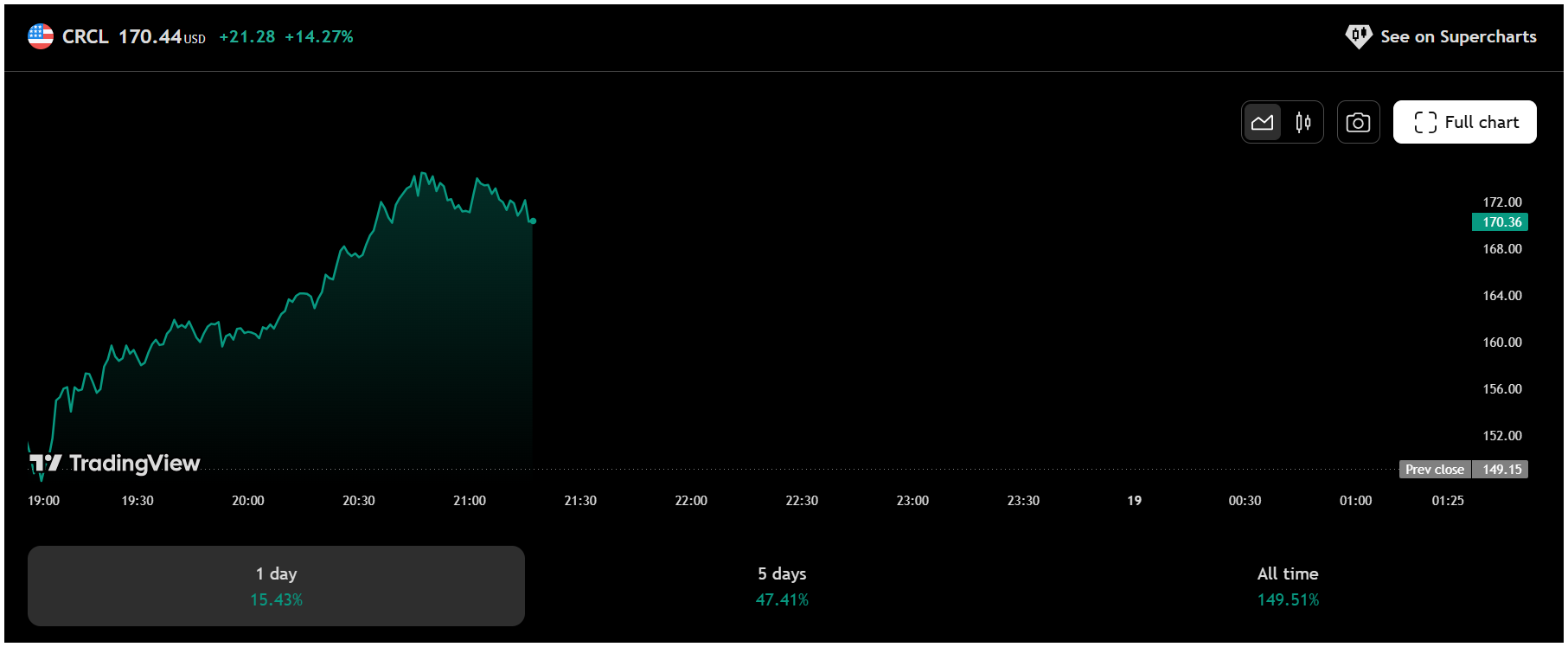

Shares of Circle Internet Group Inc. (NYSE: CRCL) surged on June 18, 2025, after the U.S. Senate passed a historic bill to regulate stablecoins. CRCL jumped 14.65% to trade at $171.00 by 11:49 a.m. ET, marking a $21.85 gain from its previous close of $149.15. The stock touched an intraday high of $174.82 and a low of $148.00.

This sharp upward move comes as the Senate passed a bill establishing the first federal framework for dollar-backed cryptocurrencies, also known as stablecoins. The crypto industry has been lobbying for clear, favorable regulation for years, and this development is being celebrated as a major breakthrough.

Circle, the issuer of the USDC stablecoin, is one of the biggest players in this space and is expected to benefit significantly from this new legal clarity.

Stock Performance Snapshot

CRCL has shown impressive momentum in recent sessions:

- 1 Day: +15.97%

- 5 Days: +48.10%

- All Time: +150.67%

Today’s rally not only puts CRCL near its 52-week high of $174.82, but also adds to the bullish trend that has been forming over the past week. Circle’s market capitalization currently stands at $37.78 billion, reflecting growing investor confidence in the company’s position within the digital asset ecosystem.

Also Read – Circle Internet Financial Stock Price Prediction, Forecast & Target for 2025, 2030, 2040 & 2050

Company Overview

Here is a quick overview of Circle Internet Group Inc.:

| Detail | Information |

|---|---|

| Company Name | Circle Internet Group Inc. |

| Ticker | CRCL (NYSE) |

| Founded | 2013 |

| Founder | Jeremy Allaire |

| Sector | Technology |

| Industry | Financial Technology / Cryptocurrency |

| Headquarters | Boston, Massachusetts, United States |

| Market Cap | $37.78 Billion |

| 52-Week High | $174.82 |

| 52-Week Low | $64.00 |

Why This Matters?

The passage of the stablecoin bill gives the crypto sector, especially regulated players like Circle, the regulatory clarity it has long needed to scale operations in the U.S. and globally. USDC is already one of the largest dollar-backed stablecoins by circulation, and Circle has made strategic moves in recent months to boost adoption by partnering with financial institutions and expanding into new jurisdictions.

Investors are hopeful that this legislation will encourage wider institutional use of stablecoins, boost on-chain dollar usage, and lead to greater acceptance of digital assets by traditional finance. With Circle directly tied to the success of USDC, the company is seen as one of the biggest beneficiaries of this legal shift.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.