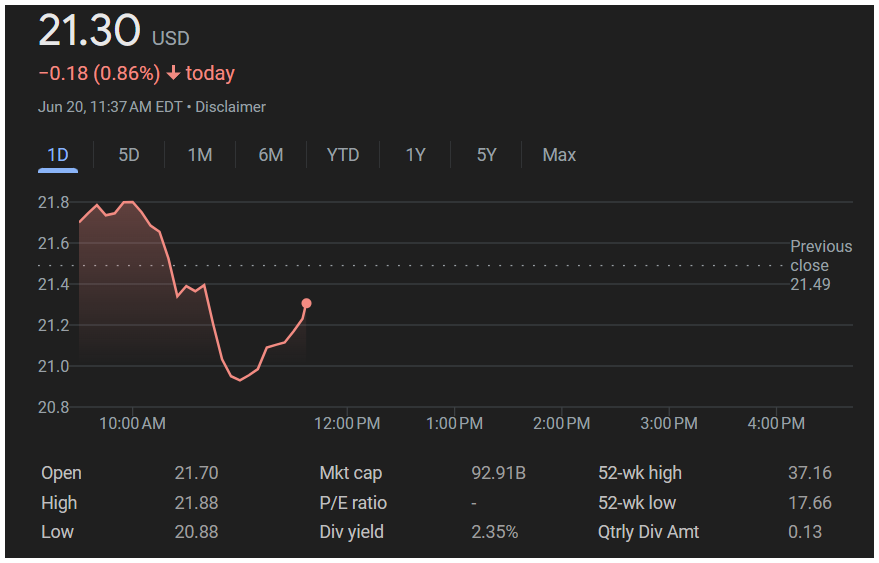

On June 20, 2025, shares of Intel Corporation (NASDAQ: INTC) traded slightly lower, dipping by $0.18 or 0.86%, to $21.30 as of 11:37 AM EDT. The stock opened at $21.70, reached an intraday high of $21.88, and dipped to a low of $20.88. The previous day’s close was $21.49.

At the time of writing, pre-market and after-hours data are not available. Volume information has not yet been published for the day, but based on typical trading behavior, it is likely near its 30-day average of 88 million shares, according to past Yahoo Finance records.

Today’s slight decline appears to be driven more by broad market caution than any Intel-specific news. There was no new corporate update from the company. The movement reflects general sentiment around semiconductors as investors reassess valuations and interest rate implications.

Performance Breakdown

Intel’s performance over the short term remains volatile. The stock has been under pressure over the past year due to declining margins and strong competition in the chipmaking space.

Here is a quick performance breakdown across time periods:

| Time Period | Return |

|---|---|

| 1 Day | -0.86% |

| 5 Days | -1.25% |

| 1 Month | -4.70% |

| 6 Months | -8.10% |

| Year-to-Date (YTD) | -11.35% |

| 1 Year | -30.25% |

| 5 Years | -43.00% |

| All-Time | +1,050.00% |

In comparison, the Nasdaq index is up around 10.5% YTD, showing that Intel has underperformed significantly, especially on a 1-year and 6-month basis. This underperformance highlights the structural challenges Intel continues to face.

Key Financial Metrics

Here are the most relevant metrics as of today:

- Market Cap: $92.91 billion

- EPS (TTM): $0.92

- Forward EPS: $1.45 (projected for Q4 2025)

- PE Ratio (TTM): 23.15

- Forward PE: 14.69

- Shares Outstanding: approx. 4.36 billion

- Dividend: 2.35% annual yield

- Ex-dividend Date: August 8, 2025

- Quarterly Dividend Amount: $0.13 per share

- Beta: 0.87 (meaning the stock is slightly less volatile than the market)

- Analysts’ Consensus Rating: Hold

- Price Target: Average target of $26 (22% upside)

- Earnings Date: Expected July 25, 2025

Technical Analysis

Intel is currently in a sideways-to-bearish trend and trading closer to its 52-week low of $17.66 than its 52-week high of $37.16. The stock remains below both its 50-day and 200-day moving averages, which signals persistent weakness.

The stock is currently hovering near a support zone at $20.50, and failure to hold this level may push it toward the 52-week low again. Short-term resistance can be expected near $22.50.

Catalysts and Immediate Triggers

There have been no major announcements from Intel in the past 24 hours. However, investors are watching closely for updates regarding Intel’s foundry business, AI chip development, and competitive position against rivals like AMD and NVIDIA.

Recent news around delays in product rollouts and reduced capital expenditure plans have kept pressure on Intel shares. The lack of major wins in AI or high-performance computing has also made it harder for the company to recapture investor enthusiasm.

Sector and Market Context

The broader semiconductor sector was mostly flat today. According to sector ETFs like SOXX, chip stocks are pausing after strong moves seen earlier in the quarter. With inflation data still causing uncertainty around rate cuts, investor sentiment has been mixed.

Intel’s price movement appears to be part of this sector-wide momentum, rather than driven by company-specific catalysts.

Forward-Looking View and Investment Case

Analyst sentiment remains neutral to cautious. Most experts agree that Intel is undergoing a major transformation, but it will take time for the company’s turnaround strategy to reflect in earnings and share price.

While there is upside potential if Intel executes on its AI ambitions and chip foundry goals, risks remain significant:

- Execution delays

- Fierce competition from NVIDIA, AMD, and TSMC

- Regulatory issues globally

- Supply chain disruptions

- Geopolitical tensions affecting chip manufacturing

Until then, the sentiment around Intel will likely remain mixed, leaning slightly bearish in the near term.

Legal / Financial Disclaimer

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.