Inflation is one of the most discussed topics in economics because it directly affects our daily lives and the financial markets. From grocery prices to rent to fuel, inflation tells us how fast the cost of living is rising. But inflation also shapes how investors behave, how central banks act, and how the stock market moves. Economists use several key indicators like CPI, PPI, PCE, and others to understand how prices are changing across the economy.

This article will help you understand how these measures work, how they connect, and why they matter for the stock market.

Table of Contents

What Is Inflation?

Inflation means the general increase in the prices of goods and services over time. When inflation rises, each unit of money buys fewer goods and services. A little inflation is normal and even healthy for an economy because it shows that people are spending and businesses are growing. However, when inflation rises too quickly, it reduces purchasing power and affects savings, wages, and investments. In the financial market, this change directly impacts how investors value companies and make decisions.

The Consumer Price Index (CPI)

The Consumer Price Index, or CPI, is one of the most popular measures of inflation. It tracks the average change in prices paid by consumers for a fixed basket of goods and services. This basket includes everyday items like food, clothing, housing, transportation, and healthcare. When the CPI rises, it means consumers are paying more for the same goods. Investors closely watch CPI data because a sharp rise can lead to higher interest rates. When rates go up, borrowing becomes expensive, which can reduce corporate profits and push stock prices lower.

The Producer Price Index (PPI)

The Producer Price Index, or PPI, focuses on price changes at the wholesale or producer level. It measures how much manufacturers and suppliers are charging retailers before the products reach consumers. When PPI increases, it signals that businesses are facing higher production costs. These costs often pass down to consumers later, causing CPI to rise. In market terms, a rising PPI can indicate inflationary pressure building up in the economy, which might make the Federal Reserve more likely to raise interest rates. Traders use PPI data to predict how future inflation might affect corporate margins and market direction.

The Personal Consumption Expenditures (PCE) Index

The PCE Index is another important inflation measure, widely used by the Federal Reserve in the United States. It reflects the average price changes of goods and services that households actually purchase, but with a broader scope than CPI. PCE adjusts more dynamically to changes in consumer behavior. For example, if beef prices rise sharply and people start buying chicken instead, PCE captures that switch, while CPI does not adjust as quickly. Since the Fed uses PCE as its preferred inflation gauge, its data often moves the markets instantly after release. A lower PCE reading usually boosts investor confidence, as it reduces the chances of immediate rate hikes.

The Wholesale Price Index (WPI)

The Wholesale Price Index, or WPI, measures price changes in goods at the wholesale stage before they reach the retail market. It covers commodities like food grains, metals, and fuel. WPI is especially important in countries like India, where wholesale prices often move faster than retail prices. Rising WPI may signal cost pressures on industries, which could hurt profit margins and affect stock valuations, particularly in manufacturing and raw material sectors.

Core Inflation

Core inflation removes volatile components like food and energy prices to show a clearer long-term inflation trend. These two categories can change sharply due to weather, political events, or supply issues. By excluding them, core inflation helps central banks understand the underlying or persistent part of inflation. For investors, stable or falling core inflation is usually a positive signal, as it suggests that price pressures are cooling and the central bank may keep rates steady or even cut them.

The GDP Deflator

The GDP Deflator measures the change in prices of all goods and services produced within an economy. Unlike CPI or PCE, it includes investment goods, government spending, and exports, giving a complete picture of inflation across the whole economy. It is broader and more comprehensive but updated less frequently. Analysts use it to compare nominal GDP (which includes inflation) with real GDP (which does not). A rising GDP Deflator suggests strong inflationary trends that might influence policy decisions and, in turn, market liquidity.

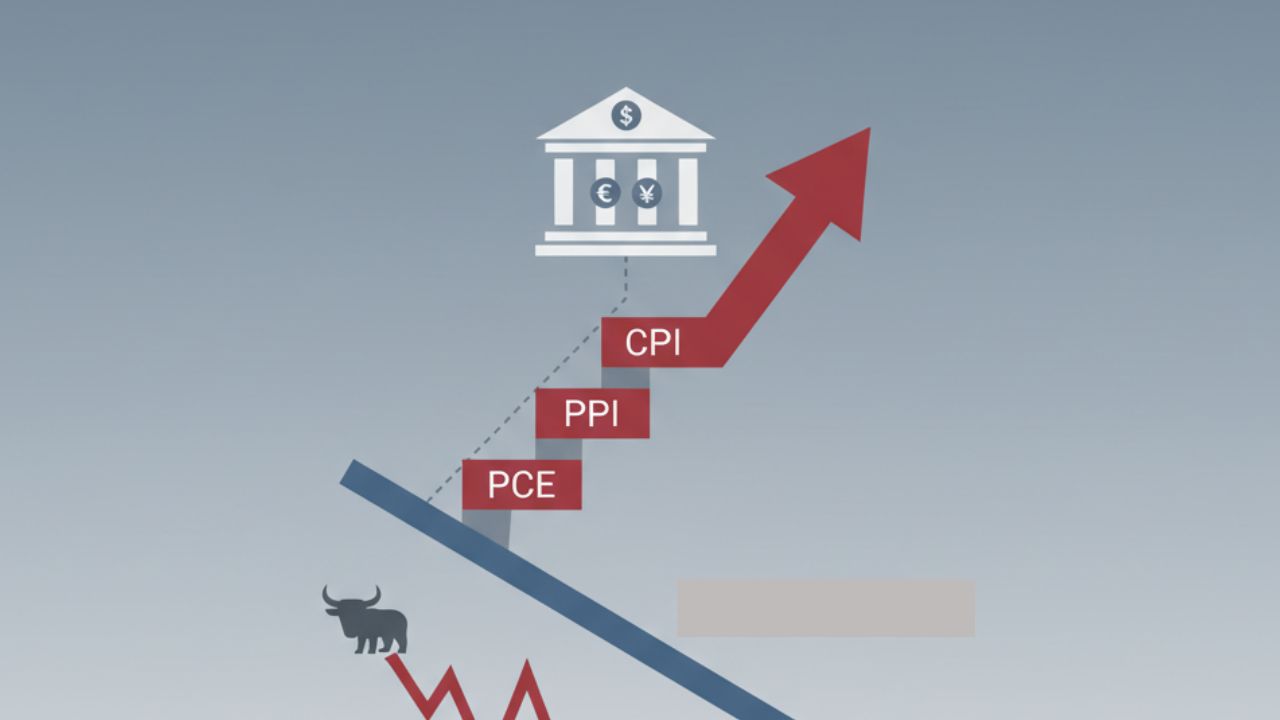

How These Measures Affect the Stock Market?

All these inflation indicators – CPI, PPI, PCE, WPI, Core Inflation, and the GDP Deflator – work together to shape market expectations. When inflation is high, central banks may raise interest rates to control it. Higher rates reduce liquidity in the financial system and make borrowing more expensive, often leading to stock market corrections. On the other hand, when inflation cools down, the market usually rallies because investors expect lower rates and higher future earnings.

Some sectors benefit during inflationary periods. For example, energy and commodity stocks often rise because their product prices increase. Meanwhile, technology and growth stocks usually underperform when inflation and rates are high, as their future earnings become less attractive in a high-yield environment.

How Inflation Hurts Stocks? – The relationship between inflation and stock prices follows a clear cause-and-effect path. When inflation starts to rise, producers face higher input costs, which push up wholesale prices measured by PPI or WPI. These higher costs gradually reach consumers, increasing CPI and PCE. As inflation stays high, central banks like the Federal Reserve respond by raising interest rates to slow down spending and borrowing. Higher interest rates make loans, mortgages, and business financing more expensive. This reduces corporate profits and consumer demand. Lower profits and weaker economic growth lead to declining investor confidence, triggering sell-offs in the stock market. Therefore, rising inflation indirectly causes market downturns through reduced earnings, tighter monetary policy, and shifting investor sentiment.

Also Read – Fed Interest Rates vs Gold Prices

Why It Matters

Understanding inflation helps investors make smarter decisions. Inflation data affects everything from bond yields to currency strength to equity valuations. Traders often adjust their portfolios based on upcoming CPI or PCE releases because these reports can cause strong short-term market reactions. Long-term investors use inflation trends to assess how their assets might perform in different economic cycles.

The Bottom Line

Inflation is not just about rising prices – it’s about how the value of money changes over time and how that change shapes market behavior. The CPI tells us what consumers are paying, the PPI and WPI show what producers are charging, the PCE reveals how people are actually spending, Core Inflation highlights the stable trend, and the GDP Deflator provides the broadest view. Together, these measures help investors and policymakers understand the economy’s direction. By keeping an eye on all of them, you can better understand how inflation trends influence interest rates, corporate profits, and the overall stock market performance.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.