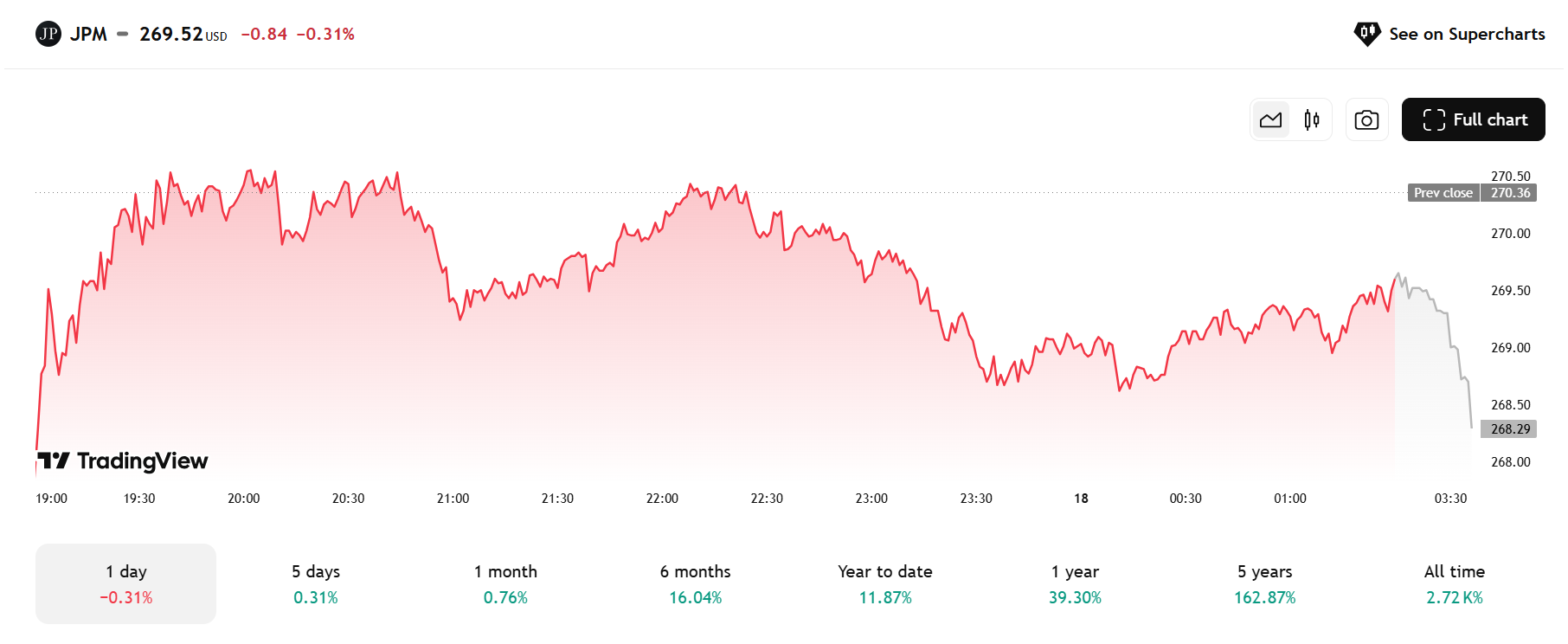

JPMorgan Chase & Co. (NYSE: JPM) shares slipped 0.31% to $269.52 as of the latest trade, amid renewed investor attention sparked by a major update to one of its flagship financial products.

The price movement comes in the backdrop of a 162.87% return over the past five years, making JPMorgan one of the standout performers in the financial sector.

On Tuesday, the banking giant announced a significant change to its premium credit card, the Chase Sapphire Reserve. Starting June 23, the card’s annual fee will rise sharply from $550 to $795. This move positions the Sapphire Reserve above rival premium cards like the American Express Platinum, which charges a $695 annual fee.

The change is expected to create mixed reactions among customers and investors. While some may be discouraged by the higher upfront cost, others may look forward to potential added benefits, which JPMorgan has hinted will be revealed in detail at the time of the hike.

The timing of the announcement comes during a relatively stable performance phase for JPMorgan stock. Although the daily change was a minor dip, the broader picture remains strong. Over the last year, the stock is up 39.30%, and it has gained 11.87% year-to-date. The all-time performance stands at 2,720%.

JPMorgan Chase & Co. is one of the largest and most influential financial institutions in the world. Headquartered in New York, it offers a wide range of services including investment banking, asset management, commercial banking, and credit cards. The firm’s strong brand reputation, innovative financial products like the Sapphire Reserve, and robust earnings history have helped it maintain a leadership position in the global banking sector.

Key Trading Data

| Metric | Value |

|---|---|

| 1 Month Return | 0.76% |

| 6 Month Return | 16.04% |

| Year-to-Date Return | 11.87% |

| 1 Year Return | 39.30% |

| 5 Year Return | 162.87% |

| All-Time Return | 2,720% |

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.