Rising geopolitical tensions involving the United States, Iran, and Israel are beginning to influence global financial markets. Historically, even the risk of escalation in the Middle East has been enough to shift capital flows, increase volatility, and trigger sector rotation across equity markets.

This week, markets are likely to trade more on geopolitical headlines than on earnings or macroeconomic data.

Energy Sector: The Most Direct Impact

The energy sector is typically the first and most sensitive area impacted by Middle East tensions.

• Crude oil prices often rise due to supply disruption fears.

• Oil producers and integrated energy companies may benefit from higher realized prices.

• Oilfield services and drilling companies could see renewed investor interest.

However:

• Airlines, logistics firms, and chemical manufacturers may face margin pressure due to higher fuel and input costs.

• Sustained oil spikes can increase inflation expectations, influencing central bank policy outlooks.

Short-term winner: Upstream oil producers.

Short-term risk: Fuel-dependent industries.

Also Read – Top 13 Stocks That Could Be Impacted by a Strait of Hormuz Blockade

Defense & Aerospace: Structural Beneficiary

Heightened geopolitical risk tends to increase expectations for defense spending.

• Missile systems, aerospace manufacturing, and military technology providers often attract capital during periods of conflict.

• Long-term government contracts provide earnings visibility, which can make defense stocks relatively defensive during uncertainty.

Even if tensions ease, increased security budgets often remain in place, providing medium-term support.

Precious Metals & Safe-Haven Assets

Geopolitical uncertainty usually drives investors toward perceived safe havens.

• Gold and precious metal miners often gain as investors hedge risk.

• U.S. Treasuries may see increased demand.

• Defensive sectors such as utilities and consumer staples may outperform broader cyclical markets.

Transportation & Industrials: Potential Headwinds

• Airlines face rising jet fuel costs and potential airspace disruptions.

• Shipping companies could experience route uncertainty and higher insurance premiums.

• Export-heavy industrial firms may see demand concerns if global trade sentiment weakens.

Defense-linked industrial companies, however, may diverge positively from the broader industrial sector.

Financials: Volatility Sensitivity

Banks and financial institutions often underperform during periods of geopolitical uncertainty due to:

• Increased market volatility

• Tighter credit conditions

• Risk repricing in global markets

If higher oil prices revive inflation concerns, interest rate expectations could also shift, adding another layer of complexity for financial stocks.

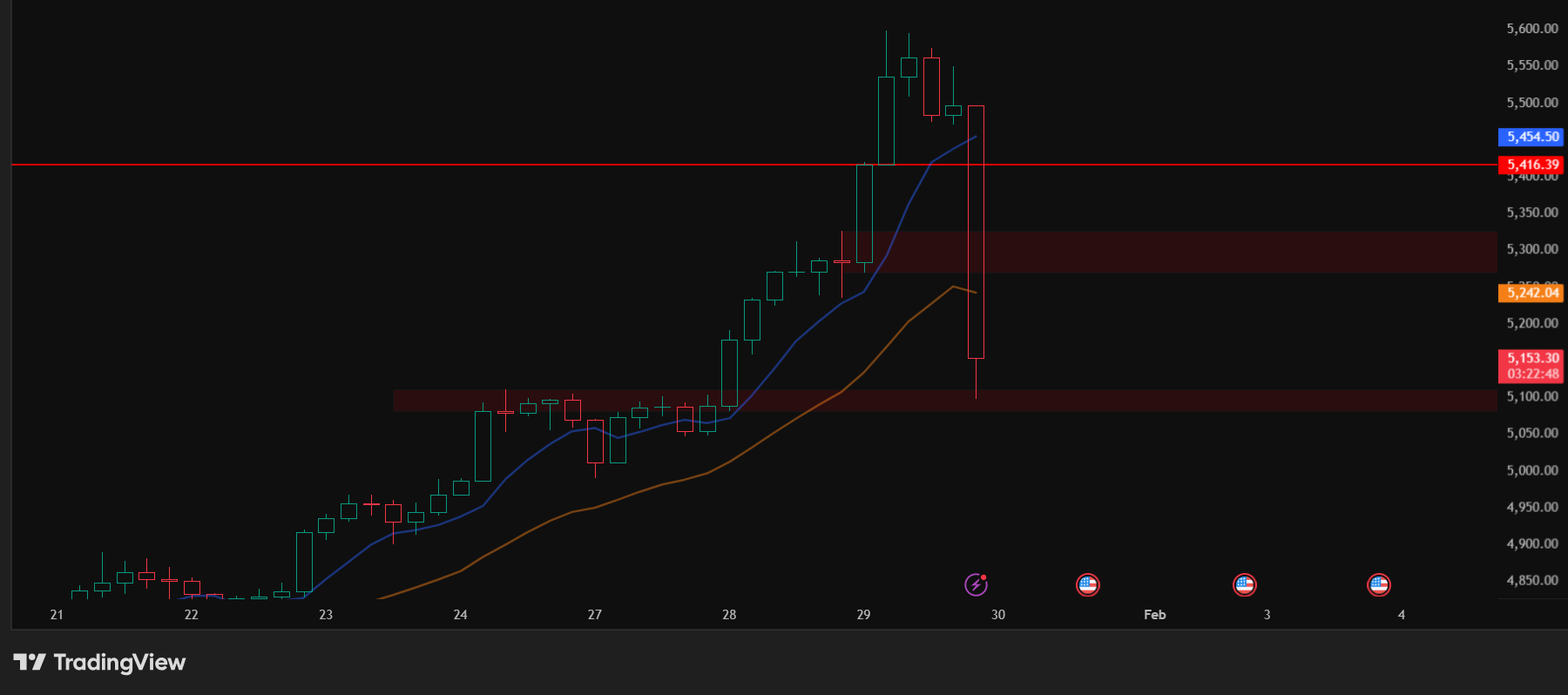

Technology Sector: Mixed Reaction

Large-cap technology stocks can behave in two ways:

• Software and cloud companies may act as relative safe growth plays.

• Hardware and semiconductor companies could face volatility due to supply chain concerns and global risk sentiment.

The reaction largely depends on whether tensions escalate into broader regional disruption.

Also Read – I Created the Best Bitcoin Guide You’ll Ever Read

Broader Market Outlook

In most historical geopolitical episodes:

• Markets experience short-term volatility spikes.

• Sector rotation becomes more pronounced.

• Energy and defense lead performance.

• Cyclical and transport-linked stocks lag.

Unless escalation becomes prolonged or expands regionally, markets typically stabilize once risk clarity improves.

Investor Takeaway

A U.S.–Iran conflict scenario primarily reshuffles sector leadership rather than triggering systemic collapse.

Potential beneficiaries:

• Energy producers

• Defense contractors

• Precious metals

Potentially vulnerable sectors:

• Airlines and transportation

• Consumer discretionary

• Financials

For investors, this is a phase of selective positioning and risk management rather than broad liquidation. Monitoring oil prices, defense spending signals, and diplomatic developments will remain critical in assessing near-term market direction.

Also Read – Why Every Investor is a Trader?

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.