Circle Internet Group Inc. (NYSE: CRCL) surged over 14% in early trading on Thursday, rising $28.33 to hit $226.95. This sharp rebound comes after the stock closed at $198.62 the previous day – marking a three-day plunge totaling 33.78% from Monday’s peak of $298.99. Today’s price action has pushed Circle’s market cap back up to approximately $49.03 billion, compared to Tuesday’s low of $43.8 billion.

Also Read – 5 Reasons Circle (CRCL) Stock Is Crashing as It Touches the $200 Mark

The rally appears to be a technical pullback, following a steep sell-off that wiped out nearly $24 billion in market capitalization within 72 hours. While traders and investors are watching closely, many are wondering: Is this the bottom – or just a pause before more downside?

A Closer Look: Is CRCL Stock Out of Danger?

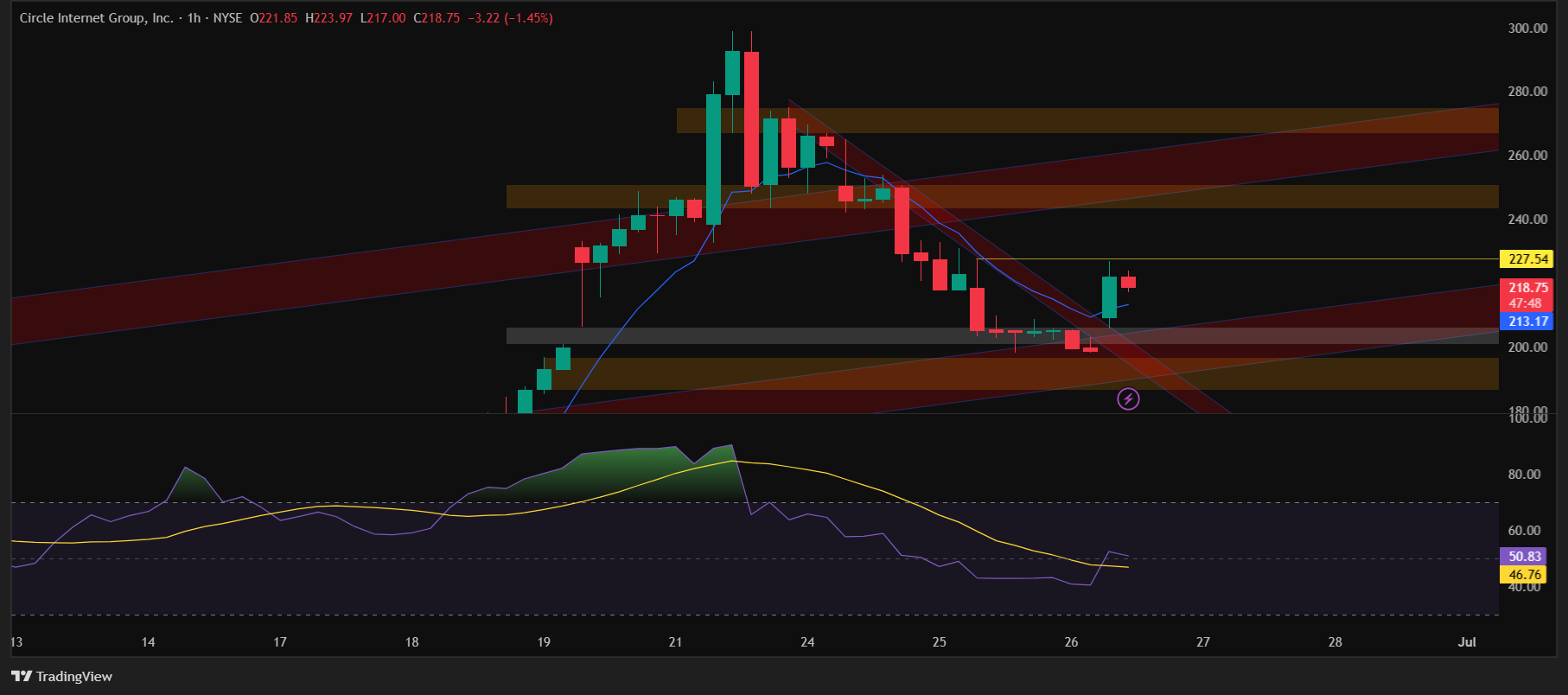

For investors hopeful that Circle’s worst days are over, the answer isn’t so simple. According to recent candlestick chart patterns, CRCL is not in confirmed bullish territory yet. Technically, the stock is still in correction mode and is only rebounding from a critical support zone between $198–$206.

To regain a bullish outlook, Circle needs to sustain above $250 – a key resistance level – for several sessions. Until then, price action may stay confined to a parallel channel that appears to be forming between $206 and $255. This range-bound movement is consistent with what has previously been observed in CRCL’s chart structure.

The stock briefly broke above a minor trendline, indicating short-term momentum. However, there is a high probability that price could retest the 9-day EMA, which currently sits at $194.85 on the daily timeframe. At the time of writing, the stock is showing some rejection near the previous session’s high, suggesting buyers are cautious around resistance zones.

Meanwhile, the RSI (Relative Strength Index) is hovering around 50, indicating neither overbought nor oversold conditions. For a stronger reversal confirmation, RSI would ideally need to bounce from near-oversold levels with increasing momentum.

Also Read – CRCL’s USDC & FI’s FIUSD – The Stablecoin Business Model Everyone Should Understand

This intraday spike may provide short-term relief, but given the volatility and broader market reaction to stablecoin regulation updates – including the BIS report that criticized the viability of stablecoins — investors should remain alert. Technical setups hint at continued volatility unless CRCL reclaims and holds higher levels with strong volume.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.