(New York, June 17, 2025) – Lockheed Martin Corporation (NYSE: LMT), a leading name in the aerospace and defense sector, is currently experiencing significant stock price volatility. On June 16, 2025, the company’s shares dropped nearly 4%, closing at $467.00. However, by 6:04 AM EDT on June 17 (4:21 PM IST), pre-market trading showed a slight recovery, with the stock rising to $472.00. This shift suggests possible stabilization in the near term.

Key Factors Driving Volatility

1. Geopolitical Tensions

On June 13, LMT stock surged 3.66% to $491.95 following increased tensions in the Middle East after Israel launched strikes against Iran. As a primary supplier of F-35 jets to Israel, Lockheed was expected to benefit from a boost in defense spending. However, the rally reversed on June 16 after Iran indicated a willingness to de-escalate, lowering short-term demand expectations.

2. F-35 Contract Reductions

Investor concerns deepened after news emerged on June 11 that the U.S. Air Force plans to cut its F-35 jet orders for FY 2026 from 48 to 24. This announcement triggered a 6% decline in the stock to $447.96 and may lead to a revenue loss of up to $3.5 billion for Lockheed Martin.

3. Defense Budget Uncertainty

While long-term government contracts like the F-35 program and the U.S. Golden Dome initiative provide a base of revenue stability, ongoing Congressional discussions about future defense spending have created uncertainty, adding pressure to the stock.

4. Macroeconomic Conditions

Rising interest rates and inflation fears continue to challenge the broader defense sector. Even though Lockheed’s forward P/E ratio of 17.49 is below the industry average of 23.2, its stock remains vulnerable to market-wide volatility.

5. Diversified Product Portfolio

Lockheed’s portfolio, which includes PAC-3 missiles, THAAD interceptors, and AI-enabled defense systems, helps mitigate some risk from the F-35 uncertainty. However, short-term price movement remains largely influenced by global headlines and news-driven sentiment.

Despite the turbulence, Lockheed Martin has managed a 4.33% year-to-date return, slightly trailing the broader aerospace and defense sector’s 6.1% gain.

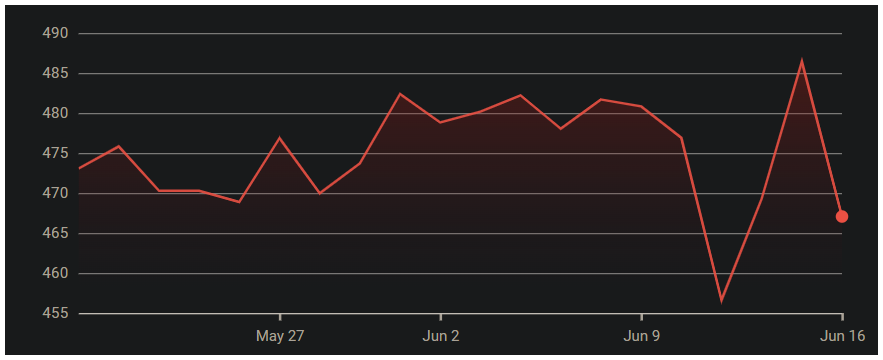

Chart Overview

A review of the one-month chart shows LMT fluctuating between $457.00 and $491.95 since mid-May. Key price points include:

- June 4: Peaked at $485.00

- June 11: Dropped to $457.00 following F-35 news

- June 13: Rebounded to $491.95 due to geopolitical escalation

- June 16: Closed at $467.00

- June 17 (Pre-Market): Slight recovery to $472.00

Over the past year, LMT reached a 52-week high of $618.95 in October 2024 and a low of $418.88. The current price is about 23.7% below its peak.

Technical Outlook

Technical indicators suggest potential for a bullish breakout:

- Resistance Level: $488.00

- Breakout Target: If breached, the stock could move toward $509.00

- Support Zone: Strong buying interest expected between $430.00 and $420.00

What’s Next?

Lockheed Martin’s upcoming earnings call on July 29, 2025, is expected to provide critical updates on contract pipelines and defense funding trends. While the June 17 pre-market recovery hints at a pause in the downtrend, the stock’s direction will likely depend on:

- Clarification regarding F-35 program cuts

- U.S. defense budget decisions

- Further geopolitical developments

As a key player in the global defense industry, LMT will remain in focus for investors tracking market momentum and sector stability.

Frequently Asked Questions (FAQs)

Q1: Why did Lockheed Martin’s stock drop 4% on June 16?

A: The decline followed Iran’s de-escalation signals, reducing expectations for immediate defense spending.

Q2: What technical levels should investors monitor?

A: Resistance is at $488.00 with a breakout target of $509.00. Support lies between $430.00 and $420.00.

Q3: How does the F-35 program affect LMT’s stock?

A: The F-35 is a major revenue driver. Reduced U.S. orders for 2026 caused a sell-off, but long-term contracts still provide revenue stability.

Q4: Are geopolitical events important for LMT’s stock?

A: Yes. Global conflicts, especially in the Middle East, often lead to increased demand for Lockheed’s products.

Q5: What supports Lockheed Martin’s long-term outlook?

A: A strong product portfolio, focus on AI and hypersonic technologies, and leadership in major defense programs.

Financial Disclaimer: This article is for informational and educational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold Lockheed Martin (LMT) stock. Investing involves risk. Past performance does not guarantee future results. Please consult a licensed financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses resulting from actions taken based on this content.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.