New York || 05:03 AM ET – In the last trading session on Friday, June 20, 2025, Darden Restaurants, Inc. (NYSE: DRI) closed at $225.78, up 1.36 percent. Recent news about the possible sale or conversion of its Bahama Breeze chain has drawn investor attention. Below, we examine DRI’s stock performance, the latest developments, and factors to monitor.

Stock Performance

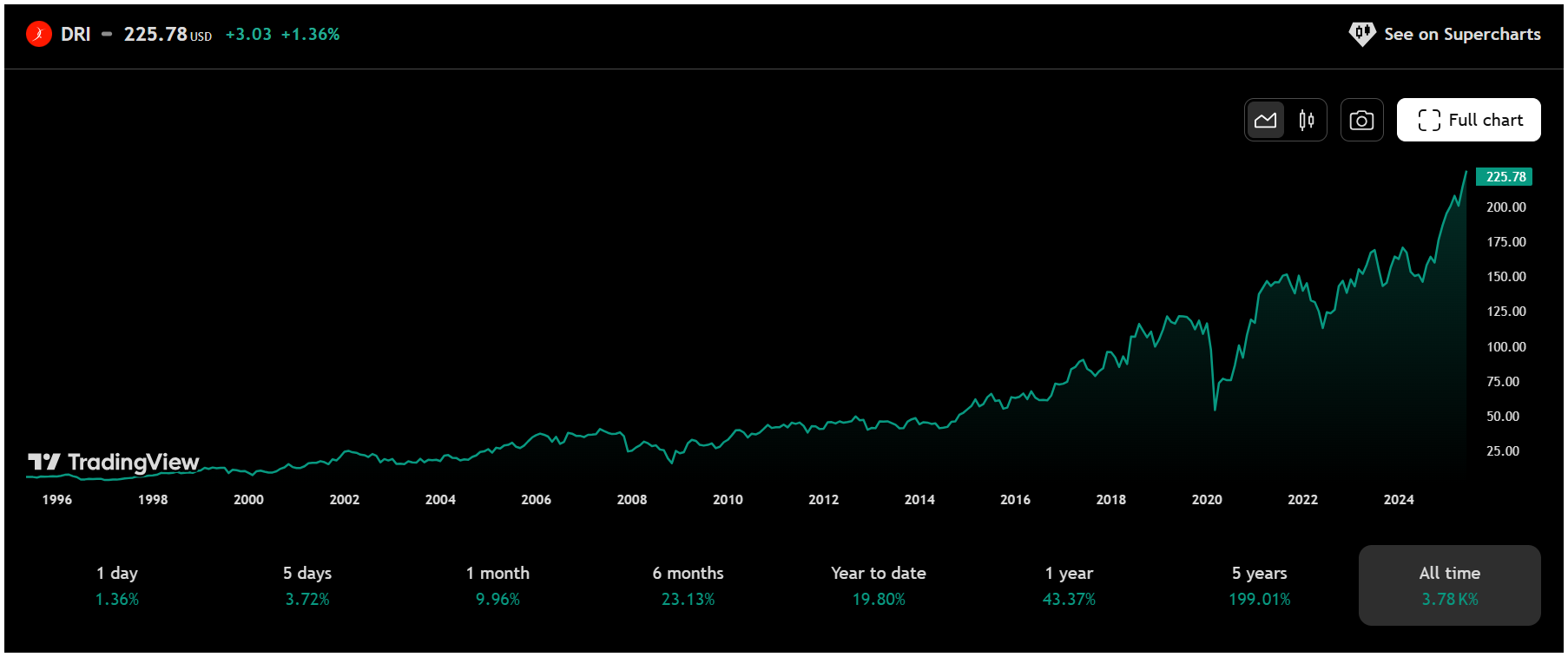

Darden Restaurants’ stock rose 1.36 percent on June 20, closing at $225.78 after moving between $222.00 and $226.30. Trading volume was 1.2 million shares, slightly above the average of 1.1 million. Over the past month, DRI has surged 9.96 percent, significantly outperforming the S&P 500’s 0.8 percent gain. The stock has gained 3.72 percent over the past five days, 19.80 percent year-to-date, and an impressive 43.37 percent over the past year. Over five years, DRI has soared 199.01 percent, reflecting its long-term strength. How Darden Restaurants stock performed in June 2025

Latest News

On June 20, Darden announced it is considering “strategic alternatives” for its Bahama Breeze chain, which may involve selling or converting its 14 remaining locations into brands like Olive Garden or LongHorn Steakhouse. This follows the closure of 15 underperforming Bahama Breeze restaurants in May 2025.

During the Q4 earnings call, CEO Rick Cardenas stated that Bahama Breeze is not a strategic priority. Darden reported Q4 revenue of $3.27 billion, up 10.6 percent year-over-year, beating estimates of $3.25 billion. The company increased its quarterly dividend by 7 percent, authorized a $1 billion share repurchase program, and signed a deal to open 30 Olive Garden locations in Canada over the next decade. Latest news about Darden Restaurants stock in June 2025

Technical Analysis and Price Forecast for DRI in June 2025

DRI is trading above its 50-day moving average of $215.50 and 200-day moving average of $205.80, confirming a bullish trend. Support is at $218.00, with resistance at $228.00, a level tested in June. The Relative Strength Index (RSI) is at 62, indicating room for growth before reaching overbought territory.

If the stock sustains above 225, it may move toward testing the 230 level next. The strongest support is seen in the 212 to 210 zone.

Valuation Metrics

Darden’s trailing P/E ratio is 25.43, with a forward P/E of 20.92, reflecting anticipated earnings growth. The PEG ratio of 2.20 suggests reasonable valuation for its growth outlook. Market cap stands at $26.42 billion, with an enterprise value of $32.13 billion. The price-to-sales ratio is 2.21, and the price-to-book ratio is 11.43. The enterprise value-to-EBITDA ratio is 16.46, and a beta of 1.25 indicates moderate market volatility.

Darden has 117.2 million shares outstanding, with a float of 116.8 million. In Q4, the company repurchased 0.2 million shares for $51 million and authorized a $1 billion buyback program on June 18, 2025, signaling management’s confidence in the stock’s value.

Key Factors Influencing Darden Restaurants Stock in June 2025

Darden’s Q4 performance, with 10.6 percent revenue growth and 4.6 percent same-store sales gains, driven by Olive Garden and LongHorn Steakhouse, underscores operational strength. The dividend increase and $1 billion buyback program reflect financial confidence, and the potential Bahama Breeze exit could streamline the portfolio. Analyst upgrades and a bullish technical outlook highlight positive momentum. However, the Bahama Breeze sale or conversion carries risks of costs or delays. The casual dining sector faces challenges from inflation and reduced consumer spending, and the stock’s price-to-book ratio of 11.43 may prompt scrutiny from value-focused investors.

This article is for informational purposes only and should not be considered financial advice. Investing in stocks, cryptocurrencies, or other assets involves risks, including the potential loss of principal. Always conduct your own research or consult a qualified financial advisor before making investment decisions. The author and publisher are not responsible for any financial losses incurred from actions based on this article. While efforts have been made to ensure accuracy, economic data and market conditions can change rapidly. The author and publisher do not guarantee the completeness or accuracy of the information and are not liable for any errors or omissions. Always verify data with primary sources before making decisions.

Dawson Blake is a financial markets expert with over 10 years of experience, focusing mainly on stock market news and price movements. He aims to become a top-tier authority in curating stock news content that readers can trust as their go-to source for market information. Dawson enjoys breaking down market activity, company updates, and daily trends to help investors stay informed and make smarter financial decisions. His writing is simple, clear, and designed to make the stock market easy to follow for everyone.