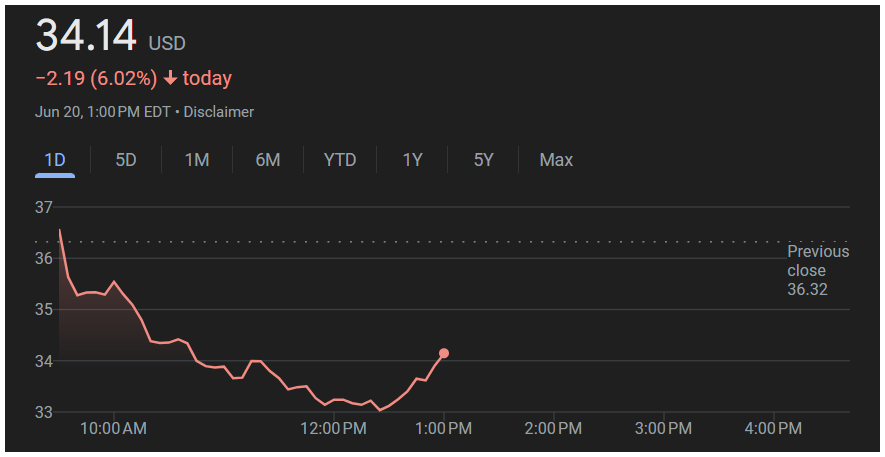

On June 20, 2025, Scholar Rock Holding Corporation (NASDAQ: SRRK) closed at $33.26, down 8.43% or $3.06 from its previous close of $36.32, per the provided data. The stock opened at $34.50, with a day’s range of $32.80 to $34.80. Volume was 1.042 million shares, below the 30-day average of 1.343 million shares, indicating reduced trading activity.

The decline was primarily driven by profit-taking after a 14% surge on June 18, 2025, following positive Phase 2 EMBRAZE trial results for apitegromab in obesity, as reported by GuruFocus.

Scholar Rock’s year-to-date gain of 329.82% significantly outpaces the Nasdaq’s 15.2% return in 2025. Over the past five days, SRRK rose 6.5%, fueled by the trial news. Due to limited historical data, 1-month, 6-month, 1-year, and 5-year returns are unavailable. Since its IPO in October 2018 at $14, the stock has gained 137.57%.

| Period | Performance (%) |

|---|---|

| 1 Day | -8.43 |

| 5 Days | +6.50 |

| 1 Month | Not available |

| 6 Months | Not available |

| Year-to-Date | +329.82 |

| 1 Year | Not available |

| 5 Years | Not available |

| All-Time | +137.57 |

Scholar Rock’s market cap is $3.158 billion, with 95 million shares outstanding. The trailing twelve-month EPS is -$2.16, making the PE ratio not applicable due to losses. Forward EPS for 2026 is projected at -$2.30, per Yahoo Finance. No dividend is offered, and the ex-dividend date is not applicable. The stock’s beta is 1.52, indicating higher volatility. Seven analysts rate SRRK a Buy, with a $50.43 price target, implying 51.62% upside. The next earnings date is August 6, 2025.

Technically, SRRK is trading below its 50-day moving average of $35.50, a short-term trend indicator, signaling a bearish shift. The stock is near its 52-week high of $35.44, set on June 18, with potential support at $30 if selling persists.

The primary reason for the drop is profit-taking after the stock’s rapid rise following apitegromab’s trial success, which showed 54.9% lean mass preservation in obesity patients. Posts on X noted short-squeeze potential earlier, but today’s lower volume suggests investors are locking in gains. Mild biotech sector weakness, with the XBI ETF down 0.5%, may have contributed, but the decline was largely stock-specific.

The biotech sector saw slight pressure, while the Nasdaq rose 0.3%, highlighting SRRK’s underperformance. Broader market uncertainty, including geopolitical tensions, may have encouraged profit-taking.

SRRK’s outlook remains bullish due to apitegromab’s potential in spinal muscular atrophy (SMA) and obesity. Risks include clinical trial setbacks, regulatory delays, and high cash burn ($246.3 million net loss in 2024). Investors should monitor the Q2 2025 EMBRAZE topline data and PDUFA date for apitegromab.

DISCLAIMER: This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.