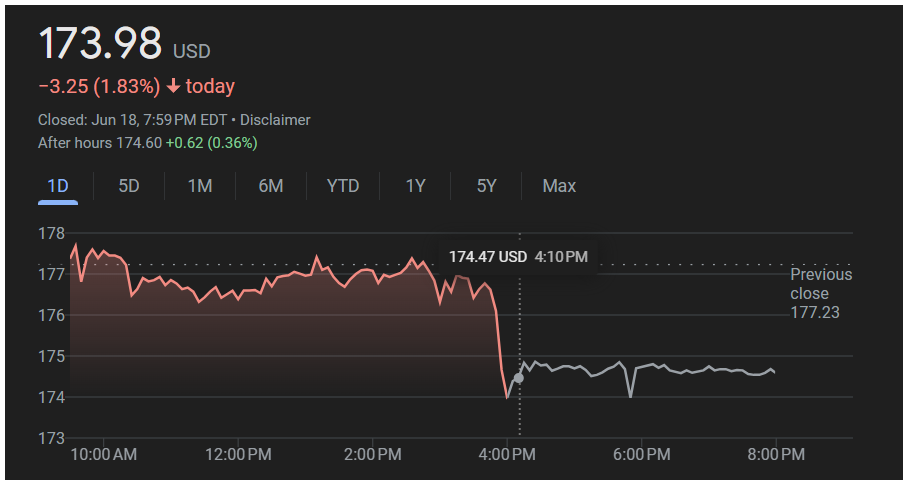

Alphabet Inc. (NASDAQ: GOOG), the parent company of Google, witnessed a slight pullback in its stock price on Tuesday, June 18, 2025. The stock closed at $173.98, down $3.25 or 1.83% from the previous session’s close of $177.23.

The downward move comes after a relatively steady trading session where the stock opened at $177.28 and traded within a narrow range of $172.84 to $177.82. After-hours trading offered a mild recovery as the stock edged up to $174.60, showing a gain of $0.62 or 0.36%.

Technical analysts suggest that Alphabet’s stock may dip further during trading on June 19. The stock appears to be approaching a confluence of trendline support between the $170 to $169 price range. This area may act as a critical zone, where buying interest could emerge. A failure to hold above this support level might attract short-term selling, while a bounce from here could provide a favorable technical setup for bullish traders.

As of the latest data, Alphabet holds a market capitalization of $2.11 trillion, reaffirming its position as one of the world’s most valuable technology companies. The stock trades at a trailing twelve-month P/E ratio of 19.71. Alphabet also provides a modest dividend yield of 0.48%, with a recent quarterly dividend of $0.21 per share.

Also Read – CRCL Stock Soars Over 33% as Stablecoin Market Cap Hits $252 Billion After Genius Act Passage

Returns across different timeframes show a mixed picture. The stock is down 1.49% over the past day and 1.62% over the past five trading sessions. Over the past month, Alphabet has gained 5.36%, though it has dropped 6.71% over the last six months. Year to date, the stock is down 9.09%, and over the last 12 months, it has declined 2.16%. However, over a five-year period, the stock has generated a strong return of 139.09%. Since inception, Alphabet has delivered a total return of 6,830%.

On the regulatory front, recent news may have a positive long-term impact. On Friday, June 13, 2025, Mexico’s antitrust authority, Cofeco, officially closed its multi-year antitrust investigation into Alphabet. The announcement, as reported by Insider Monkey, removes a lingering regulatory overhang for the company and may gradually restore investor confidence.

In terms of business strategy, Alphabet continues to focus on artificial intelligence, quantum computing, and cloud infrastructure. The Google Cloud segment has been steadily growing and is expected to be a key contributor in future earnings. YouTube’s monetization performance and the company’s evolving advertising model will also be key areas of focus in the next earnings cycle.

Overall, while the short-term trend shows a minor pullback, Alphabet’s long-term fundamentals remain strong. Market participants will keep a close watch on technical support zones and upcoming earnings announcements to determine the next direction for the stock.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.