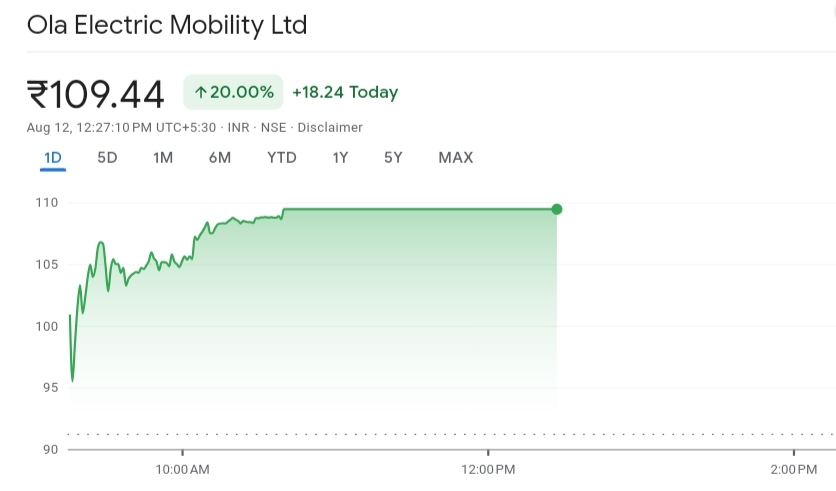

Ola Electric’s stock has been performing exceptionally well since its market debut. After a flat start, the shares quickly rallied, closing at INR 91.18 on their first trading day. On August 12, 2024, the shares hit a new high of INR 109.41, representing a 20% increase from the previous close. The company’s market valuation now stands at approximately INR 48,258.89 crore.

Ola Electric went public with a valuation of $4 billion, which was a 25% reduction from its previous valuation of $5.4 billion during its last funding round in September 2023. Initially, the company had aimed for a valuation of around $10 billion for its IPO, but this was later adjusted following investor feedback.

Despite the company’s strong revenue growth, with operating revenue jumping over 90% to INR 5,009.8 crore in FY24, it reported a net loss of INR 1,584.4 crore for the same period, a 7.6% increase from the previous year.

Table of Contents

Company Overview

Ola Electric Mobility Limited, led by Bhavish Aggarwal, is an electric two-wheeler manufacturer. The company recently made a successful debut in the stock market, with its shares experiencing a strong upward momentum. On Monday, August 12, 2024, Ola Electric’s shares jumped by 20%, hitting the upper circuit limit and reaching a new high of INR 109.41 on the Bombay Stock Exchange (BSE). This surge followed its listing at INR 75.99 per share, which was slightly below its IPO issue price of INR 76.

Also Read – What is an IPO in Simple Words? – 6 Important Steps to Know

Fundamental Overview

Ola Electric’s initial public offering (IPO) was highly anticipated, as it was the first by an electric vehicle (EV) manufacturer in India. The IPO, which opened for bidding from August 2 to August 6, 2024, was oversubscribed 4.27 times. The total value of the IPO was INR 6,145 crore, with a fresh issue of shares worth INR 5,500 crore and an Offer-for-Sale (OFS) of 8.49 crore equity shares.

The company has earmarked the funds from the IPO for several key initiatives:

- Capacity Expansion: Ola Electric plans to use INR 1,227.6 crore to expand its cell manufacturing plant’s capacity from 5 GWh to 6.4 GWh.

- Research and Development: INR 1,600 crore will be invested in research and product development to strengthen the company’s offerings.

- Debt Repayment: The company intends to use INR 800 crore to repay existing debts.

- Organic Growth: INR 350 crore will be allocated for organic growth initiatives.

Official Commentary

Ola Electric’s Red Herring Prospectus (RHP) detailed plans for the development and expansion of its Ola Gigafactory in Krishnagiri, Tamil Nadu. The first phase of this project will be funded through internal accruals and long-term borrowings secured by its subsidiary, Ola Cell Technologies Pvt Ltd. The company is focused on enhancing its manufacturing capabilities to meet the growing demand for electric vehicles and related components.

Founder Bhavish Aggarwal commented on the company’s IPO pricing strategy, stating that it was deliberately priced to attract a broad range of investors. This approach was intended to allow more people to participate in Ola Electric’s growth story, which the company believes has significant potential for future expansion.

Conclusion

Ola Electric’s successful IPO and subsequent stock market performance highlight the growing interest in electric vehicles in India. With plans to expand its manufacturing capacity and invest in research and development, the company is well-positioned to capitalize on the increasing demand for EVs. Investors will need to monitor the company’s financial progress closely as it works through the challenges of expanding its operations.

Visit the official website to learn more.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.