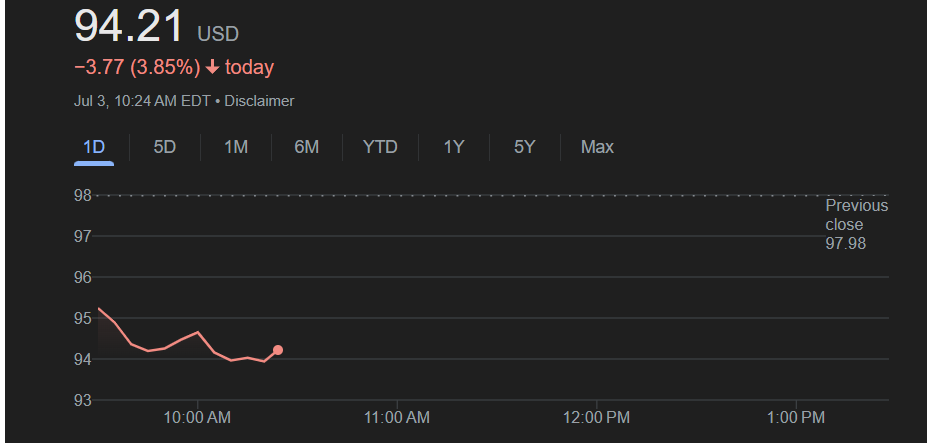

Shares of Robinhood Markets Inc (NASDAQ: HOOD) declined sharply Thursday morning, trading at $94.21, down $3.77 or 3.85% as of 10:24 AM ET. The stock is reversing after a high-profile rally, pressured by fresh doubts and technical resistance.

Why Is Robinhood Falling?

OpenAI Denial Hits Tokenized Shares Sentiment

Robinhood shares had initially surged after the company launched tokenized shares for private giants like OpenAI and SpaceX, promoting the products as a way for retail investors to access Silicon Valley startups via blockchain.

However, OpenAI quickly issued a strong statement on X, denying any partnership with Robinhood, clarifying that it had never authorized any transfer of its equity, and explicitly rejecting any endorsement of these offerings. That swift denial rattled market confidence and triggered a rapid reversal from fresh highs.

HOOD: Technical Outlook for July 2025

Robinhood had broken its all-time high of $85 on June 25, closing above it on June 30, and touched $100 for the first time on July 2. This move encouraged profit booking by traders.

Now, price action shows a double-top pattern forming around the $100 mark, which could continue to pressure the stock unless it breaks out decisively above that resistance. If Robinhood fails to hold support near $89.70, the next support area could be in the $74–79 zone, followed by a stronger level between $62–67 if selling deepens.

On the hourly timeframe, the Relative Strength Index (RSI) is near 50, indicating the stock is still far from oversold territory.

Also Read – Everything You Need to Know About the Dollar Index in 2025

Recent Performance Snapshot

The company holds a market capitalization of $82.87 billion with a trailing price-to-earnings ratio of 53.90 and earnings per share of $1.75. Robinhood’s next earnings announcement is expected on July 30, 2025. Year to date, the stock has surged 153.17%, far outperforming the S&P 500’s gain of 6.63%. Over one year, Robinhood is up 312.10% versus the S&P 500’s 13.27%, and its three-year return is an impressive 1,053.18% compared to the broader index’s 63.95%. Over the past five years, Robinhood has gained 148.24%, modestly outpacing the S&P 500’s 100.37%.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.