The Metropolitan Stock Exchange of India (MSEI) has raised Rs. 238 crore through fresh equity issuance, attracting investments from key players like Zerodha’s Kamath brothers, Groww’s parent company, Share India Securities, and Securocorp Securities. The exchange issued 119 crore equity shares at Rs. 2 per share, valuing it at approximately Rs. 1,200 crore. Share India alone invested Rs. 59.5 crore for a 4.958% stake. The new capital aims to encourage MSEI’s position and market activity.

Moreover, the MSEI, in its circular dated 29 November 2024, notified everyone about the new weekly and monthly expiry dates, which will now happen on Friday of the week and the last Friday of the month.

Table of Contents

What is MSEI?

The full form of MSEI is Metropolitan Stock Exchange of India. It was previously known as MCX-SX (MCX Stock Exchange) before its rebranding. It provides a platform for trading in equity, equity derivatives, currency derivatives, and debt instruments.

MSEI is not as large as the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE), which dominate the Indian stock market. However, it is a recognized stock exchange in India.

MSEI began operations in 2008 and launched its Capital Market Segment, Futures and Options Segment, and its flagship index, SX40.

Trading in the SX40 index began in February 2013.

While there has been some activity in equity and currency derivatives, most trading segments witness minimal activity.

Who owns MSEI?

Breakdown of Ownership of MSEI

- Key Investors at the Early Stages:

Rakesh Jhunjhunwala and Radhakishan Damani were among the prominent early investors.- Currently, Radhakishan Damani holds a 0.89% stake in MSEI.

- Major Shareholders:

- Multi Commodity Exchange of India: Holds a 6.9% stake as of September 30.

- Siddharth Balachandran (a prominent non-resident Indian investor): Owns a 4.9% stake.

- Share Capital: Announced an investment of ₹59.5 crore to acquire 29.75 crore equity shares, constituting a 4.958% stake in the post-issue paid-up share capital.

- Banks: Several banks hold stakes in MSEI, including:

- Union Bank of India

- State Bank of India

- Bank of Baroda

- Punjab National Bank

- Indian Bank

- Bank of India

- Axis Bank Limited

- Indian Overseas Bank

- Canara Bank – Mumbai

- HDFC Bank Limited

What is the MSEI-SX40 index of India?

SX40 is a stock market index introduced by the Metropolitan Stock Exchange of India (MSEI).

MSEI-SX40 serves as a benchmark index for tracking the performance of the top 40 stocks listed on the MSEI.

The index uses the free-float market capitalization method, which considers only the shares available for trading in the market, excluding those held by promoters or large stakeholders.

Know More About SX-40 Index Here

What is the full form of SX-40?

The term ‘SX’ in SX40 is commonly understood to stand for Stock Exchange, where ‘S’ represents stock and ‘X’ represents exchange. The number 40 in SX40 signifies the top 40 large-cap companies included in the SX40 index.

However, no official clarification has been provided regarding the exact full form of SX40.

learn more about the SX40 FAQs

New Expiry Day in SX40 Derivatives Trading

Starting January 1, 2025, the expiry day for SX40 Index derivatives contracts in the equity derivatives segment of the Metropolitan Stock Exchange of India (MSEI) will be revised.

As per the new guidelines, all contracts—weekly, monthly, quarterly, and semi-annual—will now expire on Fridays, replacing the previous schedule where expiry occurred on Thursdays.

Also Read – How to Find SX40 Candlestick Chart on TradingView?

This change will affect both existing and new contracts. Contracts expiring on or after January 1, 2025, will reflect this update. If the expiry day falls on a trading holiday, the preceding working day will serve as the expiry date.

Read The Official Notification Here

Watch this video to know more:

What is the Lot Size for SX 40 in India?

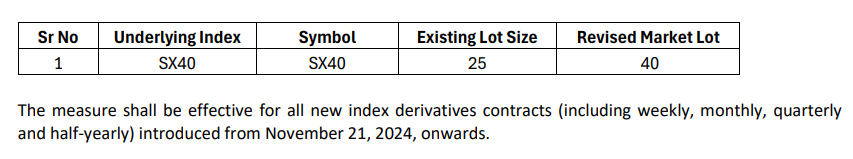

The new lot size for SX 40 F&O instruments has been revised to 40, in line with SEBI’s new rule regarding the increased contract value.

Previously, the lot size was 25 shares.

Also Read – What is an Index Fund in simple words? – Complete basics for beginners

When is the expiry of the SX40 index?

The weekly expiry is scheduled on Friday of every week, and the monthly expiry is scheduled on the last Friday of every month.