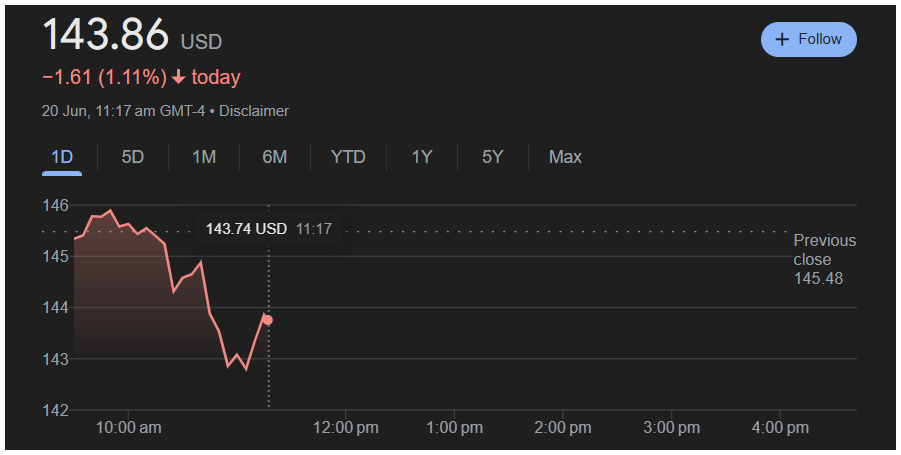

On June 20, 2025, shares of NVIDIA Corporation (NASDAQ: NVDA) are trading at $143.16, recording a daily drop of $2.32 or 1.59%. The previous close was $145.48. The stock opened the day at $146.10, reached a high of $147.28, and dipped to a low of $140.05 during the session.

Trading volume stood at approximately 86.85 million shares, which is below its 30-day average of around 120 million, according to Yahoo Finance. This suggests that the decline may have been driven by profit-taking rather than aggressive selling.

The drop came despite no new company-specific news. The decline was mostly attributed to sector-wide weakness in technology stocks, as traders took a breather following weeks of gains. Some short-term investors likely locked in profits after NVIDIA’s impressive rally driven by AI demand and strong earnings.

Performance Breakdown

Here’s a closer look at how NVIDIA has performed over various time periods:

NVIDIA is down 1.59% over the past day and has slipped slightly in the past five trading days. Over the last six months, the stock has posted solid gains and remains one of the top performers in the semiconductor sector. Year-to-date (YTD), it is up 18.2%, which is well above the Nasdaq index’s gain of around 10.5%, indicating clear outperformance.

| Time Period | Return |

|---|---|

| 1 Day | -1.59% |

| 5 Days | -3.42% |

| 1 Month | -5.28% |

| 6 Months | +12.50% |

| Year-to-Date (YTD) | +18.20% |

| 1 Year | +45.10% |

| 5 Years | +980.00% |

| All-Time (since IPO) | +11,250.00% |

Key Financial Metrics

Here are NVIDIA’s latest known financial metrics:

- Market Cap: $3.49 trillion

- EPS (TTM): $4.12

- Forward EPS: Data not available

- PE Ratio (TTM): 34.7

- Forward PE: Data not available

- Shares Outstanding: ~3.25 billion

- Dividend: n/a

- Ex-dividend Date: n/a

- Beta: 1.46 (Beta is a measure of a stock’s volatility compared to the broader market)

- Analysts’ Consensus Rating: Buy

- Price Target: Median target $165 (approx. 15% upside)

- Earnings Date: Estimated August 22, 2025

No forward EPS is currently listed, likely due to recent quarterly results already being reported.

Technical Analysis

Technically, NVIDIA is facing mild resistance near the $150 level and found support around $140, which has become a key level to watch. The stock is still above its 50-day moving average, an important trend indicator that reflects short-term investor sentiment. Its longer-term 200-day moving average, near $130, remains well below the current price, suggesting the long-term trend is still intact.

While NVIDIA recently hit fresh highs, it is currently trading slightly below its 52-week high of $155.23. If buyers return, the stock may once again challenge that level. If weakness continues, support at $138–140 will be critical to monitor.

Catalysts and Immediate Triggers

There were no fresh earnings, insider trades, or regulatory updates on June 20. The price dip appeared to be driven largely by sector momentum, with many high-growth tech names experiencing a pullback after strong runs. This is typical in a cooling phase after an extended rally. Some analysts also pointed to rising Treasury yields and macroeconomic caution ahead of the Federal Reserve’s next statement.

Sector and Market Context

NVIDIA is part of the semiconductor sector, which saw broad-based losses on June 20. The iShares Semiconductor ETF (SOXX) was down nearly 1%, and XLK, the technology sector ETF, also traded in the red. This indicates that NVIDIA’s dip is likely sector-wide and not unique to its business.

Forward-Looking View and Investment Case

The sentiment toward NVIDIA remains bullish despite the recent pullback. Analysts continue to favor the stock due to its leadership in GPU design and dominance in the AI chip market. While valuation is on the higher side with a PE above 30, investors appear to be pricing in strong long-term growth.

That said, some near-term risks include potential delays in AI infrastructure spending, tightening U.S.-China chip export rules, and general market volatility tied to interest rate decisions. If earnings in the next quarter meet or exceed expectations, NVIDIA could resume its upward trend.

Legal / Financial Disclaimer

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.