HEG Ltd is a prominent company of the LNJ Bhilwara group and is India’s leading graphite electrode manufacturer. Recently, it announced a stock split in the ratio of 1:5. Each equity share with a face value of Rs. 10/- will be split into 5 equity shares with a face value of Rs. 2/- each. The decision was approved on August 13, 2024, and is subject to the approval of the members through a Postal Ballot. The company will announce the Record Date for the stock split very soon.

Read the official notification here

Table of Contents

About HEG Ltd

HEG Ltd is a key player in the graphite electrode manufacturing industry, with one of the largest integrated Graphite Electrode plants in the world. The company is known for processing sophisticated UHP (Ultra High Power) Electrodes and has a strong presence in both domestic and international markets.

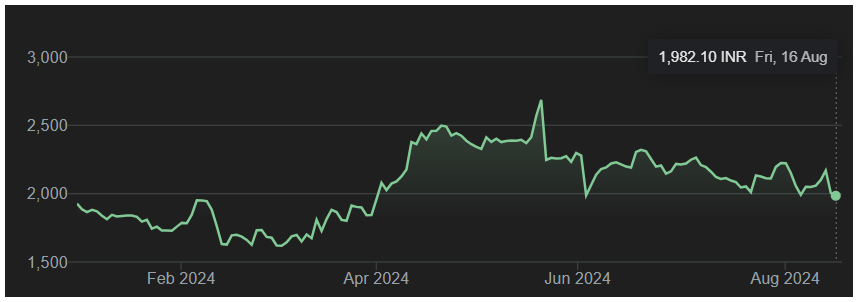

HEG Ltd Shares Performance

HEG shares have experienced mixed performance over different timeframes. Over the past 6 months, the stock surged by 22%, but it has declined by 16% in the last 3 months. In the last 1 year, the stock soared by 15%, and over the last 2 years, it gained 56%. However, the stock has seen a decline of 14% in the last 3 years. Despite this, HEG shares have offered a return of 98% over the last 5 years.

| Timeframe | Performance |

|---|---|

| Last 6 months | +22% |

| Last 3 months | -16% |

| Last 1 year | +15% |

| Last 2 years | +56% |

| Last 3 years | -14% |

| Last 5 years | +98% |

The 52-week high price of HEG shares on the BSE is Rs. 2744.60 per share (as of May 22, 2024), while the 52-week low price is Rs. 1466.85 per share (as of October 26, 2023).

Weak Q1 Results Trigger Sharp Decline in HEG Shares

| Metric | Q1 FY25 (June 30, 2024) | Q1 FY24 (June 30, 2023) | Change |

|---|---|---|---|

| Standalone Net Profit | Rs. 2.58 crore | Rs. 97.56 crore | -97.36% |

| Standalone Revenue from Operations | Rs. 571 crore | Rs. 671 crore | -14.90% |

| Total Standalone Income | Rs. 592 crore | Rs. 698 crore | -15.17% |

HEG Ltd reported its Q1 FY25 results, which revealed a significant decline in profitability. The company’s standalone net profit for the quarter ended June 30, 2024, dropped to Rs. 2.58 crore, down from Rs. 97.56 crore in the corresponding quarter of last year. Standalone revenue from operations also declined to Rs. 571 crore, compared to Rs. 671 crore in the same quarter of the previous year. The total standalone income for the quarter was Rs. 592 crore, down from Rs. 698 crore in the corresponding quarter of last year.

Following the announcement of these weak financial results, HEG shares witnessed a sharp decline of over 8% on the BSE, with the current market price standing at Rs. 1994.75 per share.

Also Read – This Cable Making Company has Announced a Share Buyback worth ₹112 Crore

HEG Ltd Share Holding Pattern

Here’s a table presenting the shareholding pattern for June 2024:

| Category | June 2024 |

|---|---|

| Promoters | 55.77% |

| FIIs | 6.06% |

| DIIs | 13.08% |

| Public | 25.08% |

| No. of Shareholders | 1,19,399 |

- Promoters: Their stake has remained relatively stable with a minor decrease to 55.12%, indicating a slight reduction in their shareholding.

- FIIs (Foreign Institutional Investors): Their share has decreased to 6.06%, down from previous levels, reflecting a reduction in their investment.

- DIIs (Domestic Institutional Investors): DIIs have increased their stake to 13.08%, showing a significant rise and growing confidence in the company.

- Public: The public’s shareholding has decreased to 25.08%, marking a decline from earlier periods.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.