Gold prices have been on a historic tear in 2026, smashing through multiple all-time highs amid geopolitical chaos, economic uncertainty, and a weakening U.S. dollar.

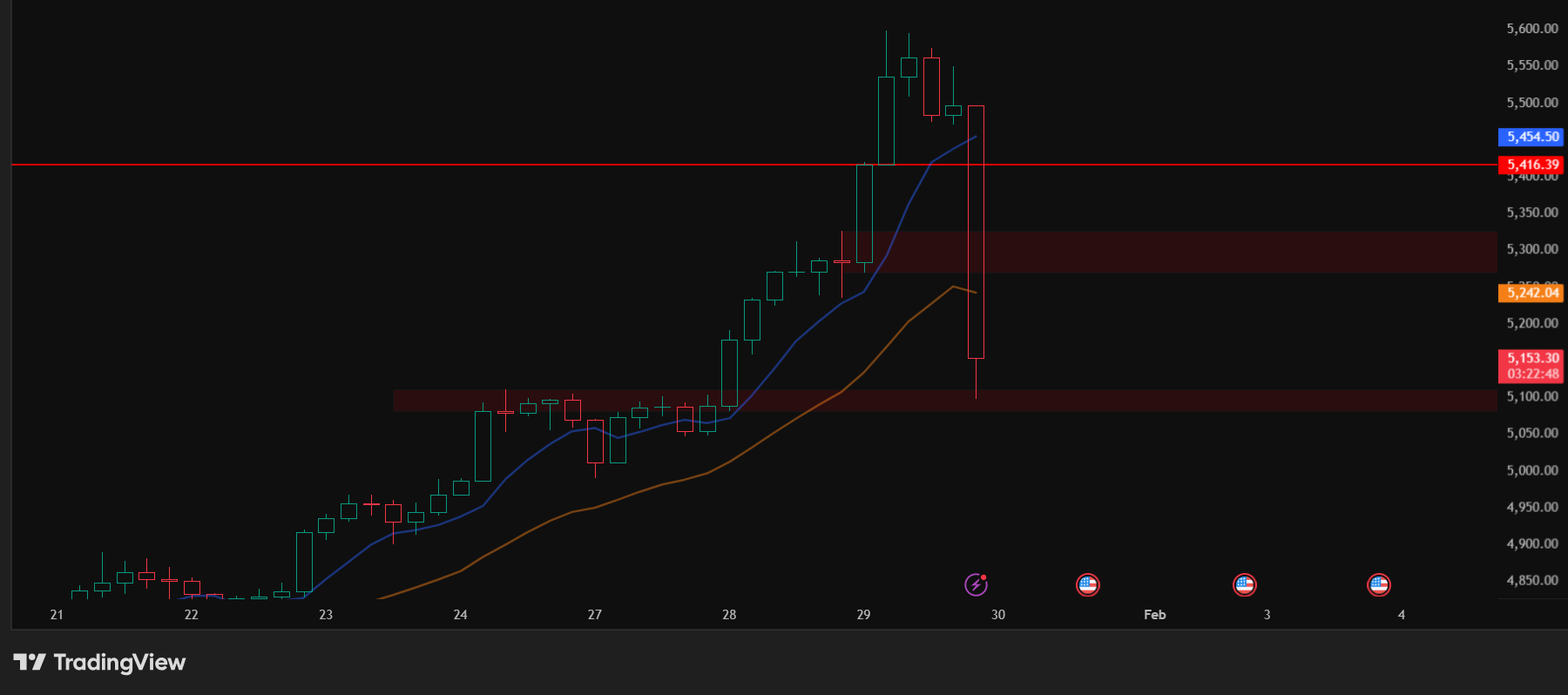

After peaking near $5,598 per ounce on January 29, the yellow metal witnessed a sharp 4% retreat, slipping toward the $5,100 level in intraday trading.

Such volatility is not unusual in overheated bull markets. Rapid, parabolic gains often invite corrections, even when the broader trend remains intact. While the long-term outlook for gold continues to look constructive – supported by safe-haven demand and sustained central bank buying—the recent pullback reflects a convergence of short-term pressures.

Below are the five key reasons behind gold’s swift reversal.

1. Profit-Taking After an Explosive Rally

Gold’s January rally was extraordinary. Prices surged more than 30% in a single month, rising from around $4,319 at the start of the year to above $5,598 at the peak. Moves of this magnitude naturally attract short-term traders looking to capitalize on momentum.

Once gold approached a major psychological level like $5,500, profit-taking intensified. Many investors chose to lock in gains, especially after gold delivered an unprecedented 64% return in 2025.

As selling began, algorithmic strategies and stop-loss orders amplified the downside, creating a cascading effect that accelerated the decline.

2. Hawkish Federal Reserve and Shifting Rate Expectations

The Federal Reserve’s January decision to keep interest rates unchanged at 3.50%–3.75%, combined with Chair Jerome Powell’s assessment that the U.S. economy remains in a “good place,” dampened expectations for near-term rate cuts.

Also Read – Fed Interest Rates vs Gold Prices – What to Expect Ahead of the September 2025 FOMC Meeting?

Gold typically performs best in low-interest-rate environments, since it does not generate yield. As markets adjusted to the possibility of fewer rate cuts in 2026—amid persistent inflation and resilient growth—real yields edged higher. This shift reduced gold’s relative appeal and triggered a rapid unwinding of bullish positions, contributing to the sharp pullback.

3. Forced Selling From Index Funds and Market Rebalancing

January is a common period for commodity index rebalancing. Passive funds are required to adjust their holdings based on predefined rules, regardless of price trends or fundamentals. This process can result in forced selling, even during strong bull markets.

Such mechanical flows can temporarily distort prices, increasing volatility and pressuring gold lower. With banks holding sizable net short positions in paper gold, these rebalancing-driven selloffs tend to magnify downside moves, as weaker hands are shaken out and liquidity-driven declines feed on themselves.

4. Easing Geopolitical Fears and a Shift Toward Risk Assets

Gold’s rally has been fueled in large part by safe-haven demand, driven by geopolitical tensions, trade conflicts, and rising global debt concerns. However, even minor signs of de-escalation can cool demand for defensive assets.

Recent indications of softer trade rhetoric and progress in diplomatic discussions have reduced immediate hedging urgency. At the same time, strong corporate earnings—particularly in the technology sector—and major equity indices pushing to new highs have encouraged a risk-on environment. As capital rotates back into equities, gold often experiences temporary pullbacks.

5. Dollar Stabilization and Speculative Position Unwind

Earlier weakness in the U.S. dollar provided a powerful tailwind for gold, making it cheaper for international buyers. However, as the dollar stabilized, the traditional inverse relationship between the two assets reasserted itself.

Crowded speculative long positions—built on themes such as de-dollarization and fiat currency debasement—began to unwind rapidly once macro signals shifted. While these flows can drive sharp short-term declines, they do not necessarily undermine gold’s longer-term structural support.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.