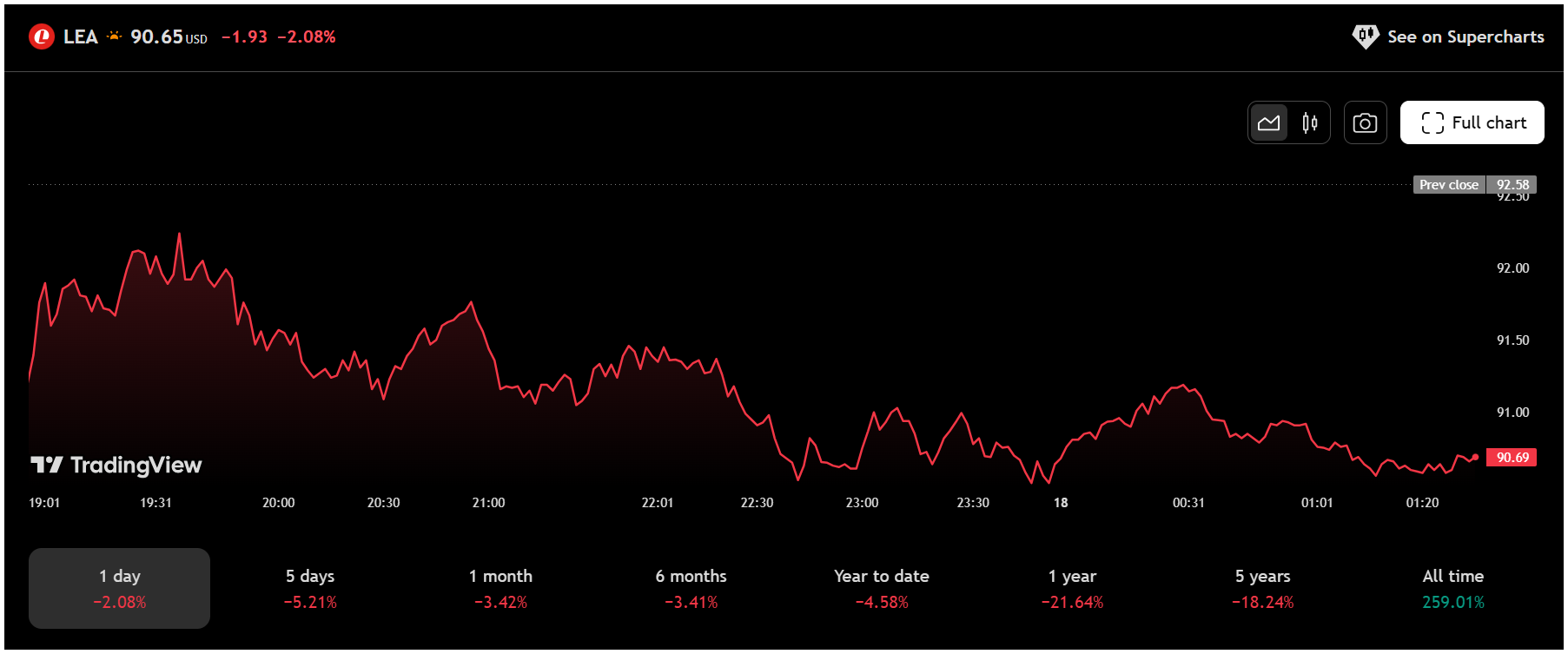

On Tuesday, June 18, 2025, Lear Corporation (NYSE: LEA) experienced a notable decline in its share price, closing at $90.65, down $1.93 or 2.08% from the previous close of $92.58. This dip comes after recent insider activity, which may have influenced short-term investor sentiment.

The insider transaction involved Director Conrad L. Mallett, Jr., who sold 1,187 shares of Lear stock on June 16, 2025, at an average price of $92.86, totaling $110,224.82, as disclosed in a U.S. Securities and Exchange Commission (SEC) filing. After the sale, Mallett retained only 84 shares, valued at approximately $7,800.24. While insider selling can result from various personal financial reasons, it has sparked concern among some investors, especially during a period of price weakness for the stock.

Also Read – Circle Stock Falls 3.5% Amid Market Volatility

Stock Performance Overview

Lear’s recent stock performance has been under pressure across multiple timeframes. The following breakdown shows its return across different periods:

| Time Period | Return |

|---|---|

| 5 Days | -5.21% |

| 1 Month | -3.42% |

| 6 Months | -3.41% |

| Year to Date | -4.58% |

| 1 Year | -21.64% |

| 5 Years | -18.24% |

| All Time | +259.01% |

The stock’s 1-year and 5-year losses of 21.64% and 18.24% respectively are significant, driven by macroeconomic pressures and softer revenue. However, its all-time return of +259.01% highlights Lear’s long-term ability to create value for investors.

Major News and Developments

Despite near-term struggles, Lear has delivered positive developments recently. In its Q1 2025 earnings (announced May 6), the company reported:

- Adjusted EPS of $3.12 per share (vs. analyst estimate of $2.69)

- Revenue of $5.56 billion, beating consensus by $180 million

- Continued strength in both Seating and E-Systems segments

CEO Ray Scott noted that operating margins improved despite lower industry-wide vehicle production, reflecting operational discipline.

Analyst sentiment, while mixed, leans positive:

- Bank of America raised its price target from $110 to $115, maintaining a “Buy” rating

- JP Morgan increased its target to $120, rating the stock as “Overweight”

- CFRA upgraded Lear to “Buy” with a $120 price target

- GuruFocus estimates GF Value at $145.02, suggesting the stock is 53.33% undervalued

However, MarketBeat reports a consensus rating of “Hold” among 14 analysts (1 Sell, 8 Hold, 5 Buy), with an average target of $107.09.

At the Wells Fargo Industrials and Materials Conference (June 11), management expressed confidence in reinstating full-year guidance during the Q2 2025 earnings call (expected August 4). They projected:

- Q2 revenue of $5.9 billion (above consensus of $5.73 billion)

- Operating income between $260–$270 million

- $25 million in stock repurchases planned

However, executives warned that 2027 may be a slow year due to global uncertainties and rising input costs.

Strategic and Insider Moves

Lear is strengthening its position in automotive tech, winning a 2025 Automotive News PACE Award for its Zone Control Module, an advanced vehicle electronics solution. A new China joint venture is expected to add $70 million in 2025 revenue, boosting its E-Systems segment.

Insider activity is mixed. While Mallett’s sale raised eyebrows, Director Rod Lache earlier bought 2,178 shares for $199,940 on March 5, reflecting internal confidence.

- Insiders own 0.91% of Lear’s stock

- Institutions hold 97.04%, showing strong backing from funds and investment firms

Market Outlook and Risks

Lear’s focus on electrification and advanced seating systems aligns with trends in the EV space. However, challenges such as:

- Rising copper prices (hurting E-Systems margins)

- Potential tariffs on global trade

- And sluggish industry growth in coming years

…are key concerns flagged by analysts including John Murphy of Bank of America.

Still, Lear’s undervaluation, steady earnings, and strategic roadmap provide hope. If upcoming guidance in Q2 proves strong, it may trigger renewed momentum in the stock, especially for long-term investors.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.