In this article, we will study about Jagatjit Industries Limited and its business. We will also discuss about Jagatjit Industries Limited Share Price Target from 2025 to 2030. So let us begin.

Table of Contents

Company Overview

Jagatjit Industries Limited (JIL) was founded in 1944. The company started its journey with Jagatjit Chemical and Pharmaceutical Works and Jagatjit Laboratories in 1946, followed by the launch of its distillery in 1948. Over the decades, JIL has established itself as a pioneer in the industry, producing several premium brands, including the famous Aristocrat and Teachers whiskies. In 2023, JIL received approval for its Ethanol plant, marking another significant milestone in its long history.

Business Overview

Jagatjit Industries Limited is a global leader in the premium drinks segment, operating the largest integrated distilleries in Asia for manufacturing potable alcohol. The company is a trailblazer in India, being the first to have in-house capabilities for producing molasses and non-molasses based potable alcohol through fully automated distillation plants. Beyond alcoholic beverages, JIL’s diverse product range includes malt, malt extract, nutritious planned food, milk powder, ghee, dairy products, and malted milk foods.

Recent Financial Performance

| Metric | Quarter Ended June 2024 | Quarter Ended June 2023 | % Change |

|---|---|---|---|

| Sales (₹ Crore) | 153.65 | 174.11 | −11.75% |

| Net Profit (₹ Crore) | -4.26 | 2.74 | −255.47% |

In the quarter ended June 2024, the company’s sales decreased by 11.75% compared to the same quarter in June 2023, dropping from ₹174.11 crore to ₹153.65 crore. Additionally, the company’s financial performance worsened significantly, with a net loss of ₹4.26 crore in June 2024, compared to a net profit of ₹2.74 crore in June 2023. This resulted in a negative change of 255.47% in net profit, indicating a sharp decline in profitability.

Key Financial Metrics

| Metric | Value |

|---|---|

| Market Cap | ₹ 971 Cr. |

| Price to Earnings Ratio (P/E) | 357.07 |

| Industry P/E | 39.6 |

| Price to Book Value (P/BV) | 12 |

| Industry P/BV | 7.21 |

| Return on Equity (ROE) | 11.1% |

| Return on Capital Employed (ROCE) | 10.7% |

| Return on Assets (ROA) | 1.40% |

| Debt to Equity | 3.56 |

The company’s Market Cap stands at ₹971 crore, reflecting its overall valuation in the stock market. The Price to Earnings Ratio (P/E) is notably high at 357.07, significantly above the industry average of 39.6, indicating that the stock may be overvalued compared to its peers. The Debt to Equity ratio is 3.56, which suggests the company is heavily leveraged, relying more on debt than equity for financing. Lastly, the Return on Equity (ROE) is 11.1%, showing a moderate level of profitability in generating returns for shareholders relative to the equity invested.

Also Read – Promoters Increase Stake by Acquiring 6.16 Lakh Shares in NBFC

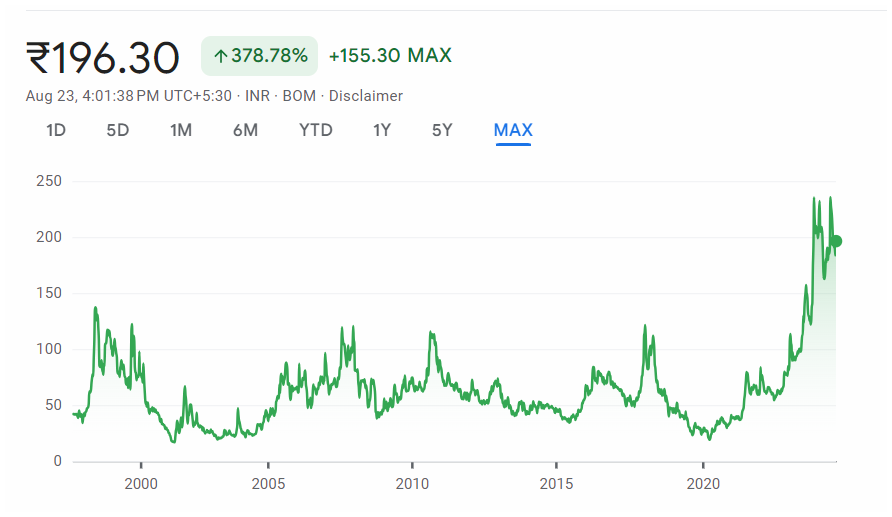

Stock Performance till now

| Time Period | Returns |

|---|---|

| All time | 408.29% |

| Past 5 Years | 804.12% |

| Past 1 Year | 61.24% |

| Past 1 month | 4.58% |

The stock has given a return of 10% CAGR in the past 10 years.

Share Price Target

| 2025 2026 2027 2028 2029 2030 | Numbers you see online do not make any sense. They are often guesses and not reliable. Not even a SEBI-registered analyst can predict future targets accurately. It is very hard to predict share prices years ahead. The stock market is fundamentally driven and mainly depends on how well a company performs. If the company does well, the stock will likely do well too. If the company struggles, the stock might not do well. But the thing is, no one can see the future. The future is always uncertain. To make better decisions, keep an eye on the company’s financial health and performance on a regular basis. Always talk to a financial advisor before making any investment decisions. |

While it’s tough to predict exact prices, you can use a simple method to guess future prices.

For example, if a stock is currently at ₹100 and the company has grown by 18% per year, you might expect the stock to grow at a similar rate if the company continues to perform well. The company’s growth refers to an increase in its revenue and profits.

If the company keeps growing at 18% per year, the stock might increase to about ₹118 (₹100 + 18% of ₹100).

On the other hand, if the stock has been falling by 10% due to poor financial performance, the price might drop to around ₹90 (₹100 – 10% of ₹100).

Remember, these are just rough estimates. Markets are inherently uncertain, and predicting exact future prices is nearly impossible.

Focus on the fundamentals of the business and make decisions accordingly. Whether to stay invested or to exit depends entirely on the financial performance of the company. Stay informed through regular analysis.

Don’t know how to analyze a company? Join our YouTube channel to learn fundamental analysis for free – Feel The Candlesticks

Share Holding Pattern

| Shareholder Category | Holding (%) |

|---|---|

| Promoters | 87.34% |

| Foreign Institutional Investors (FII) | 0% |

| Domestic Institutional Investors (DII) | 0.01% |

| Public | 12.66% |

Promoters hold a significant stake of 87.34% in the company, which shows their confidence in the company’s long-term profitability.

The Bottom Line

The company operates the largest integrated distilleries in Asia, producing premium brands like Aristocrat and Teachers whiskies. JIL is also known for its diverse product range, including dairy products and malted milk foods. Despite recent market challenges, the company remains committed to innovation and profitability, as evidenced by its approval for an Ethanol plant in 2023 and strong promoter confidence with a significant 87.34% ownership stake. JIL’s focus on growth positions it well for future success.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

Visit the official site for more information