On August 16, 2024, an entity within the Promoter Group of Piramal Enterprises Limited (PEL) bought 616,615 equity shares on the National Stock Exchange (NSE). This represents 0.27% of the company’s total paid-up share capital. Because of this purchase, the Promoter Group’s stake in PEL increased from 46.03% to 46.30%.

Read the Official Notification Here

Table of Contents

Company Overview

Piramal Enterprises Limited (PEL) is a diversified Non-Banking Financial Company (NBFC) that operates in retail lending, wholesale lending, and fund-based platforms. PEL has a strong technology platform powered by artificial intelligence (AI), which allows it to offer innovative financial solutions across various sectors. In retail lending, PEL focuses on serving under-served and unserved markets in India, with a presence in 26 states and a network of 501 branches catering to over 1.3 million customers.

In wholesale lending, PEL provides financing to real estate developers and corporate clients, and has formed strategic partnerships with global financial institutions like CPPIB, APG, and Ivanhoe Cambridge. Additionally, PEL holds a 50% stake in Pramerica Life Insurance, a joint venture with Prudential International Insurance Holdings.

Significance of the Transaction

It is notable that the Promoters/Promoter Group did not participate in PEL’s share buy-back in 2023, which suggests that they may have opted to increase their stake through open market purchases instead.

Increase in Promoter Holding

The Promoter Group’s stake in the company increased by 0.27%, from 46.03% to 46.30%, which signifies a marginal but positive reinforcement of the promoters’ confidence in the company.

Demonstrated Confidence

The promoters have shown ongoing confidence in PEL’s growth and future potential, reflecting their trust in the company’s business fundamentals and strategic direction.

No Participation in Buy-Back (2023)

It is notable that the Promoters/Promoter Group did not participate in PEL’s share buy-back in 2023, which suggests that they may have opted to increase their stake through open market purchases instead.

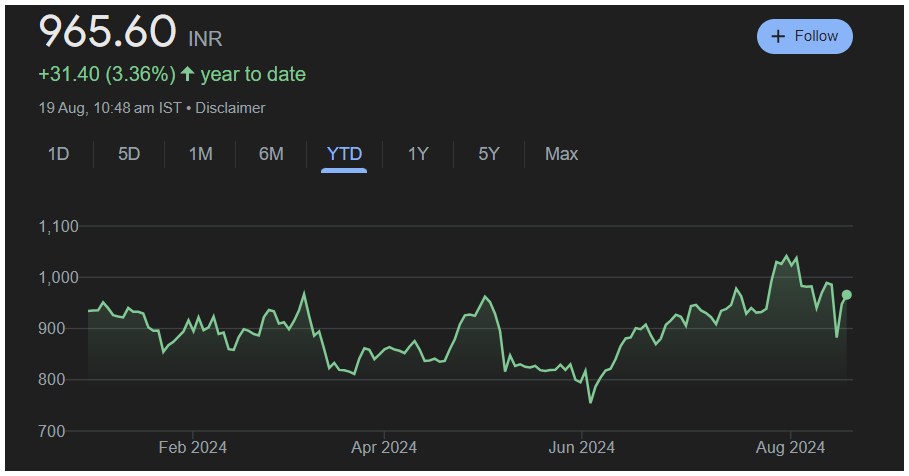

Stock Performance

Also Read – Inflation and CPI Explained – What’s the Effect on the Stock Market?

Important Financial Metrics

| Metric | Value |

|---|---|

| Market Cap | ₹ 21,711 Cr. |

| Price to Earnings | 172.94 |

| Industry P/E | 20.9 |

| Price to Book Value | 0.81 |

| Industry PBV | 1.87 |

| Return on Equity | 1.25 % |

| Debt to Equity | 2.02 |

| ROCE | 3.91 % |

| Return on Assets | 0.43 % |

| Dividend Yield | 1.05 % |

| Enterprise Value | ₹ 70,876 Cr. |

PEL (Piramal Enterprises Limited) has a market capitalization of ₹21,711 crore and a Price to Earnings (P/E) ratio of 172.94, calculated based on trailing twelve months (TTM) earnings. This elevated P/E ratio indicates that the stock is priced at a premium compared to its earnings over the past year, especially when compared to the industry average of 20.9.

The Price to Book Value ratio stands at 0.81, which is below the industry average of 1.87, suggesting the stock might be undervalued relative to its book value. The company’s Return on Equity (ROE) is 1.25% and its Return on Capital Employed (ROCE) is 3.91%, showing modest returns on equity and capital.

PEL has a debt to equity ratio of 2.02, indicating high leverage. Its Return on Assets (ROA) is 0.43%, and it offers a dividend yield of 1.05%, providing some returns to investors. The enterprise value of ₹70,876 crore reflects the total value of the company, including both debt and equity.

Shareholding Pattern

| Category | Percentage |

|---|---|

| Promoters | 46.30% |

| FIIs | 16.19% |

| DIIs | 13.35% |

| Public | 23.67% |

| Others | 0.50% |

Promoters have increased their holding to 46.30% of the company’s shares, indicating significant insider ownership. Foreign Institutional Investors (FIIs) account for 17.19%, reflecting a moderate level of international investment. Domestic Institutional Investors (DIIs) hold 13.02%, demonstrating institutional interest from within the country.

The Bottom Line

The purchase of shares by the Promoter Group indicates a continued belief in the future growth of Piramal Enterprises Limited. The slight increase in shareholding reaffirms the promoters’ long-term commitment to the company and its strategic direction. The transaction could be viewed positively by the market as it showcases the promoters’ confidence in the company’s value creation potential.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.