What is SMC?

SMC is simply a smart and efficient way of trading. It is a structured way of approaching the markets.

It is the process of identifying the best liquidity and the best discount zone when you are planning to buy – essentially “thinking like a big bull.”

Or finding the best premium zone when you want to sell – “thinking like a big bear.”

That is the core meaning of Smart Money Concepts.

The universal rules still remain the same:

• The best discount zone is the demand/support zone.

• The best premium zone is the supply/resistance zone.

The SMC vs ICT confusion

There is a common debate about whether SMC originated from ICT (Michael J. Huddleston).

Some argue that concepts like FVG and Order Blocks were introduced by ICT and later repackaged under the name SMC.

ICT claims this himself.

It may be true, or it may not be – we do not have an official conclusion.

But what is clear is that ICT has deep experience in financial markets, and he has introduced many strong concepts. His approach generally goes into micro-level price action analysis.

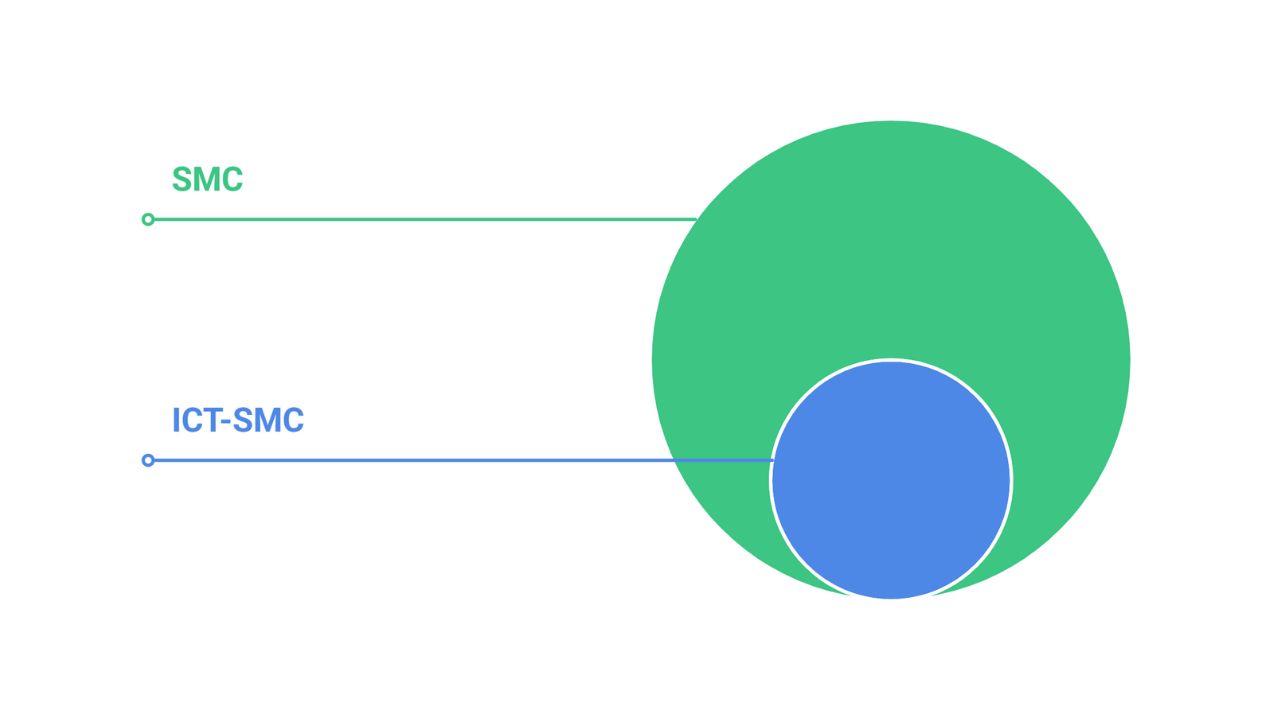

Modern SMC – or the version that people say is separate from ICT – is somewhat broader than ICT’s complete methodology.

Yes, ICT has a very refined and structured approach. But if we focus purely on the term SMC, its meaning can simply be understood as trading in a smart way to capture the best liquidity and get the best price – whether you are a buyer or a seller.

There was a well-known trader, David Paul, who was also involved in trading education. He used a smart method that we now call a “liquidity sweep,” long before the term existed.

He used to say he places entries where the masses have placed their stops. A good trade is often a difficult trade. Large players can influence the market easily – this aligns with modern AMD where “M” stands for manipulation.

So, you could call it David’s smart technique of trading.

And similarly, ICT (Michael J. Huddleston) has his smart technique of trading.

Ultimately, it depends on what you choose to follow.

The controversy will resolve when the right time and evidence come. It does not need to be our focus here.

Also Read – ICT (Michael J. Huddleston)-Biography, Net Worth, YouTube Channel, Family & Trading Success

What we will do here?

We follow a simple framework:

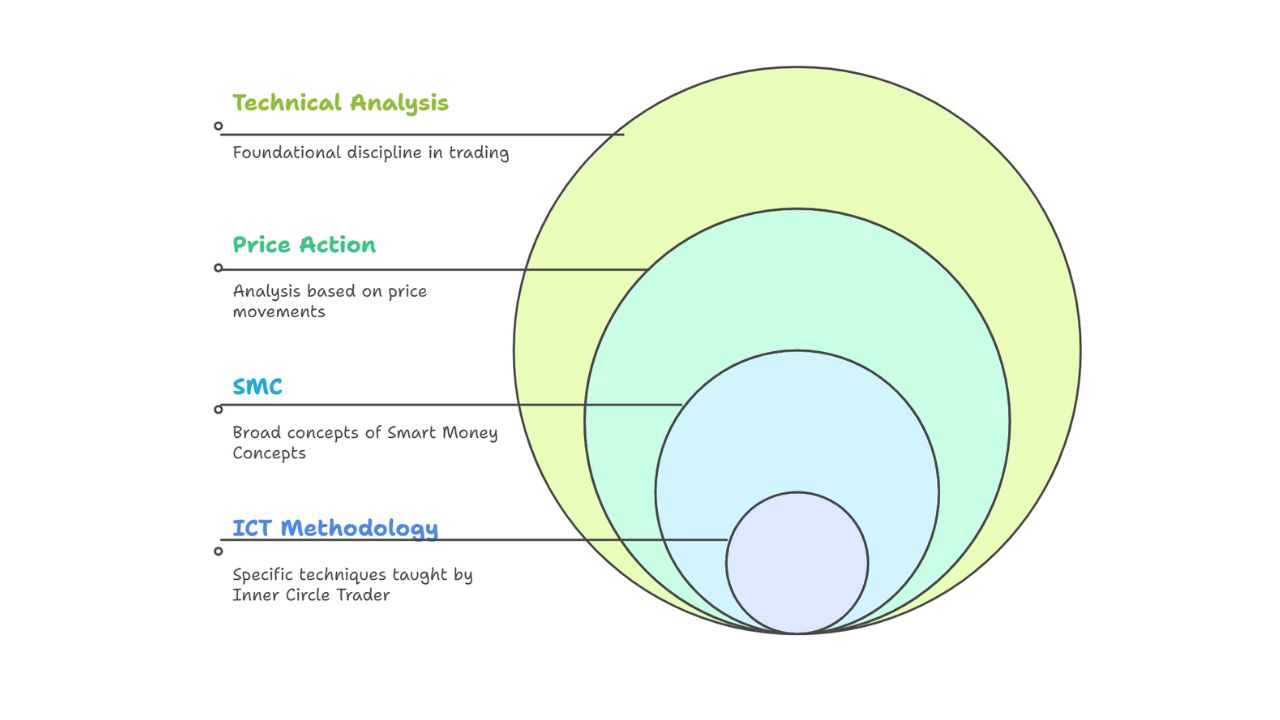

Technical Analysis < Price Action < Smart Money Concept < ICT-SMC (the refined approach from Michael J. Huddleston)

Also Read –What is the difference between ICT and SMC?

Yes, we believe in ICT’s work. And yes, if someday strong verification proves that concepts like OB and FVG were first introduced by ICT, we would have no hesitation in accepting that.

But our approach starts broadly, using classical support–resistance theories, and then moves deeper.

Stay tuned for further learning.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.