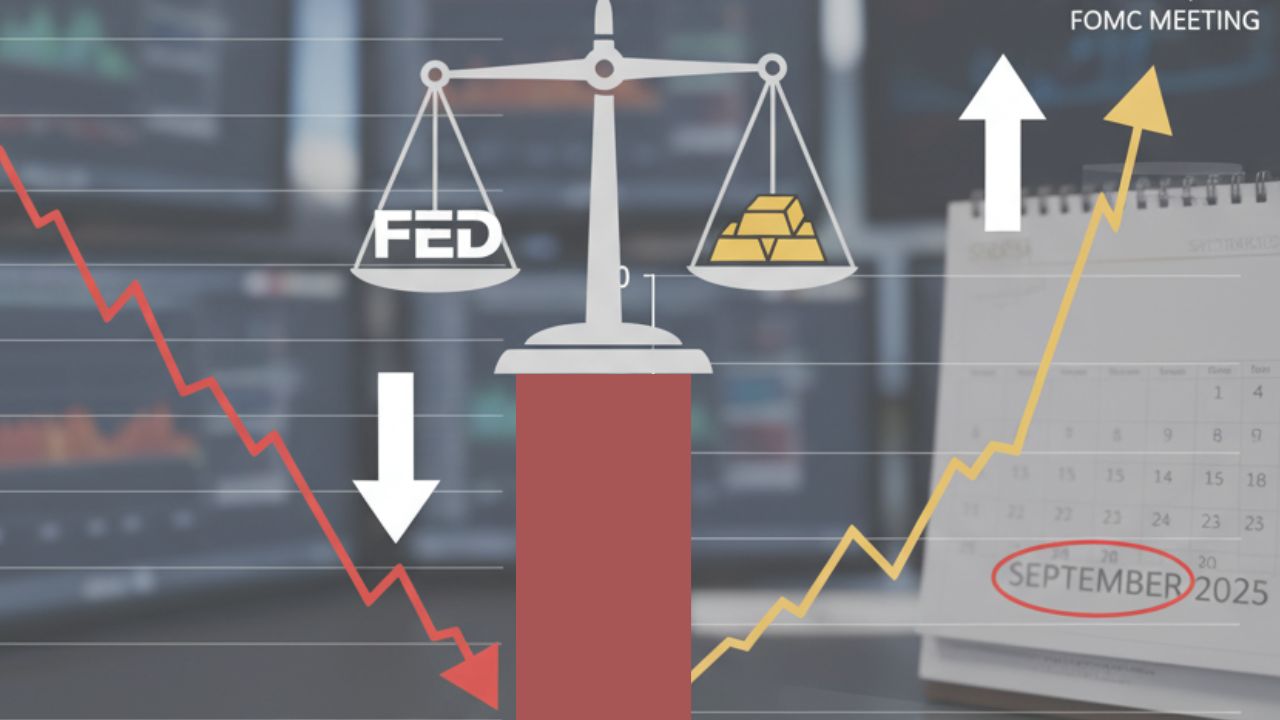

As the Federal Reserve’s September 2025 FOMC meeting approaches, the market overwhelmingly (about 91%) expects a rate cut, according to the CME FedWatch tool.

This sentiment is driven by recent inflation data, with the Producer Price Index (PPI) showing a slight decline in August and expectations of contained inflation from upcoming Consumer Price Index (CPI) reports.

Also Read – August 2025 PPI Report Explained – What It Means for Inflation, CPI, and Fed Rate Cuts?

Additionally, softer job data suggest a cooling labor market, reinforcing the narrative for monetary easing. Inflation remains modestly above the Fed’s target but shows signs of moderation, prompting speculation that the Fed will lower rates to support the economy and stabilize inflation pressures.

Why Are Gold and Fed Interest Rates Connected?

Gold and Fed interest rates are closely linked because interest rate decisions affect real returns on investments and economic risk perceptions.

The Federal Reserve’s benchmark interest rate influences the opportunity cost of holding gold, which is a non-yielding asset.

- When rates rise, yields on bonds and savings become more attractive, often pulling capital away from gold.

- When rates fall, the opportunity cost of holding gold reduces, making it more appealing.

Moreover, gold traditionally acts as a safe-haven during inflationary and recessionary periods, making Fed policies a key driver of gold’s appeal.

Fed Interest Rates and Gold – The Safe Haven Connection

Gold is considered a safe haven asset because it preserves value when inflation rises, recession fears increase, or monetary policy tightens.

Investors often flock to gold in uncertain economic times when traditional paper assets may lose value.

Gold also acts as:

- A hedge against dollar depreciation.

- A shield during geopolitical risks.

Thus, Fed policies that create economic uncertainty or affect inflation expectations strongly impact gold demand and prices.

How Does FED Interest Rate Affect Gold Prices?

(1) How Rate Increments Affect Gold Price?

When the Fed raises interest rates, it signals tighter monetary conditions.

Higher rates generally lead to –

- Increased yields on bonds and savings accounts, making these interest-bearing assets more attractive versus gold.

- A stronger U.S. dollar, which tends to lower gold prices since gold is priced in dollars globally.

- Investors moving money out of non-yielding gold in favor of assets generating income.

Hence, gold prices typically go down when Fed rates go up.

This negative correlation between interest rate hikes and gold price movements is a well-observed market dynamic.

(2) How Rate Cuts Affect Gold Price?

When the Fed cuts interest rates, the environment changes:

- Lower interest rates reduce the opportunity cost of holding gold since other investments generate less return.

- Rate cuts often coincide with worries about economic growth or inflation, enhancing gold’s appeal as an inflation hedge.

- Weaker dollar tendencies usually accompany rate cuts, helping lift dollar-denominated gold prices.

Therefore, gold prices generally go up when Fed rates go down, buoyed by increased investor interest and reduced real yields on bonds.

Also Read – The Very First Post You Should Read to Learn Cryptocurrency

Fed Interest Rate and Gold Price History

| Year | Fed Interest Rate Decision | Gold Price Reaction |

|---|---|---|

| 2007-08 | Major rate cuts during financial crisis | Gold surged ~39% over following 24 months |

| 2019 | Initial rate cuts amid global slowdown | Gold rose ~26% post-cuts |

| 2020 | Pandemic emergency cuts to near zero | Gold reached record highs (~$2,000+ per ounce) |

| 2022 | Rapid rate hikes to combat inflation | Gold fell amid rising yields but recovered on easing signals |

Examples:

- During the 2008 financial crisis, aggressive rate cuts coincided with a strong gold rally as investors sought safety.

- In 2020’s COVID-19 pandemic, emergency Fed cuts and liquidity boosts pushed gold to historic peaks.

- The 2022 hawkish Fed tightening cycle initially pressured gold prices down before stabilizing on easing expectations.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

What happens to gold when inflation goes up?

Gold usually increases in price because it is viewed as a hedge against inflation, protecting purchasing power when currency values decline.

Does gold go up in price during a recession?

Yes, gold often rises during recessions because investors seek safe-haven assets amid economic uncertainty and market volatility

What makes gold prices go down?

Gold prices tend to fall when interest rates rise, the U.S. dollar strengthens, or when investor risk appetite grows, drawing money towards stocks and bonds, which provide yields.