Cryptography and blockchain are terms you often hear when people talk about online security or things like Bitcoin. They’re related but not the same. Cryptography is a technique—a collection of methods, such as encryption, designed to secure information. Blockchain is a system—a structured framework that employs cryptography to maintain a shared, tamper-resistant record.

In this article, we’ll explain 3 main differences between them in easy-to-understand language, perfect for anyone curious about how these technologies work.

Table of Contents

What is cryptography in simple words?

How do you explain cryptography to a child?

Cryptography is a technique that safeguards information by transforming it into a secure, unreadable format. It relies on mathematical methods to ensure data remains confidential, unaltered, and authentic.

If we have to explain cryptography to a child, then we will do it like this: Imagine you want to send a secret note to your best friend in class, but you don’t want anyone else to read it. Cryptography is like a magic trick that scrambles your note so it looks like a bunch of nonsense. Only your friend, who knows the secret to unscramble it, can read the real message.

Cryptography’s primary components include:

- Encryption: Converting data into a coded format accessible only with a specific key.

- Decryption: Using the key to restore coded data to its original form.

- End-to-End Encryption: Ensuring only the sender and recipient can access the data, preventing intermediaries, such as service providers, from viewing it. This is common in secure messaging applications like WhatsApp.

- Additional Methods: Cryptography includes hashing, which generates a unique identifier to verify data integrity, and digital signatures, which confirm the authenticity of messages or transactions.

Cryptography is essential to numerous applications, including online banking, secure communications, and device protection, safeguarding sensitive information in daily digital interactions.

What is blockchain technology in simple words?

Blockchain is a system that functions as a distributed digital ledger, recording information across a network of computers. It organizes data into “blocks” that are chronologically linked, forming a chain highly resistant to modification. This design promotes transparency and trust without requiring a central authority.

Widely recognized for powering Bitcoin, where it tracks digital currency transactions, blockchain has broader applications, such as supply chain management, secure voting systems, and automated contracts. By integrating cryptography with a decentralized network, blockchain establishes a reliable and transparent record-keeping system.

How does Cryptography work in Blockchain?

Cryptography is a foundational element of blockchain’s functionality.

The techniques of cryptography—like encryption, hashing, and digital signatures act like locks to protect blockchain data. These methods ensure that only authorized users can add information and they stop anyone from messing with what’s already there, so that existing records remain unaltered.

Cryptography supplies the essential tools, while blockchain builds a robust system with their help to enable secure, decentralized operations.

Also Read – The Very First Post You Should Read to Learn Cryptocurrency

3 Important Differences Between Cryptography and Blockchain

The following are the three most critical differences between cryptography and blockchain, selected for their importance in understanding these concepts:

1. Technique vs. System

- Cryptography: A technique comprising methods like encryption, decryption, and end-to-end encryption to secure data. It functions as a toolset for protecting information.

- Blockchain: A system that integrates cryptography with a distributed network and consensus protocols to create a secure, shared ledger. It is a comprehensive framework for managing and verifying data.

2. Purpose and Objective

- Cryptography: Focuses on ensuring data confidentiality, integrity and authenticity. Its primary goal is to protect information from unauthorized access or alteration.

- Blockchain: Seeks to establish a transparent, tamper-resistant record that multiple parties can trust. It emphasizes shared accountability and verifiability across a network.

3. Independence vs. Dependence

- Cryptography: Operates independently and has been employed for centuries, from ancient coded messages to modern digital security. It requires no specific system to function.

- Blockchain: Relies on cryptography to ensure its security and integrity. Without cryptographic techniques, blockchain’s ability to maintain a trustworthy ledger would be compromised.

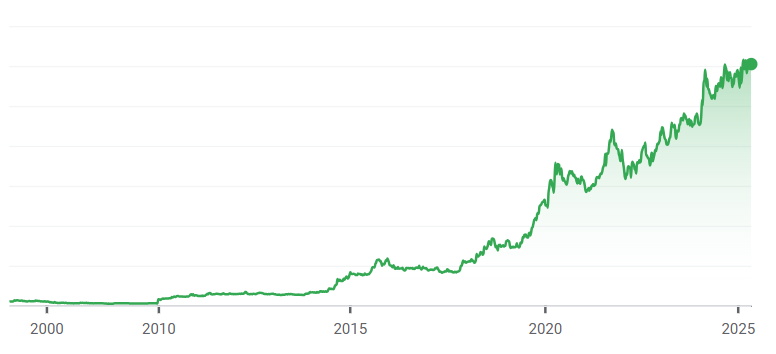

Cryptography has a long history, dating back to ancient methods like coded messages for military or diplomatic use. It remains a fundamental, often understated component of technology. Blockchain is a relatively new innovation, introduced with Bitcoin in 2009. It has garnered significant attention for its potential to transform industries like finance and logistics.

Let’s Sum Up Blockchain and Cryptography for Bitcoin

In a Bitcoin transaction, cryptography and blockchain collaborate seamlessly.

Picture a Bitcoin transaction: you send some digital cash to a friend. Cryptography is the secret agent making it happen safely—it encrypts your transaction details, uses digital signatures to prove it’s you, and hashes data to keep things secure. Blockchain is the public accountant, recording that transaction in a shared ledger everyone can check, so no one can lie about who owns what. Together, they make Bitcoin work: cryptography locks the deal, and blockchain keeps the record honest!

Cryptography provides the security foundation, while blockchain ensures a verifiable and decentralized record, enabling Bitcoin to operate as a trusted digital currency.

Also Read – What it will take for XRP to become the next Bitcoin?

The Bottom Line

Cryptography and blockchain are integral to modern digital systems, yet they differ significantly. Cryptography is a technique that employs methods like encryption, decryption, and end-to-end encryption to secure data. Blockchain is a system that leverages cryptography to create a transparent, tamper-resistant ledger. Understanding these key differences helps readers see how cryptography and blockchain work together to improve security and trust, particularly in innovations like Bitcoin.