Berkshire Hathaway Inc. (NYSE: BRK.B) is one of the most respected names in the investment world. It owns many businesses and holds shares in other big firms like Apple and Coca-Cola. It’s led by none other than Warren Buffett, one of the most successful investors of all time. This article takes a detailed look at how the company is performing, the kind of industries it is involved in, how its stock has grown over time, and what the future might look like.

We’ll also explore some price forecasts for upcoming years, including 2025, 2030, 2040, and 2050. Whether you’re a long-term investor or just curious about Berkshire Hathaway’s future, this article is meant to give you a clear picture of where things could be headed.

Class B shares (BRK.B) let small investors buy a part of the company at a lower price than Class A shares (BRK.A).

1. Company Overview

Berkshire Hathaway is a large holding company that owns businesses in different areas like insurance, railways, utilities, and consumer goods. Here’s a quick snapshot of what the company is all about:

| Company Name | Berkshire Hathaway Inc. |

| Sector | Financials |

| Industry | Insurance / Diversified Holding Company |

| IPO Year | 1996 (Class B shares) |

| Stock Exchange Listed | NYSE |

| Founded By | Warren Buffett, Charlie Munger (key figures) |

| Established In | 1839 (predecessor company); modern form 1955 |

| Specialization | Insurance, Investments, Diversified Operations |

Headquartered in Omaha, Nebraska, Berkshire Hathaway was originally a textile company. But after Warren Buffett took control in the 1960s, he turned it into a giant investment company.

Today, it owns well-known businesses like GEICO (insurance), BNSF Railway (railroads), Berkshire Hathaway Energy (utilities), Dairy Queen, and Duracell.

Its Class B shares (BRK.B), which were introduced in 1996, allowed everyday investors to invest in the company. With a strong focus on long-term investing and smart acquisitions, Berkshire is a major player in the financial world.

2. The Stock Market: What Drives Stock Prices

Stock prices don’t just move randomly—they are influenced by company performance, the economy, and how investors feel about the market. In Berkshire Hathaway’s case, its stock price is affected by:

- Profits from companies it owns

- How its investment portfolio performs (especially big holdings like Apple and Coca-Cola)

- Big-picture economic factors like inflation and interest rates

Since Berkshire has strong operations in insurance and investments, changes in interest rates can impact how much profit it earns. To understand where BRK.B is headed in the long run, it’s important to study these building blocks.

Also Read – 5 Benefits of Cryptocurrency for Governments Around the World

3. Sector Overview: Financials

Understanding the Sector

Berkshire Hathaway is part of the Financials sector. This sector includes banks, insurance firms, investment houses, and big holding companies. It plays a big role in the economy by helping manage money and risks. What makes Berkshire unique is that while it’s a holding company, insurance is at the core of its business.

Key Factors That Affect the Financial Sector

- Interest Rates: When rates go up, insurance companies earn more on investments but stocks may get hit.

- Regulations: New rules can affect how insurance firms operate.

- Economic Conditions: A strong economy boosts business, while downturns make things challenging.

Recent Performance and Trends

From 2024 to 2025, the financial sector has done well, especially with interest rates going up. Berkshire’s insurance businesses like GEICO showed better profits early in 2025 because of higher premiums and smart pricing. Although the company is careful about adopting new technologies, its focus on solid, reliable businesses has helped. As of early 2025, Berkshire had a huge cash reserve of $189 billion, giving it plenty of room to make strategic moves.

4. Industry Analysis: Insurance / Diversified Holding Company

Understanding the Industry

Berkshire sits in a space where insurance meets investment. It collects insurance premiums (called “float”) and uses that money to invest. Its insurance companies like GEICO and General Re generate steady income. Meanwhile, non-insurance companies like BNSF and Fruit of the Loom help spread out risk and boost revenue.

Main Industry Drivers

- Smart Underwriting: Making sure premiums are high enough to cover claims.

- Good Investment Returns: Profit depends heavily on how well the company invests the float.

- Economic Strength: When the economy is weak, parts of the business like manufacturing can struggle.

Recent Developments

Insurance in the U.S. grew well in 2024, with property and casualty premiums rising by 8%. GEICO itself saw a 12% jump in written premiums in early 2025. Meanwhile, Berkshire’s other businesses like energy and railroads kept doing well. The company’s ability to invest its large cash reserves when the time is right keeps it ahead of competitors.

5. Stock Growth and What’s Driving It

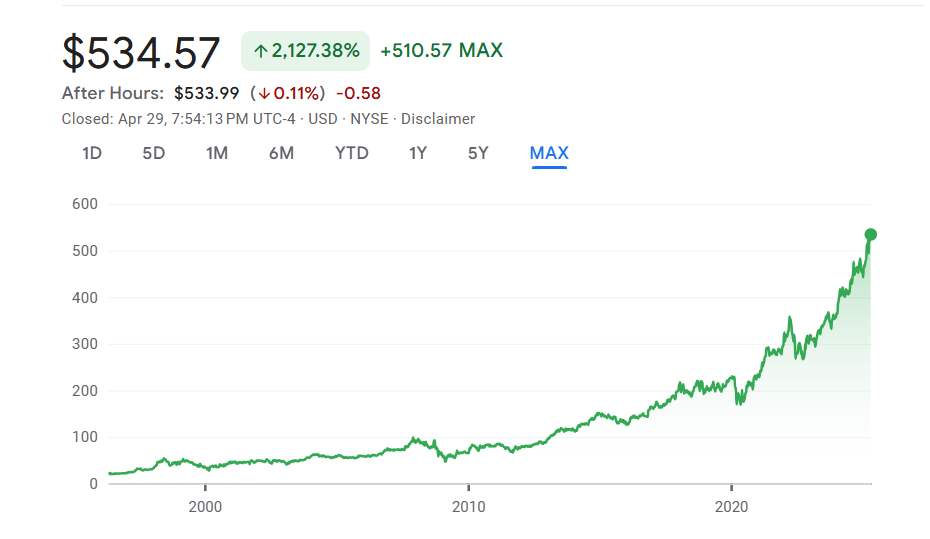

The performance of Berkshire Hathaway’s BRK.B stock has been strong over recent years. Between 2020 and 2025, the stock went up from about $231 to $461.47 (May 27, 2025). That’s an average annual growth rate of around 14.8%.

This growth is tied to:

- Profits from insurance operations

- Gains from big investments like Apple

- Solid results from businesses like BNSF Railway

The $189 billion cash reserve gives Berkshire flexibility to buy new businesses or repurchase its own shares, both of which could help the stock go even higher. As long as the company stays smart with its decisions, its stock is expected to grow in line with the sector and the broader economy.

6. Speculative Price Targets: Technical Analysis View

As of May 27, 2025, BRK.B stock is priced at $461.47. Based on chart patterns and technical indicators, here’s what the analysis says:

- Moving Averages: The 50-day average ($450) is higher than the 200-day ($430), which usually means the stock is in an uptrend.

- Support and Resistance: The stock seems to find support near $440 and could face resistance around $475.

- RSI (Relative Strength Index): At 58, it’s in a balanced zone—not too hot or too cold.

Speculative Long-Term Price Forecasts

Based on past performance and sector trends, here are some possible price targets:

| Year | Projected Price | Range (Low – High) |

|---|---|---|

| 2025 | $485 | $465 (5%) – $510 (15%) |

| 2030 | $785 | $615 (5%) – $1,000 (15%) |

| 2040 | $2,060 | $1,000 (5%) – $4,000 (15%) |

| 2050 | $5,400 | $1,700 (5%) – $16,000 (15%) |

These numbers are based on the idea that Berkshire keeps doing what it does best—investing wisely and running its businesses efficiently. But investors should also keep in mind possible risks, like changes in leadership and big shifts in the global economy.

7. Long-Term Growth Potential

There’s a strong case for Berkshire Hathaway’s long-term growth. Its mix of stable insurance income and high-quality investments gives it a solid foundation. With big stakes in Apple and Coca-Cola, the company continues to enjoy steady returns. Its large cash pile means it can jump on new opportunities quickly—like when it bought Precision Castparts in the past.

However, there are some things to watch out for:

- Warren Buffett won’t be around forever, so leadership succession is a concern.

- New regulations could change how its businesses operate.

- Economic downturns could hit profits across various sectors.

Still, with its disciplined approach and scale, Berkshire is likely to remain a key player for long-term investors.

Also Read – ProShares to Launch Three XRP ETFs: A New Era for Cryptocurrency Investment

8. Conclusion

Berkshire Hathaway Inc. (BRK.B) is more than just another financial company. It blends solid insurance operations with smart investments and a wide mix of businesses. The company’s consistent stock growth has been fueled by smart decisions, big reserves, and reliable earnings.

The long-term price targets—$485 in 2025, $785 in 2030, $2,060 in 2040, and $5,400 in 2050—give a sense of what could happen if things go right. But like all forecasts, these come with uncertainties. For investors looking for long-term value and steady growth in an unpredictable market, Berkshire Hathaway continues to be a strong candidate.

Disclaimer:

The views and opinions expressed in this article are solely those of the author and are intended for informational purposes only. They do not constitute financial, investment, or trading advice. Any stock price predictions mentioned are purely speculative and based on personal analysis. Past performance is not indicative of future results. Readers are advised to conduct their own research and, if necessary, consult a certified financial advisor before making any investment decisions. The author does not accept any liability for financial losses or gains arising from the use of this content.