In a recent announcement, Chaman Lal Setia Exports Ltd, a prominent player in India’s basmati rice export industry, has declared a significant dividend for its shareholders and provided important dates for investor consideration. This article covers the details of this announcement and its implications for shareholders and the company’s financial health.

Table of Contents

Dividend Announcement: A Boost for Shareholders

Substantial Final Dividend Recommended

In a move that signals strong financial performance and commitment to shareholder value, the Board of Directors of Chaman Lal Setia Exports Ltd has recommended a final dividend of Rs. 2.25 per equity share. This dividend represents an impressive 112.50% of the face value of each share, which stands at Rs. 2.

The announcement of such a substantial dividend is often interpreted as a positive indicator of a company’s financial health and its confidence in future cash flows. For Chaman Lal Setia Exports Ltd, this generous payout suggests a robust financial year ending March 31, 2024.

Read the official notification here.

Implications for Shareholders

For investors, this dividend announcement comes as welcome news. A dividend yield of 112.50% is significantly higher than average market returns, potentially making Chaman Lal Setia Exports Ltd an attractive option for income-focused investors. However, it’s important to note that dividend payments are subject to approval by shareholders at the upcoming Annual General Meeting (AGM).

Key Dates for Shareholders: Mark Your Calendars

Record Date: The Critical Cutoff

One of the most crucial pieces of information for shareholders is the record date. Chaman Lal Setia Exports Ltd has set Saturday, September 21, 2024, as the record date for dividend eligibility. This means that investors who are registered as shareholders of the company on this date will be entitled to receive the dividend, assuming it receives approval at the AGM.

Also Read – What is a Dividend? – A Complete Guide in Simple Words

Book Closure Period

The company has announced that its Register of Members and Share Transfer Books will remain closed from Sunday, September 22, 2024, to Saturday, September 28, 2024 (both days inclusive). This period is significant for administrative purposes related to the AGM and dividend payment.

Annual General Meeting Date

The 30th Annual General Meeting of Chaman Lal Setia Exports Ltd is scheduled for Saturday, September 28, 2024, at 4:30 p.m. In keeping with contemporary practices and potential ongoing health concerns, the meeting will be held virtually through Video Conferencing/Other Audio-Visual Means (VC/OAVM).

E-Voting Period

To facilitate shareholder participation in decision-making, the company is providing a Remote E-voting facility. Shareholders can cast their votes electronically from Wednesday, September 25, 2024 (10:00 a.m.) to Friday, September 27, 2024 (5:00 p.m.).

Company Overview: Understanding Chaman Lal Setia Exports Ltd

To provide context for this announcement, it’s worth briefly exploring the company’s background:

Chaman Lal Setia Exports Ltd, trading under the stock codes 530307 (BSE) and CLSEL (NSE), is a well-established player in India’s agricultural export sector. Specializing in basmati rice processing and export, the company has built a strong reputation over its three decades of operation.

Headquartered in Amritsar, Punjab, the heart of India’s basmati rice-growing region, Chaman Lal Setia Exports Ltd has leveraged its strategic location to establish a significant presence in both domestic and international markets. The company’s business model encompasses the entire value chain of basmati rice production, from sourcing high-quality paddy to exporting finished products.

Recent Financial Performance of the company

| (in Crores) | Jun-24 | Mar-24 |

|---|---|---|

| Revenue | ₹362.84 | ₹383.53 |

| Net Profit | ₹22.62 | ₹23.25 |

| EPS | ₹4.37 | ₹4.49 |

| P/E | 11.25 | 10.77 |

| OPM % | 9.30% | 9.74% |

| NPM % | 6.23% | 6.06% |

For the period ending June 2024, the company reported a revenue of ₹362.84 crores, which slightly decreased from ₹383.53 crores in March 2024. The net profit for June 2024 stood at ₹22.62 crores, showing a marginal dip compared to ₹23.25 crores in the previous quarter. Earnings per share (EPS) also reduced from ₹4.49 in March to ₹4.37 in June. The price-to-earnings (P/E) ratio for June is 11.25, higher than the 10.77 recorded in March. Operating profit margin (OPM) saw a slight decline, falling from 9.74% to 9.30%, while the net profit margin (NPM) improved slightly, moving from 6.06% to 6.23%.

Stock Performance

As per the BSE analytics,

- The stock has shown significant positive momentum in the short term, with a 5.22% gain over the past week and an 8.75% increase over the last month.

- Over the past 3 months, the stock has delivered a substantial 22.42% return, outperforming its shorter-term results.

- Despite recent gains, the stock is down 6.27% year-to-date, indicating it has faced some headwinds in the current year.

- The stock shows a robust 18.44% return over the past year, demonstrating strong performance over this timeframe.

- The stock has delivered outstanding long-term results, with returns of 119.13% over 2 years, 105.97% over 3 years, and an impressive 494.67% over 5 years.

- Over a 10-year period, the stock has generated an extraordinary 2059.77% return, showcasing its ability to create significant value for long-term investors.

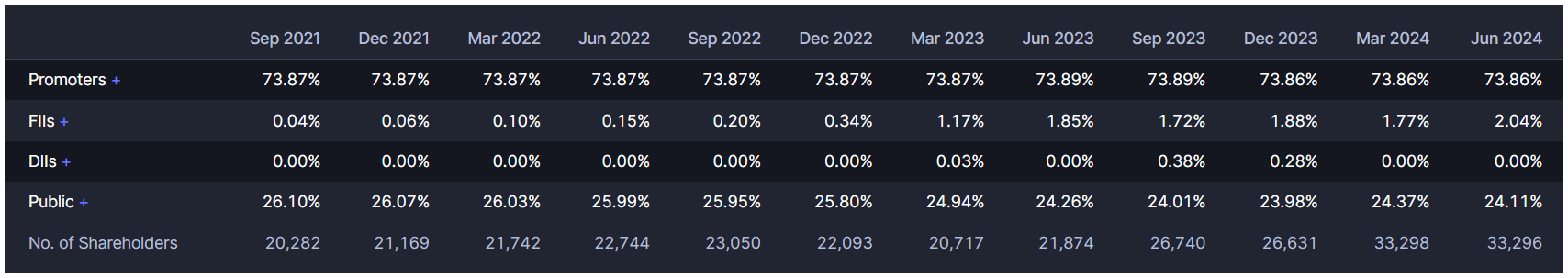

Shareholding pattern

Conclusion

The announcement of a substantial dividend and the intimation of key dates by Chaman Lal Setia Exports Ltd sends a positive signal to the market. It demonstrates the company’s financial strength and its commitment to rewarding shareholders.

For current shareholders, this news provides a clear timeline for important events and the promise of a significant return on their investment. For potential investors, it offers an opportunity to evaluate the company’s financial health and dividend policy as part of their investment decision-making process.

As always, while such announcements are generally positive, investors are advised to consider the broader financial picture, industry trends, and their individual investment goals when making decisions. The upcoming AGM may provide further insights into the company’s performance and future strategies, making it an event worth watching for those interested in Chaman Lal Setia Exports Ltd and the basmati rice export sector as a whole.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

Also Read – Insecticides India Limited Share Buyback 2024 – Record Date, Buyback Ratio & Buyback Price