In this article, we will talk about Indian Railway Finance Corporation, also known as IRFC. We will discuss the company profile and business overview, and we will also cover the share price target for Indian Railway Finance Corporation from 2025 to 2030. So, let’s get started.

Table of Contents

Company Overview

Indian Railway Finance Corporation (IRFC) was established on 12th December 1986 as the dedicated financing arm of Indian Railways. Its primary role is to mobilize funds from both domestic and international capital markets to support the financial needs of the Indian Railways. IRFC operates as a Schedule ‘A’ Public Sector Enterprise under the administrative control of the Ministry of Railways, Government of India. Additionally, it is registered with the Reserve Bank of India (RBI) as a Systemically Important Non-Deposit taking Non-Banking Financial Company (NBFC-ND-SI) and as an Infrastructure Finance Company (NBFC-IFC).

Business Overview

The core objective of IRFC is to meet the majority of the ‘Extra Budgetary Resources’ (EBR) requirements for Indian Railways through market borrowings. The company’s principal business involves raising funds from financial markets and using these funds to finance the acquisition or creation of assets, which are then leased out to Indian Railways.

Additionally, IRFC extends its financial services to various entities within the railway sector, including Rail Vikas Nigam Limited (RVNL), Railtel, Konkan Railway Corporation Limited (KRCL), and Pipavav Railway Corporation Limited (PRCL).

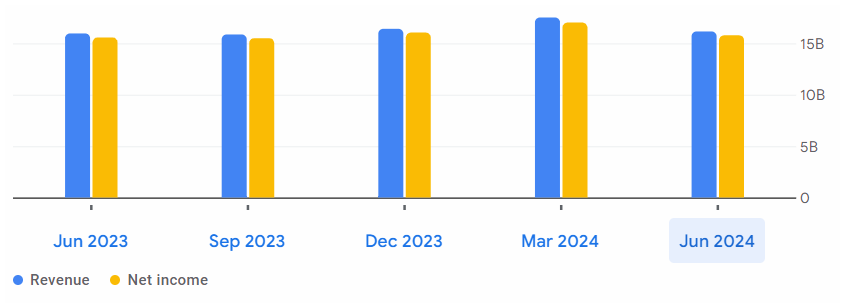

Recent Financial Performance

| Metric | Quarter Ended June 2024 | Quarter Ended June 2023 | % Change |

|---|---|---|---|

| Sales (₹ Crore) | 6766 | 6679 | 1.30% |

| Net Profit (₹ Crore) | 1577 | 1557 | 1.28% |

Also Read – What do you mean by Net Profit? – Explained

Important Financial Metrics

| Metric | Value |

|---|---|

| Market Cap | 2,35,168 Cr |

| EPS (TTM) | 4.93 |

| Price to Earnings Ratio (P/E) | 36.66 |

| Industry P/E | 27.3 |

| Price to Book Value (P/BV) | 4.81 |

| Industry P/BV | 2.28 |

| Return on Equity (ROE) | 13.11% |

| Return on Capital Employed (ROCE) | 5.73% |

| Return on Assets (ROA) | 1.31% |

| Debt to Equity | 8.02 |

The IRFC stock is trading at 4.81 times its book value, which is considered quite expensive.

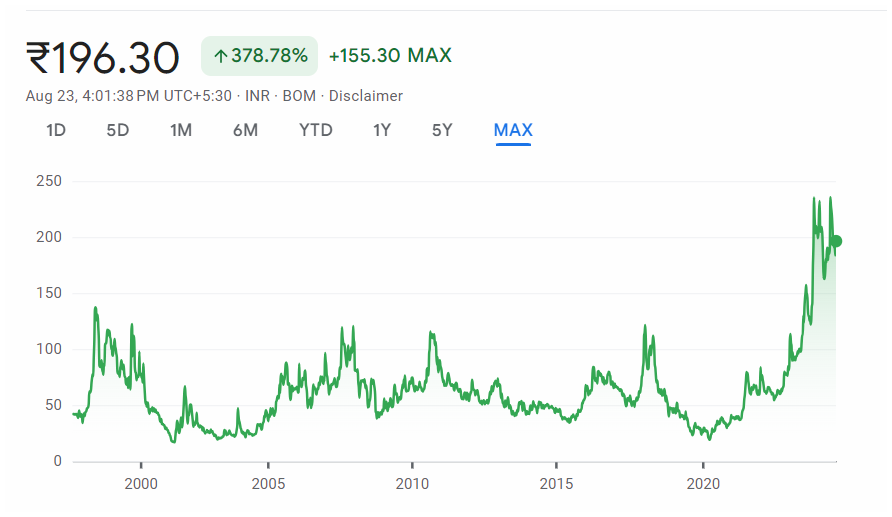

Stock Performance

| Time Period | Returns |

|---|---|

| All time | 687.53% |

| Past 2 Years | 742.86% |

| Past 1 Year | 263.61% |

| Past 3 month | -0.17% |

Indian Railway Finance Corporation Share Price Target 2025 to 2030

| 2025 2026 2027 2028 2029 2030 | Numbers you see online do not make any sense. They are often guesses and not reliable. Not even a SEBI-registered analyst can predict future targets accurately. It is very hard to predict share prices years ahead. The stock market is fundamentally driven and mainly depends on how well a company performs. If the company does well, the stock will likely do well too. If the company struggles, the stock might not do well. But the thing is, no one can see the future. The future is always uncertain. To make better decisions, keep an eye on the company’s financial health and performance on a regular basis. Always talk to a financial advisor before making any investment decisions. |

Predicting exact stock prices is challenging, but you can use a simple approach to estimate future trends.

For instance, if a stock is currently priced at ₹100 and the company has shown an annual growth of 18%, you might anticipate the stock to grow at a similar rate if the company continues to perform well. This growth is reflected in the company’s revenue and profits. In this case, the stock could potentially rise to ₹118 (₹100 + 18% of ₹100).

Conversely, if the stock has been declining by 10% due to poor financial results, the price might decrease to around ₹90 (₹100 – 10% of ₹100).

It’s important to remember that these are rough estimates, as markets are inherently unpredictable, and precise price predictions are nearly impossible.

Instead, focus on the fundamentals of the business. Your decision to stay invested or to exit should be based on the company’s financial performance. Regular analysis and staying informed are key to making sound investment decisions.

Don’t know how to analyze a company? Join our YouTube channel to learn fundamental analysis for free – Feel The Candlesticks

Shareholding Pattern

| Shareholder Category | Holding (%) |

|---|---|

| Promoters | 86.36% |

| Foreign Institutional Investors (FII) | 1.11% |

| Domestic Institutional Investors (DII) | 1.08% |

| Public | 11.45% |

Conclusion

Indian Railway Finance Corporation (IRFC) plays an important role in financing the growth and development of Indian Railways. With its strategic approach to market borrowings and asset financing, IRFC has significantly contributed to the expansion of India’s railway infrastructure.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.