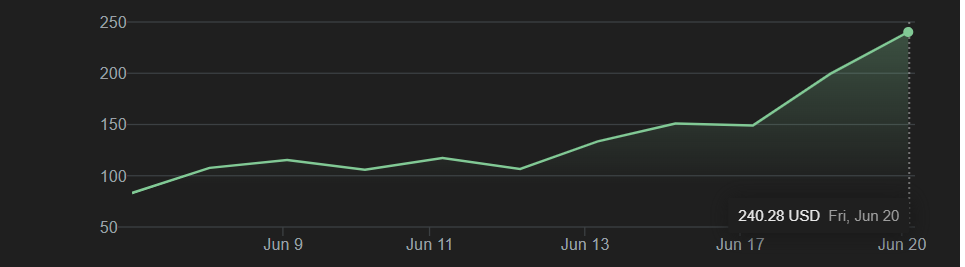

New York || 01:36 AM ET – Circle Internet Group (NYSE: CRCL) has emerged as one of the most compelling IPO stories of 2025. Following its debut on the New York Stock Exchange on June 5, the company closed the week with a 248.23 percent gain in June, pushing its market cap to an estimated $54 billion.

How CRCL Stock Performed in June 2025?

On Friday, June 20, CRCL opened at $231.50, climbed to a high of $248.88, and closed at $240.28. The after-hours session saw additional gains, with the stock reaching $245.39.

Since its IPO at $31 per share, CRCL has surged more than $170, marking a powerful start in public markets. Trading volume remains robust, reflecting strong interest from institutional and retail investors.

Latest News About CRCL Stock in June 2025

Circle has dominated headlines throughout June due to its blockbuster IPO, soaring share price, and strategic advancements in the crypto-fintech space.

Known for issuing the stablecoin USDC, the company announced partnerships with blockchain firm Ripple to integrate USDC on the XRP Ledger and with digital identity company World to add USDC and CCTP V2 (Cross-Chain Transfer Protocol) on World Chain. Additionally, Circle plans to scale global treasury and merchant payment tools, further solidifying its role in regulated digital finance. These developments, coupled with the Senate’s passage of the GENIUS Act, which enables broader stablecoin adoption by banks, fintechs, and retailers, have significantly boosted investor confidence.

Why Did CRCL Stock Go Up on Friday?

CRCL’s 20% gain on June 20 was fueled by the Senate’s passage of the GENIUS Act earlier in the week, which prompted a “buy” recommendation from Seaport Global, as reported by Insider Monkey.

Speculation about potential inclusion in future fintech indexes, strong buying interest, limited float, and bullish institutional sentiment also sustained the rally.

Technical Analysis of CRCL Stock for June 2025

CRCL remains in a strong uptrend but is currently in overbought territory, with the RSI above 70. Short-term resistance is seen at $250 and $275, while support is around $206.

Last week, CRCL closed with a strong Bullish Marubozu candle. On the daily candlestick chart, after the bullish engulfing pattern observed on Wednesday and Thursday, a hammer-like candlestick followed. However, a gap is visible below the low of that pattern. This suggests the stock may see a minor dip before continuing its upward trend, supported by strong global fundamentals.

Volume patterns show steady demand during price dips, indicating ongoing accumulation by investors.

Price Forecast for CRCL Stock in June 2025

At the time of writing, based on fundamental and technical factors, CRCL stock may continue its upward rally, reflecting bullish investor sentiment. It may face resistance around the $275 zone; however, fundamental reasons are likely to outweigh the technicals.

Investor sentiment is overwhelmingly bullish. Analysts, including Seaport Global with its “buy” rating, view Circle as a leader in the stablecoin space, bolstered by its robust infrastructure, regulatory alignment, and new partnerships with Ripple and World. Retail traders are highly active on social platforms, and institutional newsletters continue to highlight CRCL as a high-potential tech stock.

Key Financial Metrics of CRCL Stock in June 2025

According to Yahoo Finance data, CRCL’s Enterprise Value is $52.66 billion. It trades at a Price/Sales ratio of 28.30 and a Price/Book ratio of 71.78. The trailing P/E is 2,750, with no forward P/E due to the absence of earnings guidance. These metrics reflect lofty growth expectations from the market.

Based on its current share price and market cap, CRCL is estimated to have about 224 million shares outstanding. This figure will be confirmed in the company’s first official SEC filings after the quarter ends.

Is CRCL Stock a Good Choice Right Now?

This article does not offer investment advice. However, investors are weighing both the opportunities and risks based on current market behavior.

Pros:

- First-mover advantage in stablecoins with USDC

- Rapid IPO success and strong institutional support

- Strategic partnerships with Ripple and World

- Global expansion plans and regulatory tailwinds from the GENIUS Act

Cons:

- Extremely high valuation with limited earnings history

- Potential regulatory uncertainty in the broader crypto finance space

- Post-IPO volatility remains a concern

The Bottom Line

With a 248.25% return in June and a market cap nearing $54 billion, Circle Internet Group has captured the market’s attention. Strategic partnerships with Ripple and World and plans for international expansion have fueled its explosive debut. As Circle enters its first full quarter as a public entity, all eyes will be on earnings, guidance, and its ability to sustain momentum in the competitive crypto-fintech landscape.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.