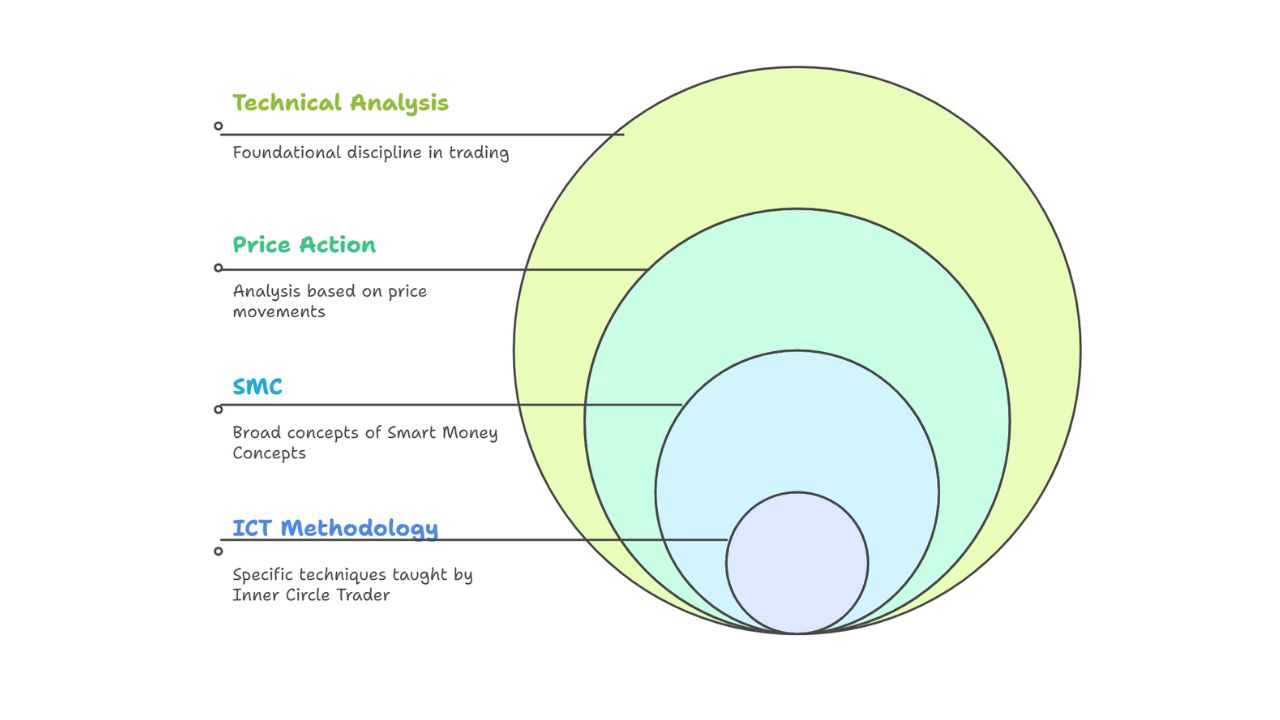

Technical Analysis is the foundation of trading analysis. It mainly includes two types of methods:

- Price action analysis

- Indicator-based analysis.

When we talk about price action, there are many styles and strategies. One popular concept is called SMC.

Now, SMC is a broad concept that includes many different methods. One of the most well-known styles within SMC is taught by Michael J. Huddleston, and it’s commonly referred to as ICT-SMC.

What is SMC?

SMC stands for Smart Money Concept.

It is a style of trading that focuses on how big players like banks, hedge funds, and institutions trade in the market. These big players are called smart money because they have more money, more information, and better tools than regular traders.

Technical analysis, the core discipline of studying price charts, can broadly be divided into two categories: indicator-based methods and price action analysis.

Within price action, trading approaches can be further classified into two distinct but complementary perspectives: macro and micro.

Macro price action refers to the traditional, big-picture view. It focuses on well-known elements like support and resistance zones, trend lines, and classic candlestick patterns.

On the other hand, micro price action explores the finer, more detailed movements of the market-what’s happening ‘under the hood.’ This is where advanced methods like Smart Money Concepts (SMC) come into play. This is the more advanced layer of analysis that seeks to understand the ‘why’ behind the market’s movements. It’s about looking beyond surface-level patterns to uncover the institutional logic driving price behavior.

Core concepts in this micro view include identifying liquidity pools, market structure shifts (MSS), and order blocks. A trader using this perspective understands that a resistance zone isn’t just a ceiling – it’s often a liquidity pool where retail traders have clustered their stop-losses and sell orders. Smart money is incentivized to ‘sweep’ this liquidity before initiating the true directional move.

For example, instead of reversing immediately from resistance, price may first move slightly above that level to trigger stop-losses – this action, known as a liquidity sweep, often precedes a sharp reversal. This confirms institutional intent and shows how smart money exploits retail positioning.

By combining a macro understanding of market direction with a micro view of institutional behavior, traders can build stronger strategies that align with the flow of smart money.

What is ICT?

ICT is the acronym for the YouTube channel of Michael J. Huddleston, who has been a trading mentor for many years.

The full name of the channel is The Inner Circle Trader.

He created and taught his own smart money concepts that are popular today. His detailed teachings are called ICT-SMC because they are his version of the Smart Money Concept.

He teaches through YouTube, mentorships, and free content. Many advanced traders follow his strategies, and some other educators even teach his concepts under different names.

However, when people say ‘ICT,’ they’re usually referring to Michael J. Huddleston himself rather than just his YouTube channel. For example, if someone says ‘ICT has uploaded a new video,’ they simply mean that Michael J. Huddleston has posted a new video on his YouTube channel called The Inner Circle Trader.

Also Read – ICT (Michael J. Huddleston)-Biography, Net Worth, YouTube Channel, Family & Trading Success

ICT vs SMC – The Difference Every Trader Should Know

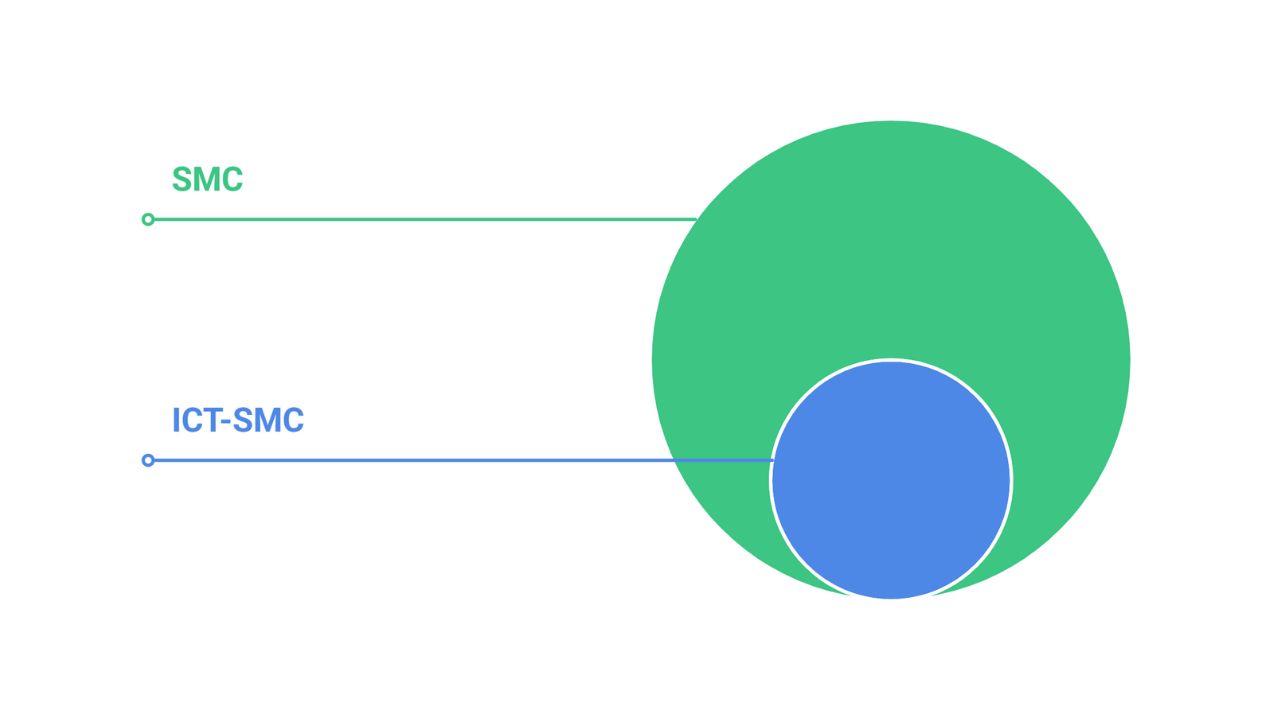

Think of SMC as the entire “fruits” category, while ICT-SMC is like “mangoes” – a specific type within that bigger group.

Just like a mango is definitely a fruit, but you wouldn’t call every fruit a mango, ICT-SMC falls under the broader SMC umbrella, but SMC may include much more than just SMC by ICT.

Here’s the thing – although the idea is somewhat controversial, the Smart Money Concept existed long before ICT (Inner Circle Trader) came along.

Traders have been studying institutional behavior, market structure, and how ‘smart money’ moves for decades. They’ve analyzed things like accumulation zones, distribution patterns, and how big players manipulate retail traders.

ICT took these foundational ideas and built a unique framework around them. He identified specific components within the chart and named them—such as order blocks, fair value gaps, liquidity grabs, Judas swings, and market structure shifts. Over time, his detailed approach became widely followed. In fact, it became so popular that many people started referring to his entire method as ‘SMC.’ However, that’s not entirely accurate, as SMC is a broader concept, and ICT’s style is just one interpretation within it.

So when someone says they trade “SMC,” they might mean ICT’s specific approach, or they could be using any number of smart money strategies.

It’s like saying you eat “fruit” – you could mean mangoes, but you could also mean apples, oranges, or anything else in that category.

The Bottom Line

| Point | SMC (Smart Money Concept) | ICT-SMC (SMC by The Inner Circle Trader) |

|---|---|---|

| What it is | A trading concept or method | A style of SMC taught by Michael J. Huddleston |

| Creator | Not specific – used by many educators | Michael J. Huddleston (ICT) |

| Depth of Learning | General idea of smart money behavior | More detailed with logic, rules, and framework |

| Learning Style | Simple and easy to learn | Detailed, long-term learning approach |

While this article has been written with proper care and attention to detail, we remain open to updating and correcting any information if errors are brought to our attention or come to our notice. The trading community’s feedback is valuable, and we encourage readers to point out any inaccuracies so we can maintain the quality and reliability of our content. Trading involves significant risk, and this information is for educational purposes only.