 EH/s as of Q1 2025. Bitdeer’s proprietary SEALMINER series, including its SEAL02 chip, along with the Bitdeer AI platform, positions it as a diversified force in both blockchain and high-performance computing.

2. The Stock Market: Fundamentally Driven

Stock markets move based on a mix of company fundamentals, broader economic trends, and industry-specific shifts. For Bitdeer, the key fundamentals include revenue from Bitcoin mining, hash rate expansion, growth in AI/HPC services, and the price volatility of cryptocurrencies.

In Q1 2025, Bitdeer reported a revenue drop to $70.1 million, down from $119.5 million year-over-year, mainly due to the Bitcoin halving in April 2024. However, it still posted a net income of $409.5 million, supported by non-cash derivative gains.

Factors like Bitcoin’s price movements, energy costs, and changing regulations in the crypto sector will continue to play a major role in shaping BTDR’s stock performance. Long-term success hinges on the company’s ability to scale its diversified business model and maintain cost efficiency across operations.

3. Sector Overview: Financials

Understanding the Sector

Bitdeer belongs to the Financials sector, which spans traditional banking, fintech, and cryptocurrency-based businesses. This sector is crucial for global economic activity, providing capital and driving technological progress.

Bitdeer’s work in Bitcoin mining and HPC places it within the fast-evolving crypto and fintech landscape. Its operations are closely tied to the rising adoption of digital assets and the increasing demand for computing power in AI.

Fundamental Factors Affecting the Sector

Several critical factors shape the dynamics of the Financials sector:

- Regulatory Environment: Changes in cryptocurrency regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements in the U.S., impact mining and hosting services.

- Cryptocurrency Prices: The price of Bitcoin directly affects mining profitability and asset valuations.

- Technological Innovation: Advancements in blockchain and AI increase the demand for powerful computing solutions.

Growth and Development in Recent Years

The Financials sector has witnessed rapid growth, particularly in fintech and crypto. Digital assets are becoming mainstream. In 2025, Bitdeer has expanded its operations with 70 MW added in Norway and 132 MW in Bhutan. It also secured a $200 million financing facility to support future growth.

Positive market sentiment in May 2025, fueled by easing U.S.-China trade tensions and a strong S&P 500 performance, has benefitted the sector overall. Bitdeer’s recent launch of its AI Training Platform through Bitdeer AI reflects the industry’s shift toward diversified technology offerings.

4. Industry Analysis: Cryptocurrency Mining / HPC

Exploring the Industry

Bitdeer operates in the Cryptocurrency Mining / HPC industry, a subcategory of the Financials sector. This industry includes Bitcoin mining, hash rate sharing, hosting services, and AI-focused computing solutions. It is characterized by high volatility, significant energy demands, and an increasing focus on diversification, especially after the 2024 Bitcoin halving.

Bitdeer competes with companies like Marathon Digital and Core Scientific but differentiates itself through its proprietary SEALMINER chips and AI-focused initiatives.

Fundamental Factors Impacting the Industry

Key elements shaping this industry include:

- Bitcoin Halving: The 2024 halving event reduced mining rewards, pressuring profit margins and pushing companies to diversify into HPC.

- Energy Efficiency: Access to low-cost and sustainable energy is crucial to remain competitive in mining.

- AI/HPC Demand: Rising AI adoption is driving increased demand for data center and high-performance computing services.

Recent Growth and Developments

The industry is undergoing rapid transformation, with many mining companies, including Bitdeer, exploring AI to mitigate the impact of reduced Bitcoin rewards.

Although Bitdeer’s revenue dropped to $70.1 million in Q1 2025 from $119.5 million a year earlier, innovation remains strong. The SEAL02 chip boasts an energy efficiency of 9.7 J/TH, and the launch of its AI Training Platform demonstrates a pivot to new revenue opportunities. In April 2025, Bitdeer mined 166 BTC, up 45.6% from March. Its total capacity also rose to 1.1 GW, with a goal to reach 1.6 GW by June 2025. Competitors like Core Scientific are also making moves into AI, reflecting an industry-wide shift.

5. Stock Growth and Fundamental Factors

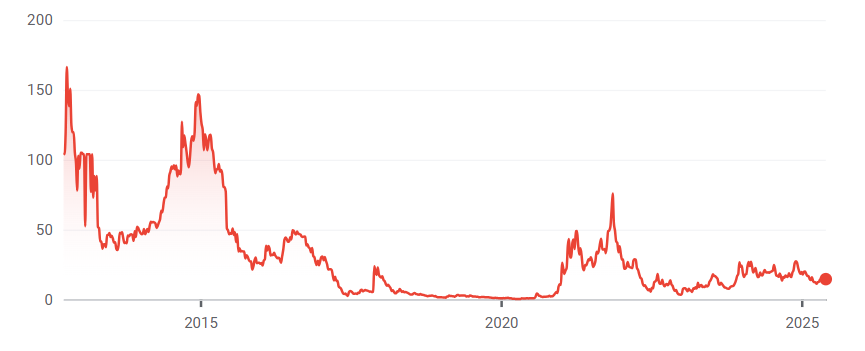

Bitdeer’s stock has faced significant volatility in 2025, falling 53.81% year-to-date to $15.32 as of May 19, 2025. The drop is linked to post-halving impacts and weakness in Bitcoin prices. However, strategic developments like the SEALMINER A1 and A2 rollouts (3.7 EH/s and 0.5 EH/s, respectively) and a $200 million financing arrangement support a more positive long-term view.

Bitdeer’s infrastructure remains cost-efficient, with air-cooled data centers built for just $140,000 per MW. Its diverse revenue sources—spanning self-mining, hosting, and AI—align with current industry trends.

In Q1 2025, the company posted a gross loss of $3.2 million, but non-cash derivative gains resulted in a net income of $409.5 million. A $9 million share repurchase and an additional $20 million buyback program through February 2026 signal strong internal confidence. Bitdeer’s continued innovation and capacity expansion offer promise, though risks tied to cryptocurrency market swings remain.

6. Speculative Targets: Technical Analysis Insights

Technical analysis offers speculative insights into BTDR’s potential price movement. As of May 19, 2025, the stock trades at $15.32, with a 52-week range from $2.77 to $14.65 (noting that the high figure may reflect an outdated price).

Key indicators show:

- Moving Averages: The current price sits above both the 20-day ($10.13) and 50-day ($8.69) moving averages, suggesting bullish momentum following an April 2025 recovery.

- Support and Resistance: Support lies around $12.00, while resistance is near $16.00.

- Relative Strength Index (RSI): An estimated RSI of around 60 suggests neutral momentum with the potential for further gains.

Speculative Long-Term Price Targets

Using a generalized growth model, price targets for BTDR stock are estimated based on an assumed annual growth rate of 10%, with conservative and optimistic scenarios of 5% and 15%, respectively:

2030 (5 years):

- Median Price (10%): $15.32 × (1.10)^5 ≈ $24.65

- Lower Bound (5%): $15.32 × (1.05)^5 ≈ $19.54

- Upper Bound (15%): $15.32 × (1.15)^5 ≈ $30.79

2040 (15 years):

- Median Price (10%): $15.32 × (1.10)^15 ≈ $64.02

- Lower Bound (5%): $15.32 × (1.05)^15 ≈ $31.80

- Upper Bound (15%): $15.32 × (1.15)^15 ≈ $124.67

2050 (25 years):

- Median Price (10%): $15.32 × (1.10)^25 ≈ $165.94

- Lower Bound (5%): $15.32 × (1.05)^25 ≈ $51.90

- Upper Bound (15%): $15.32 × (1.15)^25 ≈ $377.71

These projections assume Bitdeer sustains its hash rate growth (with a 40 EH/s goal by October 2025) and continues its expansion in AI and HPC. However, risks such as Bitcoin volatility, competition, and regulatory challenges remain significant.

7. Long-Term Growth Prospects

Bitdeer’s long-term growth outlook is strong, backed by its multi-pronged business model and focus on innovation. With a hash rate of 24.2 EH/s in Q1 2025 and plans to reach 40 EH/s by October, the company is scaling rapidly.

Its SEALMINER advancements, including the SEAL03 chip with 9.7 J/TH efficiency, improve mining productivity. The company is also tapping into the fast-growing HPC market with its AI Training Platform powered by NVIDIA DGX H100 GPUs.

Current infrastructure includes 1.1 GW of capacity, targeting 1.6 GW by June 2025. The company also maintains low operational costs—mining each Bitcoin at just $17,744. Despite a 53.81% stock decline in 2025 and a Q1 gross loss of $3.2 million, analyst sentiment remains positive, with a price target of $19.50 (a 34.86% potential upside). If Bitdeer succeeds in scaling both its AI and mining arms, it could deliver substantial long-term returns, though crypto and regulatory risks continue to loom.

8. Conclusion

Bitdeer Technologies Group stands out as a diversified leader in the Cryptocurrency Mining / HPC space, leveraging its presence in the Financials sector to advance Bitcoin mining and AI technology. Despite a drop in Q1 2025 revenue, the company reported a solid net income of $409.5 million, supported by innovations like the SEALMINER chips and its AI platform.

Speculative price targets for 2030 ($24.65), 2040 ($64.02), and 2050 ($165.94) indicate promising long-term potential. However, the company must navigate challenges tied to Bitcoin price volatility and intense industry competition. Investors should carefully consider Bitdeer’s low-cost operations, hash rate growth, and expanding presence in HPC before viewing it as a high-risk, high-reward opportunity.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.