Table of Contents

What is an Index?

An index is created using a group of stocks. These stocks might belong to the same sector, the same industries, or could be a mix of stocks from different sectors or industries.

An example of an index is Nifty 50, which comprises stocks from different sectors of the economy. Another example is Bank Nifty, also called Nifty Bank, which consists of banking stocks from the banking sector.

An index helps us understand the performance of the entire stock market or a particular sector collectively.

There are two major stock exchanges in India: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Top Stock Market Indices of India

- Nifty: This index includes the top 50 companies listed on the National Stock Exchange (NSE) in India.

- Sensex: This index includes the top 30 companies listed on the Bombay Stock Exchange (BSE).

These indices provide a snapshot of how the market is performing by looking at the top included companies.

Companies are included in these indices based on their market capitalization, which represents the total market value of their outstanding shares. A higher market capitalization increases a company’s likelihood of being selected for inclusion. Market capitalization reflects the size of a company.

What is an Index Fund?

An index fund is like a special investment basket. Here’s how it works:

- Invests in All Stocks of an Index: If you invest in an index fund that tracks the Nifty 50, your money is spread out to buy all the stocks in the Nifty 50 index in the same proportions.

- Managed by a Fund Manager: A professional manages the fund, making sure your investments match the index.

- Low Cost: Index funds usually have lower fees compared to other types of mutual funds.

- Passive Investing: Instead of picking individual stocks, the fund just follows the index.

In an index fund, the fund manager just mirrors the index and adjusts the weightage of stocks in the fund as the weightage changes in the original index.

Please note that when you invest in an index fund, you own a portion of the fund itself, not the individual stocks that make up the index it tracks.

How is an Index Fund Different from a Mutual Fund?

- An index fund has fixed stocks that are part of an index. These funds are passively managed by a fund manager. The fund manager cannot alter the stocks on his own, leading to a lower expense ratio.

- On the other hand, a mutual fund is actively managed by a fund manager who can change the stocks based on his own judgment, considering risk and reward. This active management results in a higher expense ratio.

Also Read – What is an ETF in Simple Words? – 3 Important Points to Know

Returns and Risks

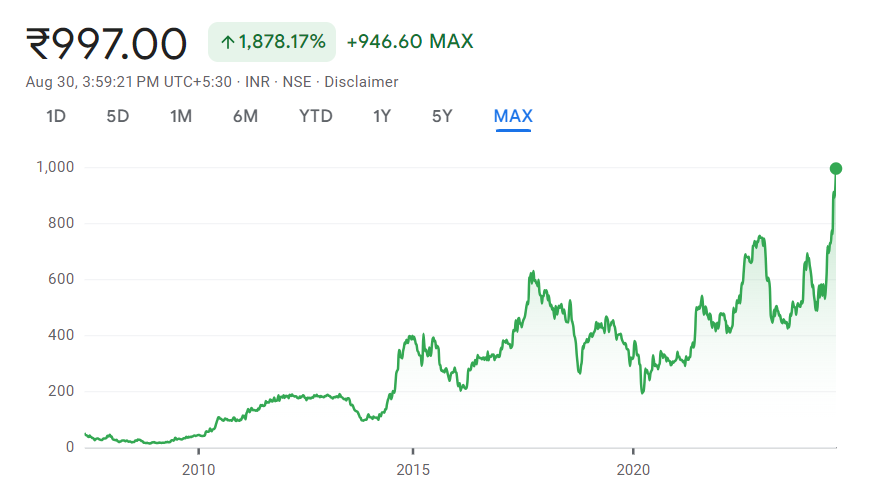

Index funds are generally good for long-term investments. Over time, they often perform better than fixed deposits. For example:

- If you invested in the Nifty 50 index in the year 2000, your money would have grown significantly by the end of 2021.

- Fixed deposits usually offer lower returns compared to index funds over long periods.

However, index funds do involve some risks, especially because they are tied to the stock market’s ups and downs.

How to Choose the Right Index Fund

When picking an index fund, consider these key factors:

- Expense Ratio: This is the fee you pay to manage the fund. Lower expense ratios are better. For example, an expense ratio of 0.2% means you pay 20 paise per 100 rupees invested.

- Tracking Error: This measures how closely the fund follows the index. A lower tracking error means the fund more accurately reflects the index’s performance.

- Assets Under Management (AUM): This shows how much money is invested in the fund. Generally, a higher AUM is better because it indicates stability.

Conclusion

Index funds are great for long-term investments and can help you grow your money over time. They are not risk-free, but with proper research, you can make informed choices. Look for funds with low expense ratios and good tracking accuracy. Remember, investing in index funds is about being patient and thinking long-term. Happy investing!

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

Also Read – Is there any difference between a sector and an industry?