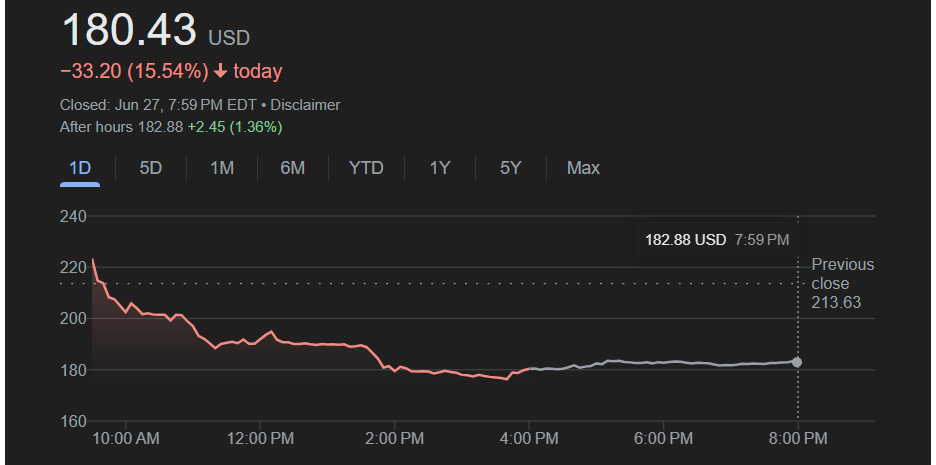

Circle Internet Group Inc. (NYSE: CRCL) closed Friday at $180.43, down 15.54% on the day and ending a bruising week with a 24.91% weekly decline.

Since touching an all-time high of $298.99 on Monday after announcing a major partnership with Fiserv, the stock has seen relentless selling pressure. CRCL attempted a modest rebound of 7.56% on Thursday but could not sustain the momentum, breaking down again Friday to finish near session lows.

Friday’s trading opened at $223.65 and reached an early high at the same level before collapsing to an intraday low of $175.60. After-hours prices recovered slightly to $182.88, up 1.36%, but market confidence remains weak. The company’s market capitalization has shrunk to $40.15 billion from its Monday peak of roughly $67 billion, wiping out nearly $27 billion in value in just five trading days.

Also Read – 5 Reasons Circle (CRCL) Stock Is Crashing as It Touches the $200 Mark

According to Yahoo Finance, Circle’s valuation metrics remain stretched despite the correction. Its trailing P/E ratio stands at 2,070, with a forward P/E of 128.21, and a lofty price-to-book ratio of 53.90. These numbers underline investor concerns about overheating.

Since its IPO price of $31, CRCL has still delivered a staggering return of approximately 481% even at $180.43, reflecting the scale of the prior rally.

Technical Outlook for Monday

CRCL’s price chart is showing concerning weakness. The stock decisively broke through its first parallel channel support in the 190–200 zone, which had served as a critical technical level earlier in the week.

With Friday’s deep close, CRCL is now trading inside a second parallel channel, bounded by 170–160 as crucial support. If this lower channel fails to hold, the next significant levels could be much deeper.

Short-term resistance is likely to emerge near 190, coinciding with the broken prior support, while the upper band of the current channel around 205–210 will serve as a major resistance level on any meaningful bounce.

How Much Will It Fall?

Given the severe weekly drop of nearly 25% and a 39.65% collapse from Monday’s all-time high, sentiment is highly fragile. If CRCL cannot hold above the 170–160 channel support early next week, the decline could accelerate toward 150 or lower in a washout phase.

At the same time, the Relative Strength Index is hovering around 35 on the hourly timeframe, approaching oversold territory. That could temporarily slow the decline.

For now, the chart suggests a bearish bias with the potential to retest the 170–160 zone.

Valuation Still in Question

Circle’s valuation metrics are extremely rich compared to traditional fintech peers. A trailing P/E above 2,000, forward P/E over 128, and price-to-book ratio of nearly 54 put its fundamentals under intense scrutiny. Combined with a collapse in technical structure and critical comments from the Bank for International Settlements (BIS) questioning the long-term viability of stablecoins, CRCL’s profile has shifted from high-flying to highly vulnerable in a matter of days.

As of now, Circle’s massive run from its $31 IPO to $298.99 on Monday, a 864% gain at the top, is experiencing a harsh reality check. Even after falling to $180.43, the stock retains an approximate 481% return from IPO, underscoring just how inflated the price had become.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.