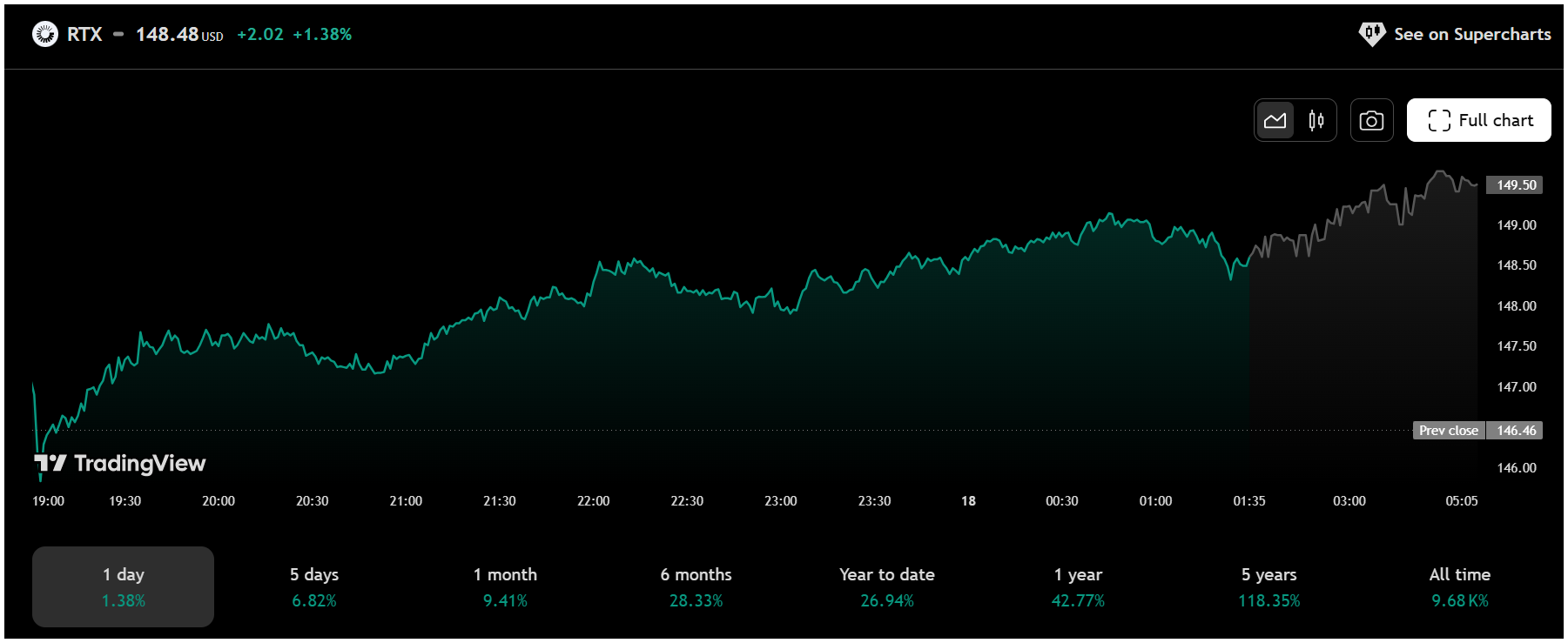

Shares of RTX Corporation (NYSE: RTX) rose by 1.38% to $148.48, adding $2.02 in a single day of trade. While short-term gains grabbed headlines, long-term investors are taking notice of something far more impressive: RTX has delivered a stellar 118.35% return over the past five years.

This strong 5-year performance signals consistent value creation in the defense and aerospace sector. From legacy operations under Raytheon Technologies to a refined post-merger strategy under the RTX brand, the company has steadily expanded its business, boosted innovation, and maintained strong earnings despite global uncertainty.

Over the past six months alone, the stock has risen 28.33%, while it has climbed 26.94% year-to-date. In the past one month, RTX has returned 9.41%, with a 6.82% gain in the past five trading sessions. Its one-year return stands at an impressive 42.77%, further reinforcing investor confidence.

RTX Corporation, formerly known as Raytheon Technologies, is a major American aerospace and defense company. Headquartered in Arlington, Virginia, it operates through three main segments: Collins Aerospace, Pratt & Whitney, and Raytheon. The company provides advanced systems and services for commercial and military customers globally. RTX is one of the largest defense contractors in the world, known for producing high-tech missiles, sensors, aircraft engines, and avionics systems.

Analysts say RTX’s long-term uptrend is supported by robust defense contracts, steady cash flows, and rising demand for aerospace and military technology. In addition, a global geopolitical environment that continues to prioritize defense spending has helped drive sentiment around the stock.

Yesterday’s rise is a continuation of its recent bullish pattern, following strong buying momentum seen across the broader sector. If this trend continues, RTX may test new highs over the coming quarters.

However, market watchers recommend keeping an eye on macroeconomic risks, such as interest rate decisions and global tensions, which could affect near-term volatility.

Recent Developments Bolster RTX’s Outlook

RTX Corporation continues to strengthen its position in the defense and aerospace sectors with significant contract wins and strategic advancements. On June 18, 2025, RTX secured a $299.69 million contract modification for missile testing equipment and spares, reinforcing its critical role in U.S. defense programs. Earlier in June, Raytheon, an RTX business, was awarded a $1.1 billion U.S. Navy contract to produce AIM-9X Block II missiles and a $646 million contract for SPY-6 radar production, highlighting sustained demand for its advanced missile and radar systems.

Additionally, RTX’s Collins Aerospace expanded its aircraft electrification capabilities with a new engineering center in the UK and a production line in France, announced on June 9, 2025, aligning with the industry’s push toward sustainable aviation. Pratt & Whitney, another RTX division, secured a contract on June 16, 2025, to supply TJ150 engines for Leidos’ Small Cruise Missile program, further diversifying its propulsion portfolio.

Despite a U.S. Department of Justice mandate requiring Safran to divest its North American actuation business as part of a $1.8 billion acquisition from Collins Aerospace, announced on June 17, 2025, RTX’s diversified backlog of $92 billion as of Q1 2025 supports long-term revenue stability.

Financial Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Investing in the stock market involves risk. Readers are advised to do their own research or consult with a professional before making any investment decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.