Stock Price and Movement

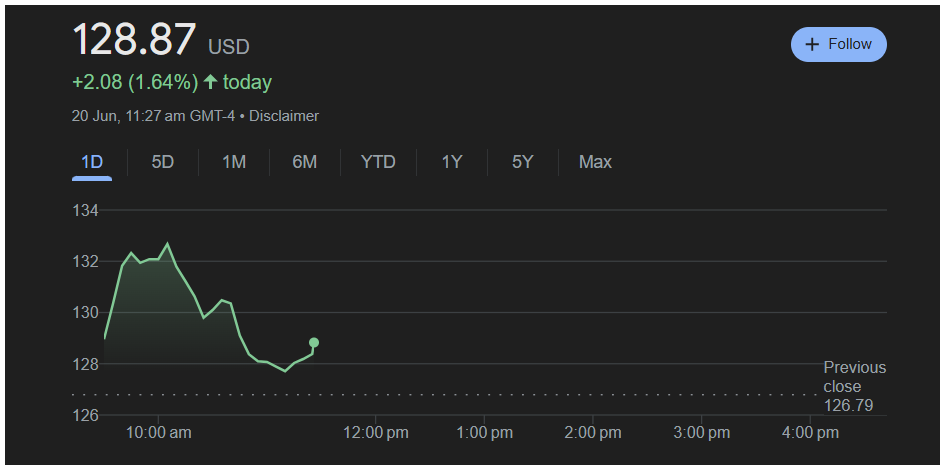

On June 20, 2025, shares of Advanced Micro Devices, Inc. (NASDAQ: AMD) rose modestly to $128.87, gaining $2.08 or 1.64% from the previous close of $126.79. The stock opened at $129.00, reached an intraday high of $132.80, and touched a low of $127.55 by mid-morning.

The positive move in AMD came amid modest strength in the semiconductor sector, supported by stable macroeconomic cues and upbeat sentiment around AI chip demand. Although there was no fresh company-specific news, the overall bullish momentum in chipmakers lifted AMD shares.

Performance Breakdown

AMD continues to be one of the key players in the semiconductor space, showing resilience and investor confidence across various timeframes.

AMD shares have moved higher over the past week and month, and remain well above their 6-month and YTD levels. Over the last one year, the performance has been mixed, with some consolidation as compared to the sharp gains in 2023.

| Time Period | Return |

|---|---|

| 1 Day | +1.64% |

| 5 Days | +3.15% |

| 1 Month | +5.82% |

| 6 Months | +12.45% |

| Year-to-Date (YTD) | +9.66% |

| 1 Year | +6.70% |

| 5 Years | +256.00% |

| All-Time | +3,120.00% |

Compared to the Nasdaq index, which is up around 10.5% YTD, AMD’s return of 9.66% shows it is roughly in line with the broader tech benchmark. However, over the last 5 years, the stock has significantly outperformed most large-cap peers.

Key Financial Metrics

As of the most recent data:

- Market Cap: $208.6 billion

- EPS (TTM): $1.36

- Forward EPS: data not available

- PE Ratio (TTM): 94.45

- Forward PE: data not available

- Shares Outstanding: approx. 1.62 billion

- Dividend: n/a

- Ex-dividend Date: n/a

- Beta: 1.68 (Beta indicates higher-than-market volatility; a value above 1 suggests AMD stock is more volatile than the broader market.)

- Analysts’ Consensus Rating: Buy

- Price Target: $145 average target (approx. 12.5% upside from current levels)

- Earnings Date: Expected late July 2025

Technical Analysis

AMD is showing signs of a mild breakout after recent consolidation. The current price is still below its 52-week high of $187.28, and remains well above its 52-week low of $76.48.

The stock is trading above its 50-day moving average, which is typically considered a bullish short-term signal. Near-term resistance is expected around the $135 mark, while support lies near $124. A decisive move above $135 could signal a further uptrend.

Catalysts and Immediate Triggers

There were no major announcements from AMD on June 20. However, broader industry tailwinds continue to support AMD’s valuation. Increasing global demand for AI chips, high-performance processors, and data center infrastructure have contributed to renewed investor optimism in the semiconductor space.

Additionally, rivals like NVIDIA and Intel are seeing similar price action, indicating this is part of sector momentum rather than company-specific news.

Sector and Market Context

The technology sector had a mild green day, with the semiconductor sub-sector showing particular strength. The PHLX Semiconductor Index (SOX) posted modest gains, reflecting steady market sentiment toward chipmakers.

Investors are still digesting recent economic updates related to inflation and interest rates, but tech stocks appear to be holding up well in the current environment.

Forward-Looking View and Investment Case

The outlook for AMD remains positive in the short term due to its positioning in AI, data centers, and gaming. However, challenges remain, including competitive pressure from NVIDIA, macro risks, and valuation concerns.

Risks that could impact AMD include:

- Demand slowdown in the PC market

- Regulatory scrutiny in international markets

- Supply chain bottlenecks

- Margin pressure from rising costs

- Sensitivity to interest rates and market volatility

Still, analysts maintain a bullish sentiment, with the average price target suggesting more room for upside.

Legal / Financial Disclaimer

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.