Insecticides India Limited (IIL), a leading player in the agrochemical industry, has recently announced a significant move that is set to impact its shareholders. The company has approved a buyback proposal for its equity shares, reflecting its commitment to enhancing shareholder value. In this article, we will cover everything you need to know about the Insecticides India Limited share buyback, including key details, record date and buyback price.

Table of Contents

What is a Buyback?

A buyback is a corporate action where a company repurchases its own shares from the existing shareholders, usually at a premium to the current market price. This reduces the number of shares in circulation, which can potentially increase the value of the remaining shares.

Insecticides India Limited Buyback 2024 Overview

Insecticides India Limited has approved a buyback of up to 5,00,000 fully paid-up equity shares, representing 1.69% of the total paid-up equity capital. The buyback price is set at ₹1,000 per share, with an aggregate buyback size not exceeding ₹50 Crore. This buyback will be conducted through the “Tender Offer” route, allowing shareholders to tender their shares at the buyback price.

Read the official notification here.

For the year 2024, Insecticides India Limited has strategically decided to proceed with this buyback to optimize its capital structure. The buyback is set below 10% of the company’s paid-up equity capital and free reserves as of March 31, 2024. This move underscores the company’s strong financial position and its aim to reward shareholders.

Buyback Record Date

The record date for determining the eligibility of shareholders to participate in this buyback is set for Wednesday, September 11, 2024. Shareholders who hold shares as of this date will be entitled to tender their shares in the buyback offer.

Buyback Ratio

The company has not explicitly mentioned a specific buyback ratio. However, it has indicated that the buyback will be on a proportionate basis, allowing all eligible shareholders to participate equally, based on their holding as of the record date.

What is the Buyback Price?

The buyback price for Insecticides India Limited share has been fixed at ₹1,000 per share. This price represents a premium over the current market price, providing shareholders with an attractive exit option.

Important Dates for Insecticides India Limited Buyback

- Record Date: September 11, 2024

- Buyback Offer Period: Yet to be announced, but shareholders should stay informed for updates.

Also Read – What is a share buyback in the stock market? – 5 Important Facts to Know About Share Buybacks

How to Apply for the Insecticides India Limited Buyback?

Shareholders eligible as of the record date will receive communication from the company or their brokers regarding the tendering process. Typically, the process involves:

- Receiving an offer letter from the company.

- Submitting a tender form to the broker or company representative.

- Confirming the shares to be tendered and completing the necessary paperwork.

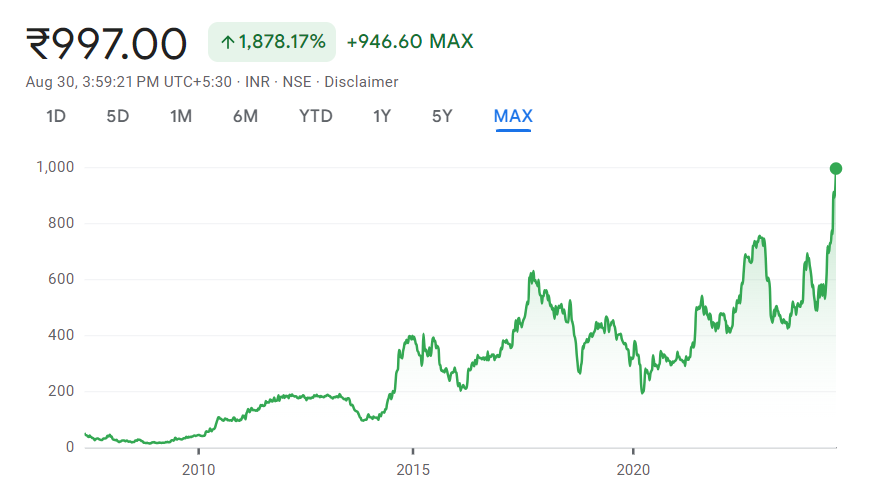

Share Price History

Conclusion

The buyback announcement by Insecticides India Limited is a clear signal of the company’s commitment to its shareholders and confidence in its future prospects. With a substantial buyback price and a well-structured process, this corporate action is set to create value for participating shareholders while optimizing the company’s capital structure.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

FAQs

What is the record date for the Insecticides India Limited buyback?

The record date is September 11, 2024.

How many shares are being bought back?

Up to 5,00,000 equity shares are being bought back.

What is the buyback price?

The buyback price is ₹1,000 per share.

How do I participate in the buyback?

Eligible shareholders will receive instructions on how to tender their shares through their broker or directly from the company.