04:00 AM ET | New York — Warrior Met Coal, Inc. (NYSE: HCC) registered as one of the top losers in the U.S. stock market on Friday, June 20, 2025. The stock fell sharply by 8.15 percent to close at $43.18, drawing attention from investors concerned about weakening coal demand and labor-related risks. As of June 21, 2025, 04:00 AM ET, following Friday’s market close, Warrior Met Coal’s year-to-date performance stands at negative 29.83 percent, placing it among the most pressured names in its sector.

Also Read – Accenture (ACN) Falls 7.11% Today – Why Stock Is Falling

Why Warrior Met Coal Stock Is Falling?

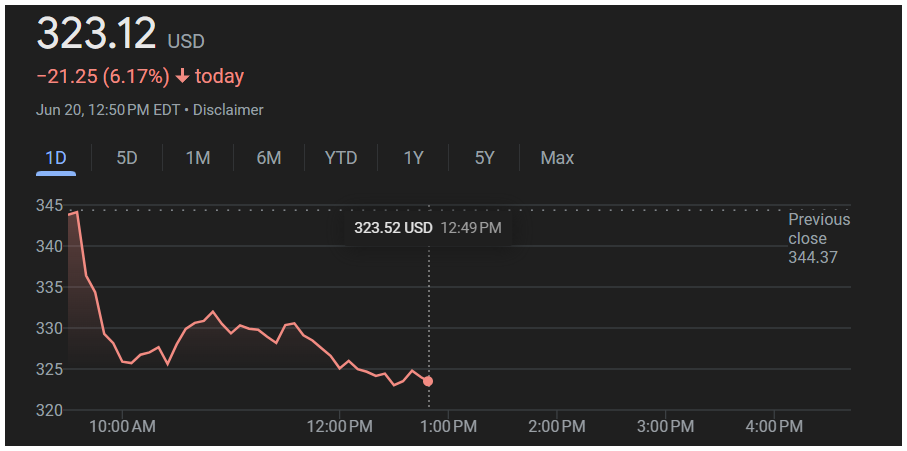

The sharp decline in Warrior Met Coal’s stock price is driven by fundamental pressures tied to the broader metallurgical coal market. Global steel production cuts, particularly from China and Europe, have pushed down the price of coking coal by nearly 40 percent in the first quarter of 2025. This has directly impacted Warrior Met’s revenue, given that nearly 40 percent of its 2025 production volume is still unpriced.

The company reported a net loss of 8.2 million dollars in the first quarter of 2025, a major reversal from its 137 million dollar net income in Q1 2024. The average realized selling price dropped 42 percent year-over-year, reflecting market-wide softness. Australian benchmark coking coal futures dipped 4.2 percent this week, reaching 235 dollars per ton — the lowest level in seven months.

On the labor front, a grievance was filed by the United Mine Workers union on June 18, demanding updated wage terms. This has sparked concern over potential labor disruptions or margin pressure, as labor costs account for roughly 35 percent of Warrior Met’s cash margins.

Latest News About Warrior Met Coal on June 20, 2025

Recent news developments on and before June 20 provide further context for the selloff:

- Q1 2025 Earnings Pressure: On June 20, TipRanks reported analysts’ concerns over Warrior Met’s Q1 results, highlighting the company’s net loss and pricing challenges.

(Source: TipRanks, June 20, 2025) - European Steel Demand Weakness: On June 19, ArcelorMittal announced reduced blast furnace operations in Germany, which may affect Warrior Met’s European exports. Europe accounts for roughly 38 percent of the company’s export sales.

(Source: Bloomberg, June 19, 2025) - Union Grievance Filing: A wage-related complaint was filed by the miners’ union on June 18, raising fears of operational risk and cost escalation.

(Source: Company 10-Q, May 2025) - Institutional Exit: Kingdom Capital Advisors sold off its position in Warrior Met Coal in Q1 2025, citing a 52-week decline of 27.85 percent.

(Source: Investing.com, May 1, 2025)

A separate public hearing held on June 20 regarding the company’s Tuscaloosa mining expansion drew limited market reaction.

Stock Performance and Metrics

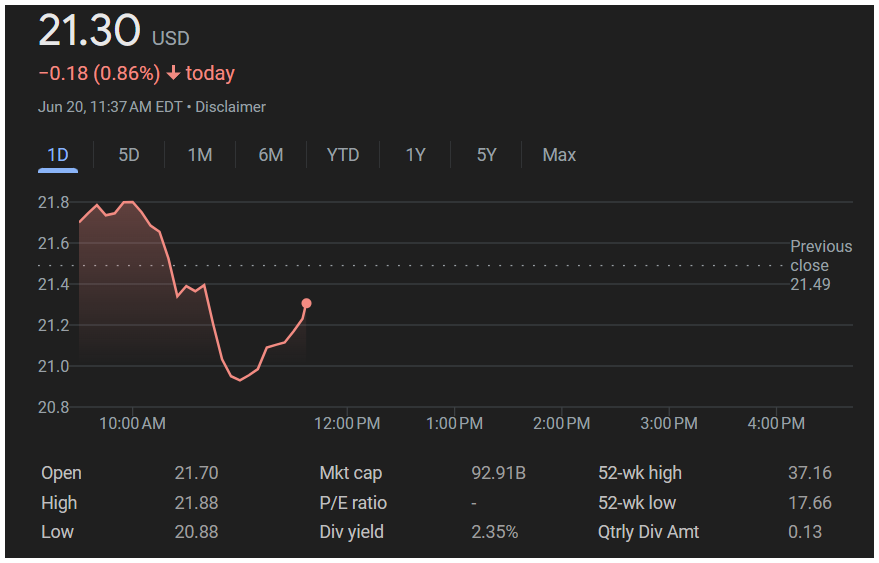

Below is a snapshot of Warrior Met Coal’s financial and stock data as of June 20, 2025:

| Metric | Value |

|---|---|

| Current Price | $43.18 |

| Market Cap | $2.27 Billion |

| EPS (TTM) | $2.00 (est.) |

| Forward EPS (2025E) | $1.85 (est.) |

| YTD Performance | -29.83% |

| Shares Outstanding | 52.57 Million |

| Beta | 0.75 |

The price-to-earnings ratio is currently around 21.59, which is roughly 15 percent higher than the company’s 5-year average, suggesting valuation concerns if earnings continue to weaken.

Short-Term Outlook

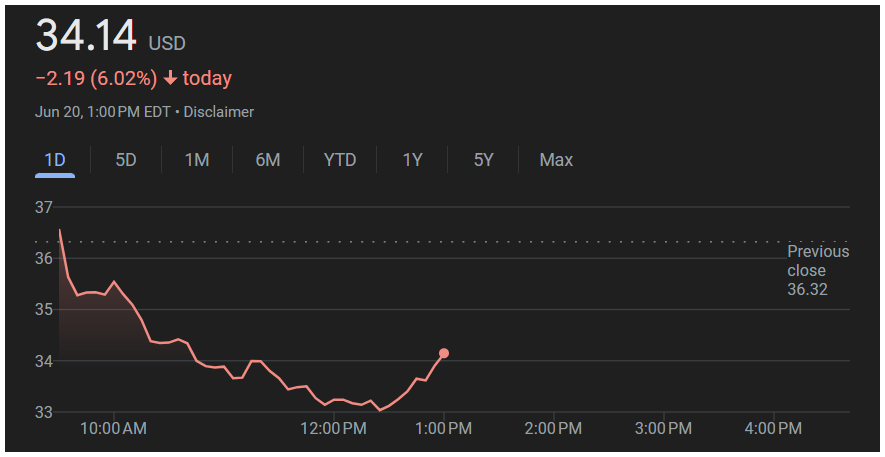

Investor sentiment remains negative. The stock’s Relative Strength Index (RSI) sits at 28, indicating oversold territory. Warrior Met closed below its 200-day moving average of $45.70 on Friday, which could prompt further algorithmic or institutional selling. Short interest is notably high at 19.74 percent of float, or about 7.56 million shares.

Technical support appears near the $42.00–$42.50 range, while resistance may form around the $47.00 level, close to the 50-day moving average. However, continued downward pressure on coal prices and unresolved labor issues could cap near-term recovery attempts.

Conclusion

Warrior Met Coal’s steep 8.15 percent drop on June 20, 2025, reflects a combination of weakening demand in key export markets, falling coking coal prices, and growing labor tensions. While long-term prospects may benefit from the upcoming Blue Creek project — expected to boost capacity by 60 percent by Q2 2026 — the current outlook remains challenged. Investors are expected to closely monitor Q2 earnings for cost guidance and labor updates. Until then, the stock is likely to stay under scrutiny due to macro and company-specific uncertainties.

LEGAL / FINANCIAL DISCLAIMER:

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.