Pro at manufacturing quality underwear, this company has declared a quite unusual dividend of ₹200. Generally, in India, such a high dividend is rarely seen.

The company we are talking about here is Page Industries, the licensee behind Jockey innerwear in India. It declared an interim dividend of ₹200 per equity share for the financial year 2024–25 on 15 May 2025. The decision was taken at a board meeting held this afternoon.

Board Meeting and Dividend Approval

The members of the Board of Directors approved a dividend of ₹200 per fully paid equity share of face value ₹10. So this dividend calculates to be 2000% of the face value, which is huge. The payout is scheduled to be completed on or before June 13, 2025. Shareholders whose names appear on the company’s register as of the record date will be eligible to receive this interim dividend.

The shares will start trading ex-dividend on June 12, 2025.

Also Read – This Pharma Giant Announces ₹475 Dividend

Series of Record Date Revisions

Although the company had already informed its investors about the upcoming dividend along with a pre-decided record date, there were multiple changes made later. Page Industries kept investors informed through separate stock exchange filings:

- April 18, 2025: The company first proposed May 23 as the record date.

- April 25, 2025: A revised notice moved the record date to May 21, 2025.

- May 15, 2025: Today’s announcement confirmed May 21 as the final record date and also fixed the payment timeline.

The shares will start trading ex-dividend on June 12, 2025.

The payment will be done on or before June 13, 2025.

Dividend History (Last Five Payouts)

| Purpose | Rs. | Ex-date | Record Date |

|---|---|---|---|

| Interim Dividend | 200 | 21 May 2025 | 21/05/2025 |

| Interim Dividend | 150 | 13 Feb 2025 | 13/02/2025 |

| Interim Dividend | 250 | 14 Nov 2024 | 16/11/2024 |

| Interim Dividend | 300 | 16 Aug 2024 | 17/08/2024 |

| Interim Dividend | 120 | 31 May 2024 | 31/05/2024 |

Though this year’s ₹200 dividend is not the highest-ever dividend amount, the company had paid a dividend of ₹300 in August 2024.

Company Profile

| Company Name | Page Industries Limited |

| IPO | 2007 |

| Stock Exchange | BSE, NSE |

| Market Cap | ₹52,842 Cr |

| Founder | Sunder, Nari and Ramesh Genomal |

| Incorporation | 1994 |

| Headquarters | Bangalore, Karnataka, India |

| Sector | Consumer Discretionary |

| Industry | Garments & Apparels |

| Key Products & Services | Manufacture and distribution of innerwear, loungewear and socks under the Jockey brand; licensed Speedo swimwear; casual and sports socks; loungewear and athleisure garments for men, women and children. |

Since 1994, Page Industries has held exclusive rights to manufacture and market Jockey innerwear in India and select neighbouring countries. Its product portfolio includes men’s, women’s, and children’s innerwear, along with loungewear and athleisure clothing.

Retail expansion has been another key factor in its growth. Page Industries operates a large network of exclusive brand outlets and shop-in-shop formats across India. Efficient supply chain management and rising consumer demand have also contributed to improved profit margins in recent quarters.

Also Read – Tata Elxsi Announces Record Date for Dividend

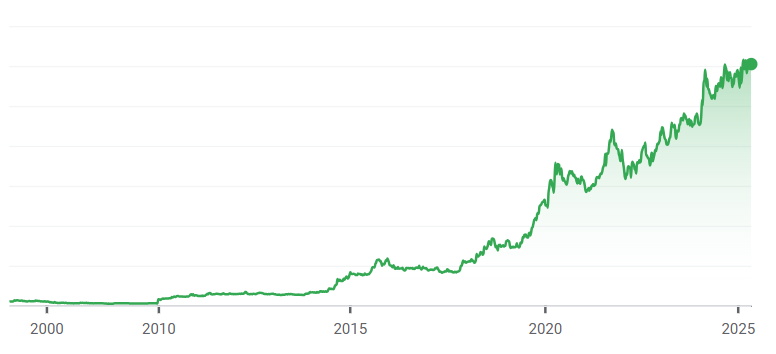

Page Industries is a part of the BSE 200 companies. With a market cap of ₹53,377 Cr, the company is trading at a P/E of 79. It has generated an ROE of 45.19%.

Disclaimer:

This article is for informational and educational purposes only. It does not constitute financial advice. The author is not a registered financial advisor. While the content is written in good faith and with the utmost care, complete accuracy is not guaranteed. However, updates and corrections will be made as needed to ensure current and correct information.