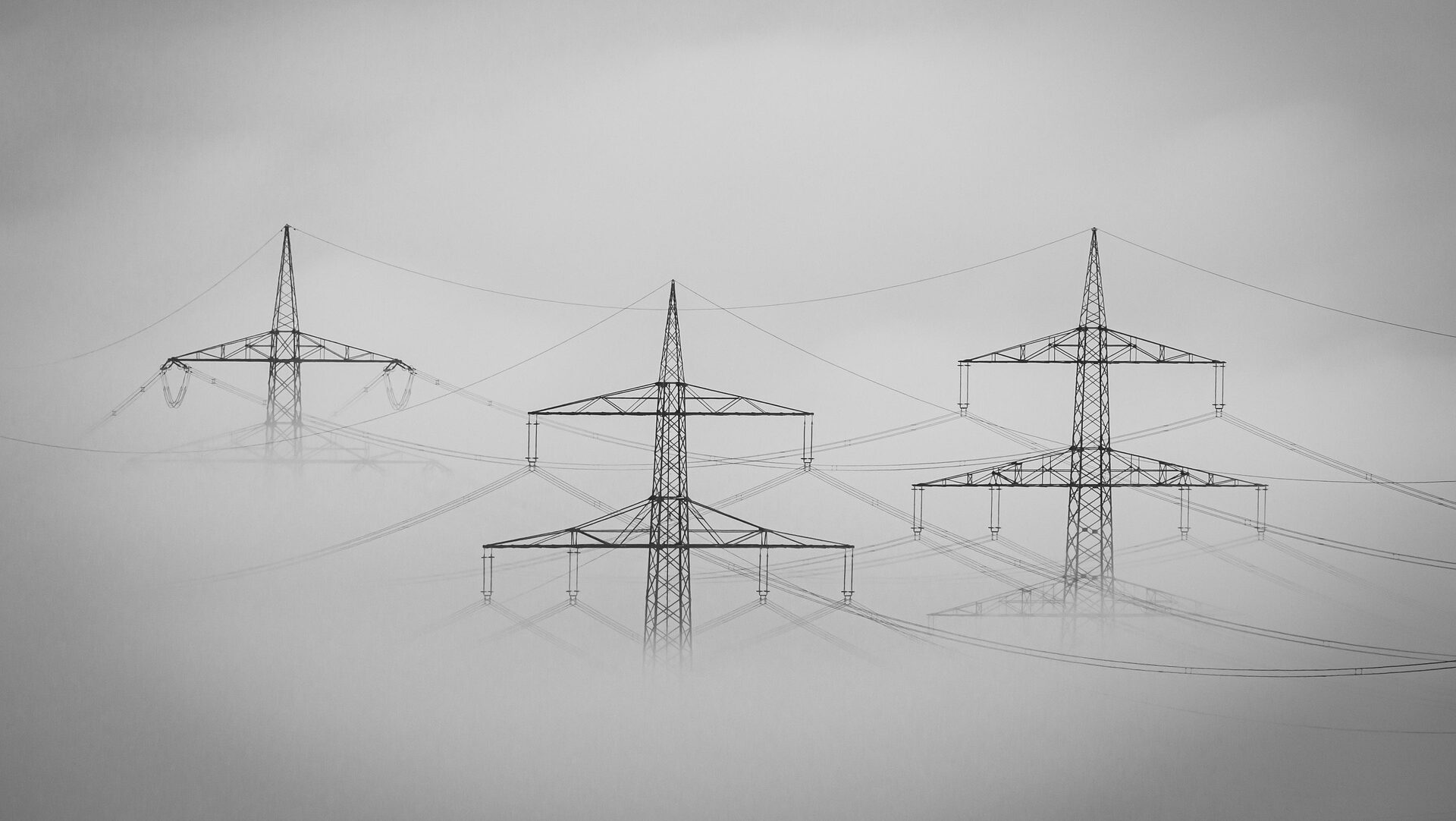

Electricity is a unique commodity: it cannot be stored easily, it flows according to the laws of physics, and its production and delivery are subject to constant balancing and complex grid conditions.

Because of these unique features, prices in the electricity market can be extremely volatile. Even short-term spikes can dramatically impact the cost of power for industrial users, distribution companies, or generators.

Unlike most other commodities, no one truly “owns” electricity after it is injected into the grid. Instead, qualified participants get the right to inject or withdraw electricity, subject to grid codes and balancing rules. This structure makes hedging strategies even more critical to manage unpredictable price movements.

Why Hedge with Electricity Derivatives?

Hedging through electricity derivatives is essentially a risk management strategy. These financial contracts including futures, forwards, options, and swaps – allow participants to lock in power prices for a future period, reducing exposure to short-term market volatility.

Key reasons to hedge include:

- Price certainty: Protects budgets from sudden spikes in power prices.

- Cash flow stability: Smoothens power purchase costs or sales revenues over time.

- Market competition: Supports competitive pricing for customers without risking margin erosion.

- Planning confidence: Enables long-term operational and investment planning.

For example, an industrial unit expecting to use 10 MW of electricity could buy a futures contract at ₹2500/MWh. If spot prices later rise to ₹5000/MWh, the futures contract saves the buyer from paying that higher rate.

How Hedging Works in Practice?

Here are common hedging tools:

- Forwards: Bilateral agreements to buy/sell electricity at a specified price in the future. In India, these are often seen as long-term Power Purchase Agreements (PPAs).

- Futures: Standardized contracts traded on exchanges like MCX or NSE, typically cash-settled. These provide liquidity and price transparency but have fixed specifications.

- Options: Work like insurance – you pay a premium for the right, but not the obligation, to buy or sell at a fixed price.

- Swaps: Agreements to exchange floating spot market prices for fixed prices over a given period, giving predictable cash flows.

Practical examples, such as a generator selling futures contracts to lock in their generation price, or an industrial buyer using options to protect against price surges while keeping the potential to benefit from lower spot prices.

Consequences of Not Hedging

The consequences of ignoring hedging are real and can be severe. Without risk management:

- Companies might face sharp spikes in electricity bills during peak seasons or unplanned demand surges.

- Profit margins could collapse if costs rise but sales prices stay fixed.

- In case of high price volatility, cash flows can become erratic, making it difficult to meet financial obligations or maintain stable operations.

- Competitors with hedging strategies may gain an advantage by offering more predictable prices to their customers.

For example, a data center operating under a fixed-price contract might suddenly see power bills increase by 50% in a heat wave. If the data center cannot pass those costs to clients, its margins could be wiped out.

This article is for informational purposes only and should not be considered financial advice. Investing in derivatives, stocks, commodities, or other assets involves risk, including the potential loss of principal. Always do your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, market conditions can change rapidly. Always verify data with primary sources before making decisions.