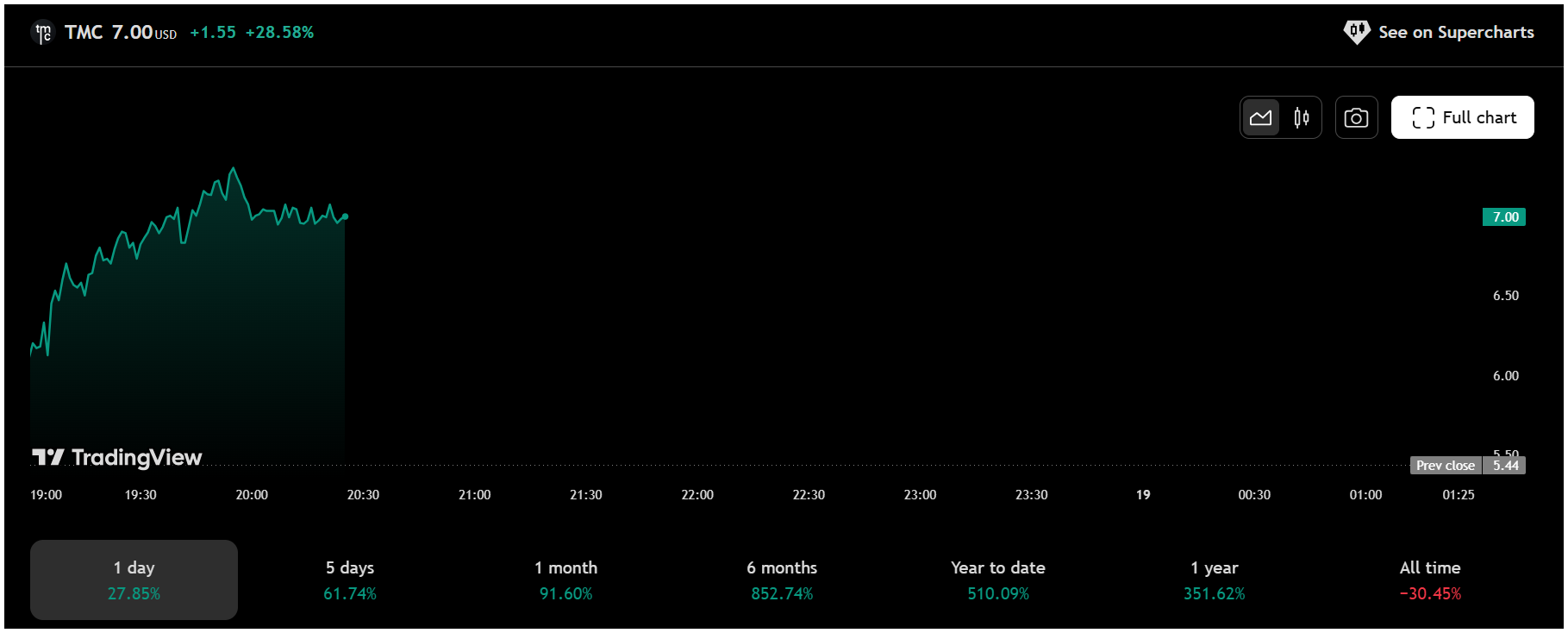

On June 18, 2025, shares of The Metals Company (NASDAQ: TMC) surged sharply, gaining 28.58% to close at $7.15, up from the previous day’s close of $5.44. The stock saw a strong uptrend during early market hours and maintained momentum through the trading session, driven by positive sentiment around leadership changes.

The spike in TMC’s share price follows the company’s announcement of two high-profile board appointments. On June 17, 2025, TMC confirmed the addition of Michael Hess and Alex Spiro to its Board of Directors. This move is seen as a strategic step, adding experienced voices to the company’s decision-making process at a time when TMC is navigating rapid growth and preparing for key milestones.

According to the latest market data, TMC’s market capitalization now stands at $2.53 billion. The company reported earnings per share (EPS) of $0.23 on a trailing twelve-month (TTM) basis, and it is scheduled to report its next earnings on August 13, 2025.

Also Read – JPMorgan Dips 0.31% Ahead of Chase Sapphire Reserve Fee Increase

Stock Performance Overview

TMC’s performance over various timeframes shows just how strong the stock’s rally has been in recent months:

- 5 Days: +61.74%

- 1 Month: +91.60%

- 6 Months: +852.74%

- Year to Date: +510.09%

- 1 Year: +351.62%

- All Time: -30.45%

Despite being down 30.45% from its all-time high, the stock has made a remarkable comeback in 2025. In just the last six months, it has skyrocketed by over 850%, fueled by growing interest in deep-sea mining and strategic partnerships.

Market Sentiment and Outlook

Investor sentiment surrounding TMC has improved significantly. The latest board additions are being interpreted as a sign that the company is serious about scaling operations and addressing regulatory, legal, and environmental challenges more effectively.

TMC is also gaining attention in the broader clean energy and EV materials space, given its focus on extracting battery-grade metals from ocean nodules. This unique business model has attracted both institutional and retail interest, especially with the EV boom driving demand for sustainable metal sourcing.

All eyes are now on the upcoming earnings release in August, which will provide further insight into the company’s financial performance and progress on its operational goals. If earnings continue to support the growth narrative, TMC may maintain upward momentum in the coming months.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.