Figma, the widely used cloud-based collaborative design platform, has officially filed for its highly anticipated initial public offering (IPO), capturing significant attention among technology investors. While this article does not make a buy or sell recommendation, it provides eight critical factors you should weigh before deciding whether Figma’s IPO fits your investment goals.

1. IPO Date, Listing Timeline, and Exchange Details

Figma filed its S-1 registration with the U.S. Securities and Exchange Commission (SEC) on July 1, 2025, confirming plans to list on the New York Stock Exchange under the ticker symbol FIG. Industry analysts suggest the IPO will take place in late summer or early fall 2025, possibly as early as August if the SEC review progresses smoothly.

Trading for FIG shares will occur during normal NYSE hours (9:30 AM–4:00 PM ET), with pre-market (4:00 AM–9:30 AM ET) and after-hours (4:00 PM–8:00 PM ET) trading potentially available through certain brokers.

- Advantage: The NYSE listing brings high liquidity and investor trust.

- Risk: SEC approval delays could push the listing into September or beyond.

2. IPO Price, Valuation, and Market Cap

Figma has not yet disclosed the specific IPO share price or offering size in its S-1. However, the company was valued at $12.5 billion during a 2024 private tender transaction. Analysts expect a public valuation in the range of $15 billion to $20 billion, depending on pricing and demand.

Industry sources, including Renaissance Capital, estimate the IPO could raise as much as $1.5 billion, making it one of 2025’s most significant technology IPOs alongside other big names such as CoreWeave. The final market capitalization will be determined by the share price and total shares outstanding, which will be updated closer to the listing date.

- Advantage: A strong valuation reflects robust investor interest and confidence in the company’s business model.

- Risk: High valuations carry downside if growth momentum slows post-IPO, potentially leading to share price corrections.

3. How and Where to Buy IPO Shares?

If you wish to participate in Figma’s IPO at the offering price, you will need to work through underwriters such as Morgan Stanley, Goldman Sachs, J.P. Morgan, or Allen & Co. Typically, these allocations are reserved for institutional clients and high-net-worth individuals, though some brokers – for example, Fidelity, Charles Schwab, or Robinhood – might offer limited retail IPO allocations.

For most retail investors, buying will be easier once FIG begins public trading on the NYSE. Like all IPOs, oversubscription is possible, which could mean limited availability for retail investors at the initial price.

- Advantage: Multiple reputable brokerages may participate, expanding accessibility.

- Risk: Retail buyers could face allocation challenges or higher prices if demand is very strong on day one.

4. S-1 Filing Details and Financials

Figma’s S-1 filing reveals a company with compelling growth metrics and a sharp turnaround in profitability:

- 2024 Revenue: $749 million, a 48% increase from 2023

- Q1 2025 Revenue: $228.2 million, a 46% jump year-over-year

- Rolling 12-month revenue (as of March 2025): $821 million

- Gross Margin: A standout 91%

- Q1 2025 Net Income: $44.9 million, compared to $13.5 million the previous year

- 2024 Net Loss: $732 million, largely from a one-time stock-based compensation expense

- Cash and Equivalents: $1.54 billion

- Debt: Minimal, consisting mostly of a revolving credit facility

- Enterprise Customers: 78% of Forbes 2000 companies, with over 1,000 clients generating more than $100,000 in annual recurring revenue

According to its filing, IPO proceeds will fund global expansion, research in artificial intelligence, and selective acquisitions.

- Advantage: Strong revenue growth, improving profitability, and a solid cash reserve.

- Risk: High stock-based compensation expenses could weigh on future earnings, depending on how aggressively Figma continues to incentivize employees.

5. Business Model and Competitive Advantages

Figma runs on a subscription-based SaaS model, providing design and collaboration tools through the cloud to individuals, businesses, and large enterprises. Unlike traditional desktop software, its browser-based platform allows real-time teamwork.

Competitive advantages include:

- 95% adoption rate among Fortune 500 companies

- 132% net dollar retention, reflecting upsell success

- 76% of Fortune 500 customers use multiple Figma products

- 85% of monthly users located internationally

- Generative AI tools, including partnerships with Adobe Firefly and third-party AI models

Competition includes: Adobe, Canva, Sketch, and InVision, as well as new players leveraging AI such as Anthropic or tools developed by OpenAI.

- Advantage: Market leadership with strong lock-in through collaborative features and sticky customers.

- Risk: Emerging AI-native competitors could challenge Figma’s market share.

6. Leadership and Ownership

Founded in 2012 by Dylan Field and Evan Wallace, Figma remains founder-led, with Field as CEO. He is widely credited with pushing its collaborative-first design model and expanding its AI capabilities.

Major shareholders include:

- Index Ventures: 16.8%

- Greylock: 15.7%

- Kleiner Perkins: 14%

- Sequoia Capital: 8.7%

Cumulatively, Figma has raised around $749 million across several funding rounds involving top-tier Silicon Valley investors.

- Advantage: Visionary founder leadership, with respected and experienced backers.

- Risk: Heavy dependence on Field’s strategic direction could be a weakness if leadership transitions are needed in the future.

7. Crypto Exposure and USDC Holdings

In an unusual twist for a design company, Figma reported in its S-1 that it holds approximately $69.5 million in Bitcoin ETFs (specifically, the Bitwise Bitcoin ETF) and another $30 million in USDC stablecoins, which it plans to convert to Bitcoin.

Also Read – I Created the Best Bitcoin Guide You’ll Ever Read

While this allocation is small compared to its cash reserves, it signals a forward-looking approach to treasury management, similar to moves by Tesla or Block.

- Advantage: Diversification of assets could enhance returns over time.

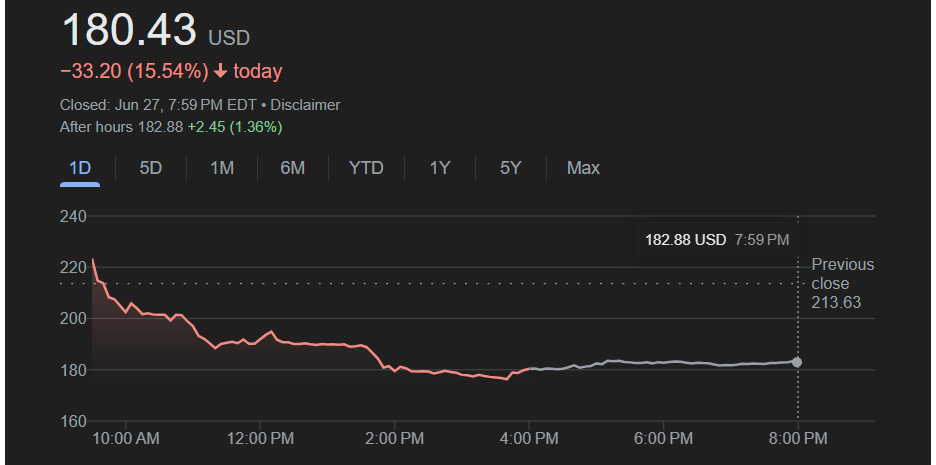

- Risk: Exposure to cryptocurrency volatility and potential regulatory scrutiny around digital assets.

8. Broader Investment Considerations: Risks, Opportunities, and Sentiment

Opportunities:

- Figma has strong revenue growth and world-class gross margins.

- A customer base of 13 million monthly active users, with two-thirds outside the design profession, creates future upsell opportunities.

- Ongoing investment in AI features positions Figma to adapt to rapidly evolving design workflows.

Risks:

- Fierce competition from Adobe, Canva, and newer AI-native design apps

- Heavy R&D spending (over $750 million in 2024, largely in stock-based compensation)

- Exposure to crypto market swings, though small, could unsettle conservative investors

- Lofty valuations could face corrections if macroeconomic or sector-specific headwinds emerge

Market sentiment so far is cautiously optimistic, with pre-IPO commentary on social media platforms like X showing excitement about its 132% net dollar retention, profitability turnaround, and high user stickiness.

Expert analysts at Renaissance Capital have expressed bullish projections for the IPO, while some caution that valuations above $15 billion might be aggressive if the tech sector weakens.

Timing considerations: IPOs often trade with high volatility in the first 30 to 90 days. Some investors prefer to wait for a post-lock-up period (commonly 90–180 days) before initiating a position, as early employees and insiders become eligible to sell.

Conclusion

Figma’s IPO represents one of the most significant SaaS opportunities of 2025, showcasing robust growth, profitability improvements, and dominant market share in the collaborative design space. Its dual focus on AI-driven innovation and a proven subscription business model gives it an enviable position relative to many rivals.

However, the combination of intense competition, a possibly high valuation, and modest but nontrivial crypto exposure should caution even growth-oriented investors.

Ultimately, whether Figma is “worth it” depends on your personal risk tolerance, IPO pricing, and a careful reading of the S-1 and subsequent SEC updates. Monitoring institutional demand, short interest, and broader tech-sector sentiment will also be important in the weeks before the IPO. Investors should consider consulting a qualified financial advisor to match this opportunity with their portfolio objectives.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.