Options are financial derivatives, meaning they derive their value from an underlying asset such as stocks, Bitcoin, crude oil, gold, silver, etc.

Options are commonly used for hedging, which is a strategy to reduce potential financial losses.

- One main purpose of options is hedging, which is a way to protect yourself against losses. Think of it as buying insurance for your trades. For example, if you own shares of a stock and are worried about a possible price drop, you could buy a put option (an option to sell) to reduce your loss. Hedging is common in options, as it helps traders reduce risks.

In general, the market often involves a continuous contest between bulls (those who expect prices to rise) and bears (those who expect prices to fall)—essentially, a battle between buyers and sellers.

These buyers and sellers can either be futures traders (future buyers and sellers) or options traders (option buyers and option sellers), depending on their strategy and position in the market.

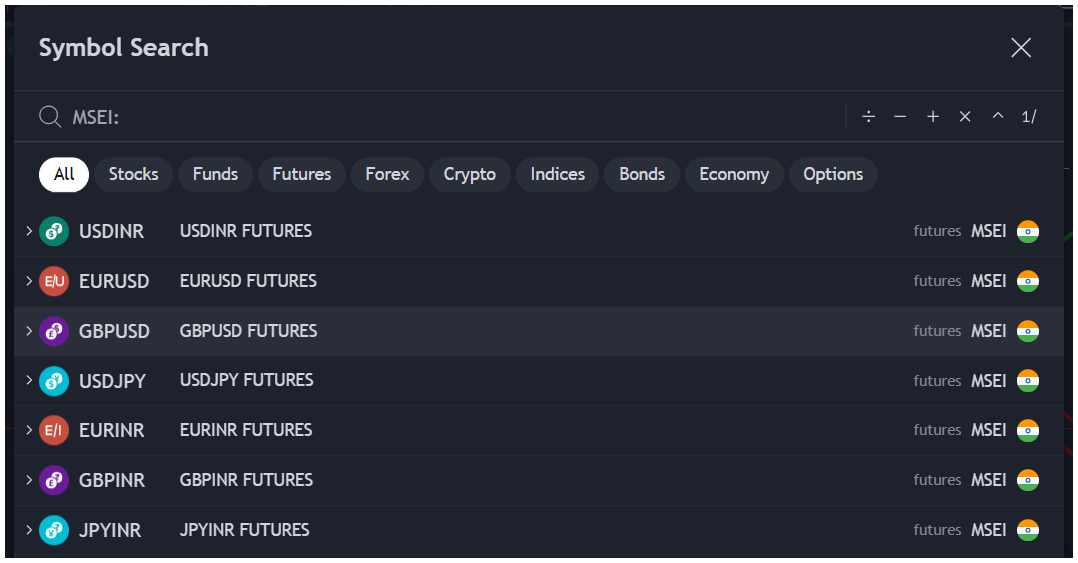

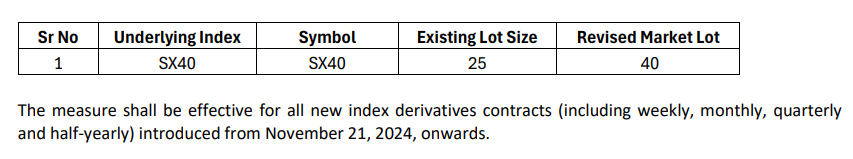

The Basics of Futures Trading

In futures trading, you can choose to buy if you believe the market will go up or short sell if you think it will go down. In essence, futures trading gives you only two choices based on your market expectations.

The probability of making a profit in futures trading is generally around 50%. You can either gain by 1 tick, lose by 1 tick, or break even if the market remains static. That’s it—no other factors influence your gains or losses directly in futures trading.

For a futures trade to happen, there must be both a buyer and a seller. For example, suppose you decide to buy Bank Nifty futures at an index value of 48,000. If the market price rises to 48,001, you would make a profit of ₹1 per share in a lot (while the futures seller would lose ₹1 per share in that lot). Conversely, if the market price drops to 47,999, you would incur a loss of ₹1 per share in a lot (and the futures seller would make a profit of ₹1 per share in that lot). If the market stays at 48,000, there is no gain or loss, as this is your breakeven point.

The Basics of Options Trading

Options trading revolves around calls and puts, which are the building blocks of this market. Think of call and put options like heads and tails on a coin. If you believe the market will go up, you’d buy a call option. If you think it’s heading down, you’d buy a put option. This is how option buyers operate, seeking profit based on market direction.

Option Buyers are people who buy call options (if they think the market will rise) or put options (if they think the market will drop).

Option Sellers are people who sell options to collect premiums. Option sellers usually believe the market will stay stable or move in the opposite direction of the option they sold.

Four Key Strategies in Options Trading

In options trading, there are four main strategies, allowing you to position yourself based on your market expectations:

- If you think the market will go up:

- Buy a call option from an option seller.

- Sell a put option to a put buyer.

- If you think the market will go down:

- Buy a put option from an option seller.

- Sell a call option to a call buyer.

By selling options, they collect premiums upfront. This premium serves as a safety net. Even if the market moves slightly against them, they can still make a profit as long as the movement doesn’t exceed the premium collected.

Option sellers can profit in two scenarios. First, if the market remains stable and does not move in either direction, they benefit from the decay of the option premium over time. This time decay means that even if the market doesn’t change, the value of the option they sold will decrease, allowing them to keep the premium as profit.

Second, if the market moves in their favor, the premium will decay even faster, leading to quicker profits. This creates a favorable environment for option sellers. The probability of making a profit in option selling is around 66%. Although the profit may be small—limited to the premium collected—option selling is considered a safer strategy. This is especially true for those who have a solid understanding of charts, price action, and effective trade management.

The probability of making a profit in option buying is only 33%. This is the lowest probability compared to futures buying/selling and option selling. Option buyers face significant challenges because they rely on the market moving in their favor within a specific timeframe. If the market doesn’t move significantly, the option premium will decay, leading to potential losses. This low probability emphasizes the importance of understanding market trends and timing when engaging in options buying. In contrast, option sellers enjoy higher probabilities of profit due to the benefits of time decay and market stability.

In options trading, it’s a zero-sum game: Option buyer’s profit is the option seller’s loss and vice versa.

The Battle of Time and Market Movements

For the option buyer, both the option seller and time work as opponents. As time passes, option premiums naturally decay—a phenomenon known as time decay. If the market doesn’t move in the buyer’s favor, they may face increasing losses as the option’s value declines with time.

On the other side, option sellers benefit from time decay since they keep the premium as long as the option doesn’t move against them. Here, time is an advantage for the seller, while their main opponent remains the option buyer.

Key Psychological Differences

Let’s sum up the different approaches and mindsets of option buyers and sellers:

- Risk vs. Reward:

- Buyers are okay with losing the premium but aim for big rewards if the market moves.

- Sellers aim for consistent, smaller profits by collecting premiums, but they face potentially high losses if the market moves against them.

- Market Movement Expectations:

- Buyers usually expect large price swings to maximize their profits.

- Sellers prefer calm, stable markets that allow them to keep the premium without needing to fulfill the option.

- Time Sensitivity:

- Buyers are racing against time since the option expires. If the market doesn’t move enough before expiration, they lose the premium.

- Sellers benefit from time decay (theta), where the option’s value decreases as it gets closer to expiration. For them, the passing of time works in their favor.

Conclusion

The psychology of option buyers and sellers is rooted in how each side views risk and reward. Option buyers are usually looking for high potential gains, accepting the limited risk of losing their premium. Option sellers, on the other hand, focus on steady, smaller gains but take on higher risks if the market moves against them. Each strategy has its strengths and weaknesses, and understanding these differences can help traders decide whether they prefer to be an option buyer or seller based on their risk tolerance and market outlook.

Also Read – What is Options Trading?-Understanding the Basics of Options Trading